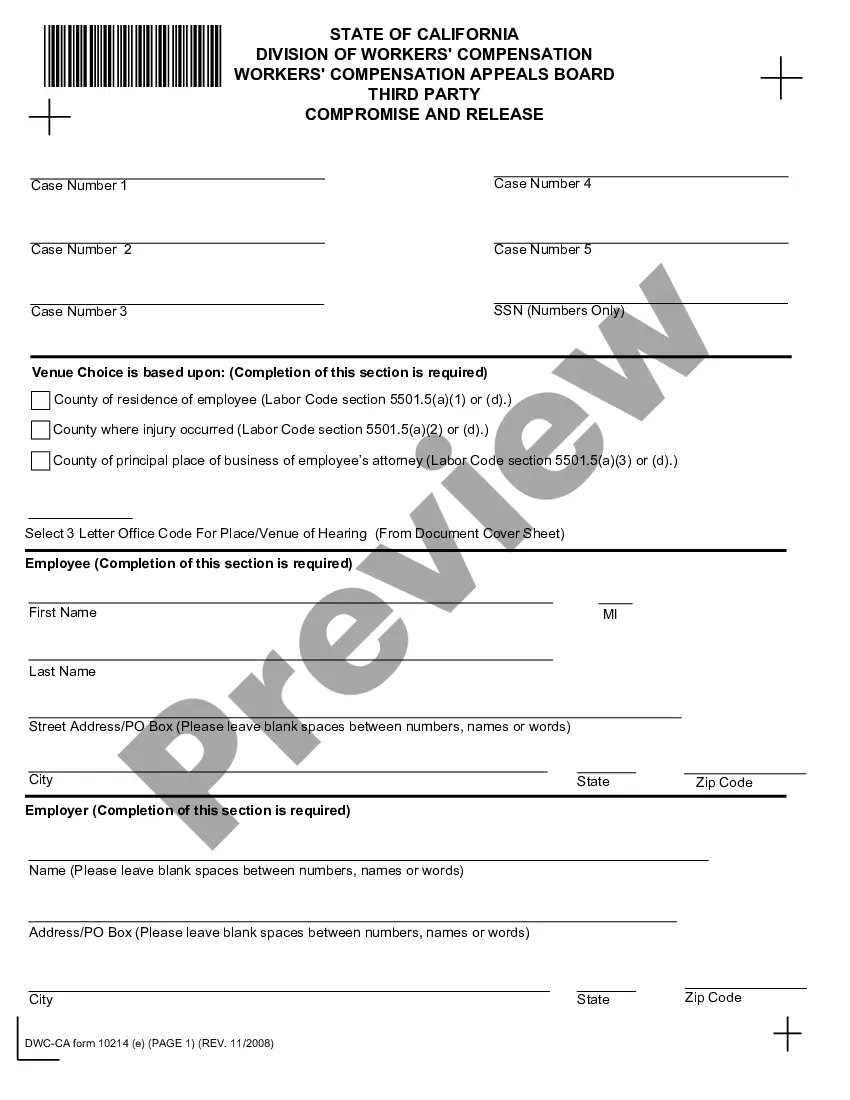

Nebraska Appraisal System Evaluation Form is an assessment tool used in the state of Nebraska to evaluate the performance and effectiveness of various appraisal systems utilized in appraising real estate. This comprehensive evaluation form plays a crucial role in improving the appraisal process, ensuring fair and accurate property valuations, and maintaining consistency across the state. The Nebraska Appraisal System Evaluation Form comprises several sections that cover different aspects of the appraisal process. These sections include: 1. General Information: This section captures basic details such as the appraiser's name, date of evaluation, property details, and the appraisal firm's information. 2. Compliance: This section assesses the appraisal system's compliance with state laws, regulations, and professional standards. It examines whether the system follows accepted methodologies, guidelines, and ethical considerations. 3. Data Collection and Analysis: This section evaluates the effectiveness of the system in collecting and analyzing relevant data. It considers factors such as the appraiser's selection and use of appropriate comparable sales, market research methods, adjustment techniques, and data verification processes. 4. Valuation Accuracy: This section examines the accuracy of the appraised values produced by the system. It assesses the consistency and reliability of the valuation process, including the appraiser's estimation of property values, reconciliation of multiple approaches to value, and consideration of relevant market factors. 