Nebraska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

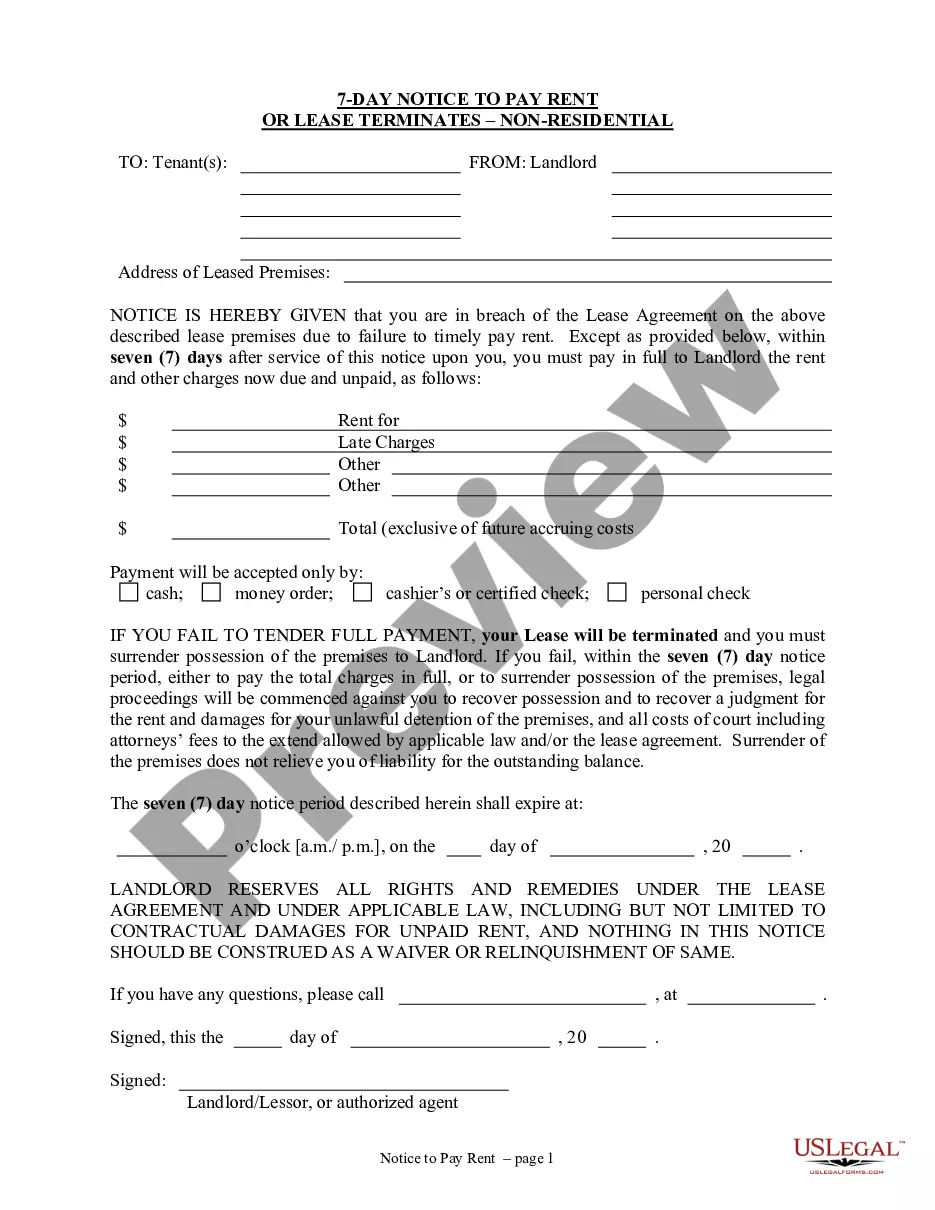

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

US Legal Forms - one of the biggest libraries of lawful forms in the States - offers a variety of lawful papers web templates you may download or print. Using the internet site, you can find a huge number of forms for company and person reasons, sorted by groups, states, or keywords and phrases.You can get the most up-to-date variations of forms much like the Nebraska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate within minutes.

If you currently have a registration, log in and download Nebraska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate from the US Legal Forms catalogue. The Obtain option can look on each and every form you perspective. You gain access to all formerly downloaded forms within the My Forms tab of your accounts.

If you wish to use US Legal Forms for the first time, listed here are basic directions to get you started off:

- Make sure you have selected the right form for the city/county. Click the Preview option to analyze the form`s content. Read the form outline to actually have selected the right form.

- In the event the form doesn`t satisfy your requirements, utilize the Lookup area towards the top of the screen to obtain the one that does.

- Should you be pleased with the form, affirm your option by visiting the Buy now option. Then, opt for the rates plan you prefer and give your accreditations to register on an accounts.

- Process the financial transaction. Make use of your charge card or PayPal accounts to finish the financial transaction.

- Choose the formatting and download the form on your gadget.

- Make modifications. Fill out, change and print and signal the downloaded Nebraska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Every web template you included in your money lacks an expiration day and is your own property eternally. So, if you would like download or print an additional backup, just go to the My Forms segment and click about the form you want.

Gain access to the Nebraska Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate with US Legal Forms, by far the most extensive catalogue of lawful papers web templates. Use a huge number of professional and status-distinct web templates that meet up with your small business or person requirements and requirements.

Form popularity

FAQ

Requesting a releaseThe Retiring Guarantor would typically send a written request for its release to the lender or, in a syndicated facility, the agent. Often the Retiring Guarantor's parent company or the borrower would also be party to the request (the Requesting Parties).

Corporate credit cards. Instead, by using a credit that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

A personal guarantee is an agreement that allows a lender to go after your personal assets if your company, relative, or friend defaults on a loan. For instance, if your business goes under, the creditor can sue you to collect any outstanding balance.

By agreeing to a personal guarantee, the business borrower is agreeing to be 100 percent personally responsible for repayment of the entire loan amount, in addition to any collection, legal, or other costs related to the loan.

A personal guarantee refers to an individual's promise to repay finance if their business can't. In other words, if the business can't repay the debt, the business owner/director will be held personally liable.

The elements of offer, acceptance, intention to be bound by law and consideration must be satisfied. This also slightly varies depending on the form of the agreement. Personal guarantees are often written in the form of a deed because deeds do not require consideration.

Personal guarantees are usually enforceable. The typical route would be for the lender to take the guarantor to court to request the enforcement of a judgement against their personal assets. Once a lender takes legal action, the enforcement of a personal guarantee can be a quick process.

An otherwise valid and enforceable personal guarantee can be revoked later in several different ways. A guaranty, much like any other contract, can be revoked later if both the guarantor and the lender agree in writing. Some debts owed by personal guarantors can also be discharged in bankruptcy.