Nebraska Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Annual Disbursements To Members Of The Company?

Are you presently in a place the place you require papers for either business or person uses nearly every working day? There are tons of authorized document web templates available on the net, but finding kinds you can trust isn`t simple. US Legal Forms provides thousands of develop web templates, just like the Nebraska Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company, which are composed to satisfy federal and state needs.

When you are presently acquainted with US Legal Forms site and get your account, merely log in. After that, you can down load the Nebraska Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company design.

Unless you come with an accounts and need to begin to use US Legal Forms, follow these steps:

- Discover the develop you need and make sure it is for that appropriate town/state.

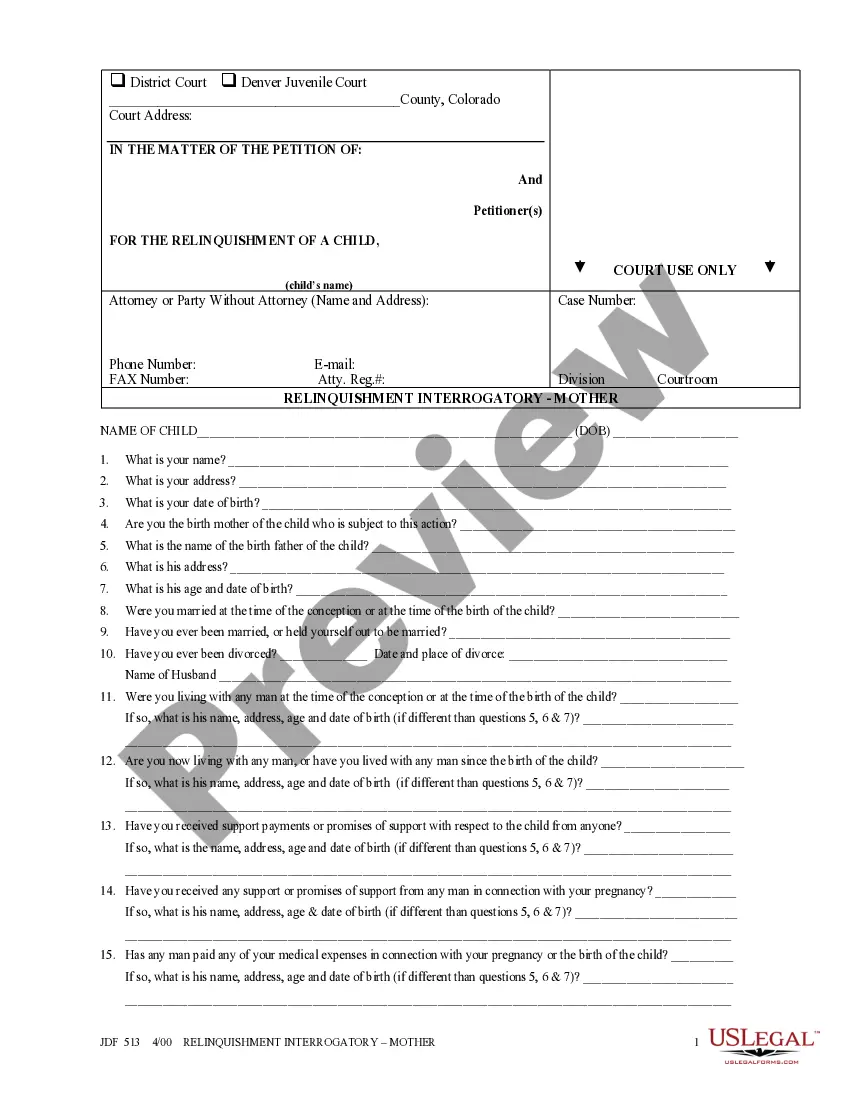

- Take advantage of the Preview option to review the shape.

- Read the outline to ensure that you have selected the correct develop.

- When the develop isn`t what you are seeking, take advantage of the Lookup field to discover the develop that meets your needs and needs.

- Whenever you obtain the appropriate develop, just click Buy now.

- Pick the costs strategy you would like, submit the necessary information and facts to generate your money, and pay for the transaction making use of your PayPal or charge card.

- Choose a convenient file format and down load your copy.

Locate every one of the document web templates you possess bought in the My Forms menus. You can aquire a further copy of Nebraska Notice of Meeting of LLC Members To Consider Annual Disbursements to Members of the Company any time, if needed. Just select the essential develop to down load or print the document design.

Use US Legal Forms, the most considerable collection of authorized varieties, in order to save time and stay away from errors. The services provides skillfully manufactured authorized document web templates which can be used for a range of uses. Make your account on US Legal Forms and initiate generating your daily life a little easier.