5. Documentation: This section analyzes the quality and completeness of the appraisal reports generated by the system. It evaluates the clarity of the appraiser's conclusions, adherence to reporting guidelines, inclusion of required data, and overall organization of the appraisal documents. 6. Communication: This section assesses the appraiser's communication skills and effectiveness in conveying appraisal findings to clients and other stakeholders. It evaluates the clarity, professionalism, and timeliness of written and verbal communication. 7. Continuing Education: This section considers whether the appraiser remains updated with the latest industry developments through continuing education and professional development activities. Different types of Nebraska Appraisal System Evaluation Forms may exist to cater to specific appraisal methodologies or segments of the real estate market. Some potential variations could include Residential Appraisal System Evaluation Form, Commercial Appraisal System Evaluation Form, Agricultural Appraisal System Evaluation Form, or Government Appraisal System Evaluation Form. Overall, the Nebraska Appraisal System Evaluation Form aims to maintain high appraisal standards, provide feedback to appraisers regarding their performance, and ensure the accuracy and integrity of property valuations across Nebraska. It serves as a valuable tool for enhancing the professionalism and competency of appraisers in the state.

Nebraska Appraisal System Evaluation Form

Description

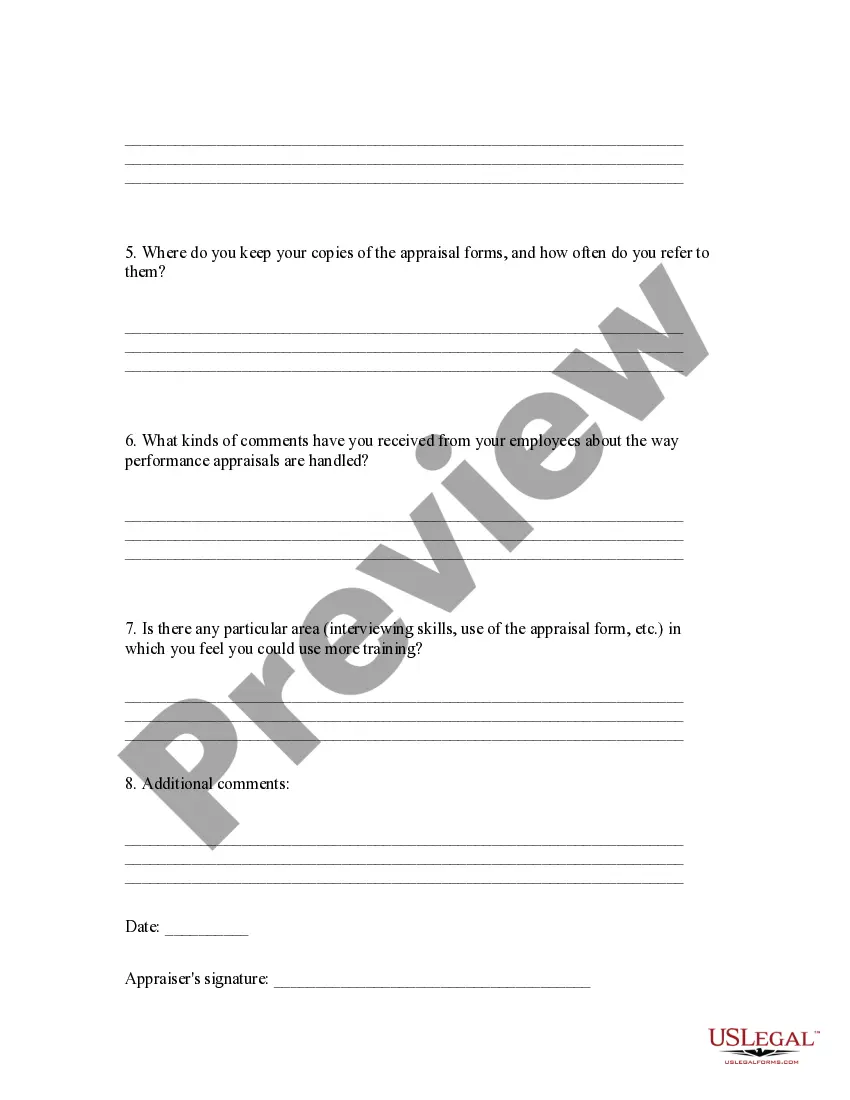

How to fill out Nebraska Appraisal System Evaluation Form?

