Nebraska Agreement to Reimburse for Insurance Premium

Description

How to fill out Agreement To Reimburse For Insurance Premium?

You might spend numerous hours online trying to find the official document template that fulfills the state and federal requirements you need.

US Legal Forms offers a plethora of legal templates that have been evaluated by professionals.

It is easy to obtain or print the Nebraska Agreement to Reimburse for Insurance Premium from the service.

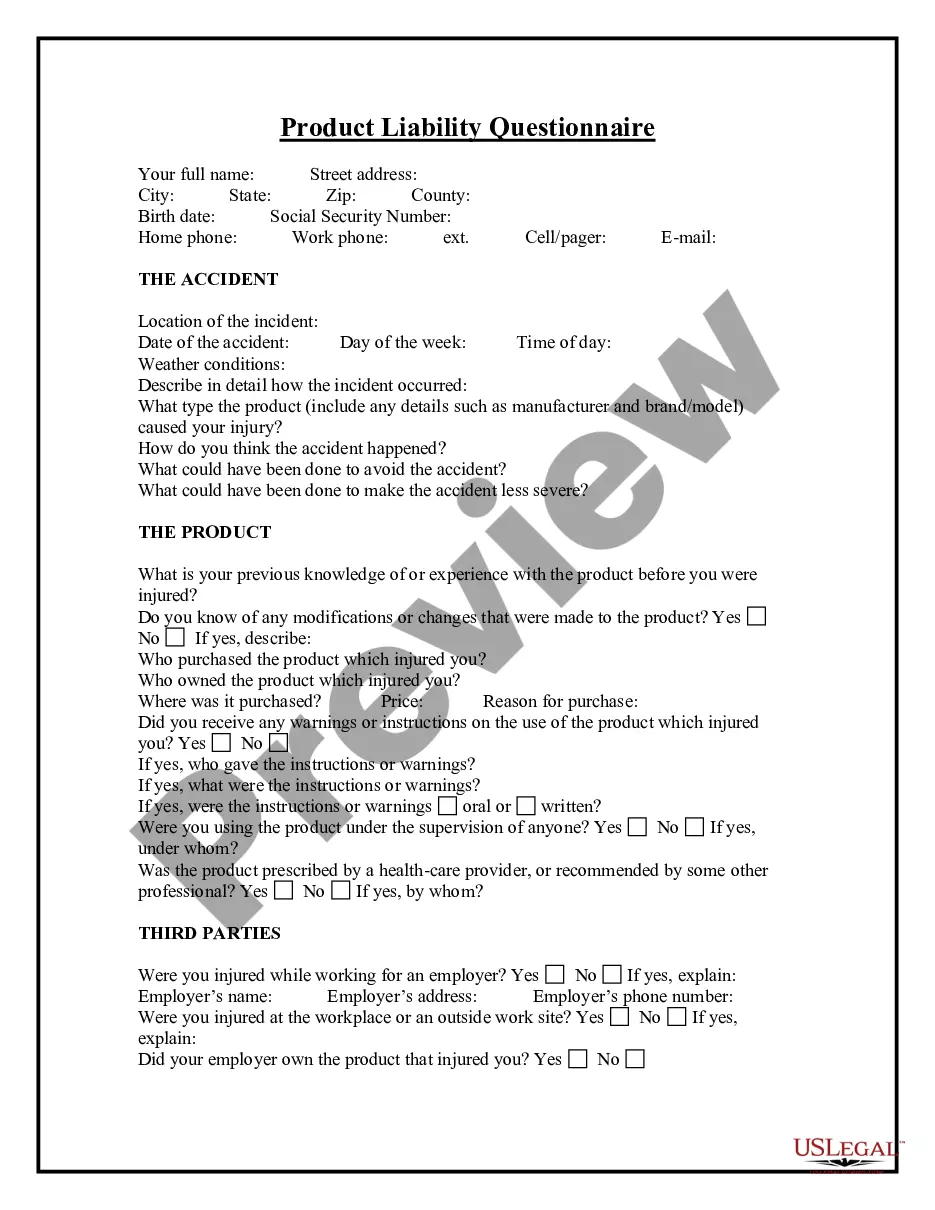

If available, make use of the Review button to preview the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Nebraska Agreement to Reimburse for Insurance Premium.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any acquired form, navigate to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the county/town of your choice.

- Review the form description to ensure you've chosen the correct form.

Form popularity

FAQ

Generally, you cannot use your Health Savings Account to pay premiums for health insurance coverage. Exceptions include COBRA premiums, long-term care premiums or premium payments that allow you to retain coverage while receiving unemployment compensation.

What Is Adjustable Life Insurance? Adjustable life insurance is a hybrid of term life and whole life insurance that allows policyholders the option to adjust policy features, including the period of protection, face amount, premiums, and length of the premium payment period.

A premium refund is a clause in some insurance policies that grants the beneficiaries a refund to the total amount of premiums paid to date. Depending on the contract and type of insurance, it will grant a refund of the premiums you paid if you die before that term runs out or if you voluntarily end your coverage.

A premium refund is a clause in some insurance policies that grants the beneficiaries a refund to the total amount of premiums paid to date. Depending on the contract and type of insurance, it will grant a refund of the premiums you paid if you die before that term runs out or if you voluntarily end your coverage.

Key Takeaways An adjusted premium is one the insurer can alter, moving it higher or lower, to a limit agreed upon in the contract. The adjustment comes from assessing the net-level premium, or total cost of the policy from inception to payout, divided by the number of years the policy is expected to be in use.

A premium is the price of the insurance you've chosen, charged by your insurance company. A deductible is an amount you have to pay before your insurance company initiates coverage. For example, if your car insurance premium is $800 per year, you must pay your insurer $800 per year to have the insurance.

Even after the due date is over. Usually, insurance companies offer a grace period of 15 days after the due date during which the insured can pay the renewal amount.

Your insurance company may issue a refund if your policy is canceled and you've paid your premium in advance. Receiving an insurance refund will largely depend on why you're canceling the policy and how much of the premium you paid in advance.

Premium Adjustment means an increase or a decrease of the premium made after the insurance policy start date (including premium refunds) on Insurance Business in force at the valuation date.

Minimum Premium the least amount of premium to be charged for providing a particular insurance coverage. The minimum premium may apply in any number of ways such as per location, per type of coverage, or per policy.