US Legal Forms - among the most significant libraries of legal kinds in the United States - provides a variety of legal record web templates you can acquire or print. Using the internet site, you may get a huge number of kinds for company and personal purposes, sorted by types, suggests, or search phrases.You will find the newest models of kinds just like the Nebraska Appraisal System Evaluation Form in seconds.

If you already have a monthly subscription, log in and acquire Nebraska Appraisal System Evaluation Form in the US Legal Forms local library. The Download button will appear on every form you see. You have access to all formerly saved kinds in the My Forms tab of your own account.

In order to use US Legal Forms for the first time, here are straightforward guidelines to get you started:

- Be sure you have chosen the correct form for your personal city/region. Click the Preview button to analyze the form`s information. Read the form explanation to ensure that you have chosen the proper form.

- If the form doesn`t suit your specifications, make use of the Search area on top of the monitor to discover the one which does.

- Should you be satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the costs strategy you prefer and provide your qualifications to register to have an account.

- Method the purchase. Utilize your credit card or PayPal account to complete the purchase.

- Select the structure and acquire the form on your gadget.

- Make modifications. Fill up, change and print and indicator the saved Nebraska Appraisal System Evaluation Form.

Each and every web template you put into your bank account does not have an expiration date which is your own property forever. So, if you wish to acquire or print yet another backup, just visit the My Forms section and click on about the form you want.

Gain access to the Nebraska Appraisal System Evaluation Form with US Legal Forms, one of the most comprehensive local library of legal record web templates. Use a huge number of specialist and status-specific web templates that satisfy your small business or personal needs and specifications.

Form popularity

FAQ

How to write an employee evaluationGather employee information. Gather required information related to the employee to get the full picture of their value to the company.List employee responsibilities.Use objective language.Use action verbs.Compare performance ratings.Ask open-ended questions.Use a point system.

Positive Sample Answer I feel I am very aware of my strengths and weaknesses and thus I am able to manage my emotions and frustrations as well as to recognise the value of my colleagues ideas, opinions and challenges. I am an effective listener and always try to understand and listen to colleagues' objections.

Self-performance review examples "Although I showed exceptional progress in providing quality service to our clients over the past eight months, there are several areas where I still believe I can improve my daily job performance." "I have already set five goals for myself that I will work to achieve in the new year.

To create a performance evaluation system in your practice, follow these five steps:Develop an evaluation form.Identify performance measures.Set guidelines for feedback.Create disciplinary and termination procedures.Set an evaluation schedule.

How to get started writing your self-evaluationReflect on feedback.Make a list of your top accomplishments and identify areas for improvements.Gather analytics to show impact.Make a commitment to improve.Set a SMART goal for yourself.Create a plan of action.Communication.Job Performance.More items...

To create a performance evaluation system in your practice, follow these five steps:Develop an evaluation form.Identify performance measures.Set guidelines for feedback.Create disciplinary and termination procedures.Set an evaluation schedule.

Before You Begin Writing Your Self-Evaluation1 Know how the self-evaluation is going to be used.2 Write out a list of your accomplishments.3 Gather analytics if you can.4 Write out a list of your struggles.5 Narrow your accomplishments list down.6 Don't forget to align your review with your manager's or team's goals.More items...?

4 Tips for Writing an Effective Self-EvaluationBe specific and provide examples. Specificity helps contextualize claims.Back up your contributions with metrics.Frame weaknesses as opportunities.Keep track of your accomplishments throughout the year.

What to Include in an Employee Evaluation Form?Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.More items...?