Nebraska Management Agreement between a Trust and a Corporation

Description

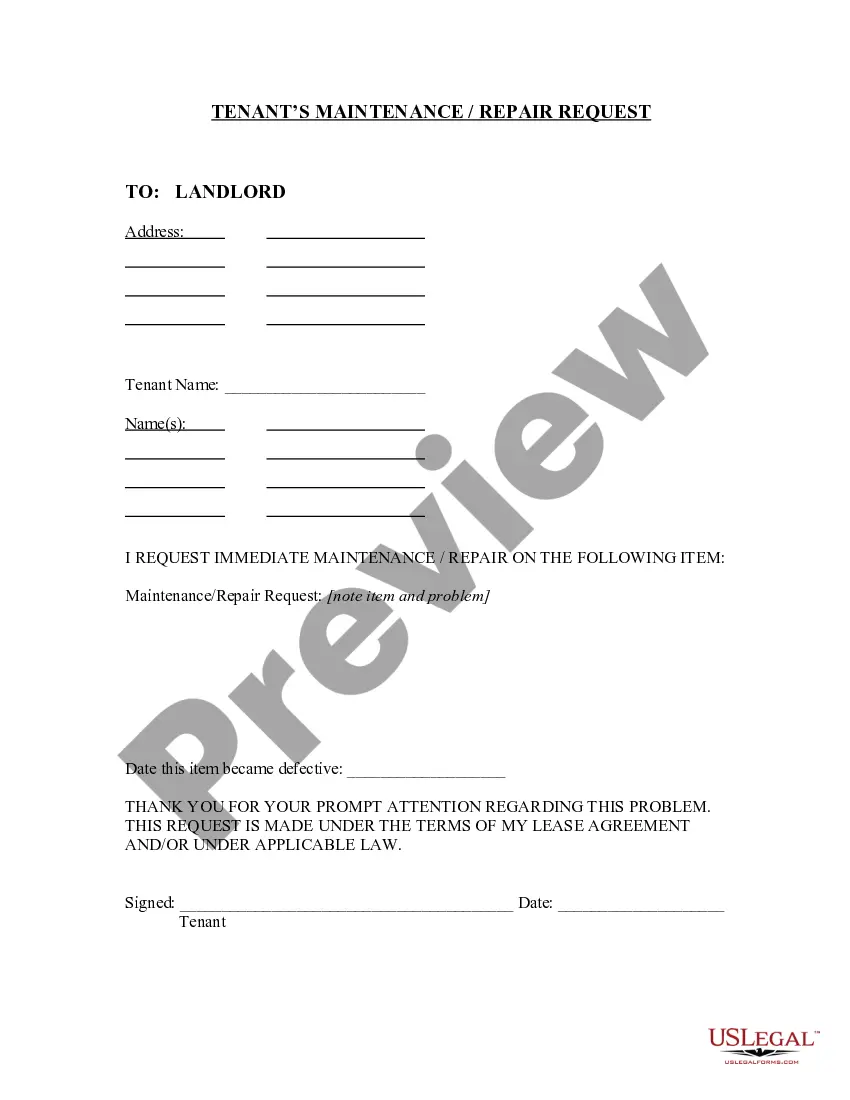

How to fill out Management Agreement Between A Trust And A Corporation?

If you have to comprehensive, acquire, or print out authorized papers web templates, use US Legal Forms, the largest variety of authorized kinds, that can be found on the Internet. Use the site`s simple and handy look for to find the paperwork you require. A variety of web templates for business and personal uses are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to find the Nebraska Management Agreement between a Trust and a Corporation with a handful of click throughs.

In case you are previously a US Legal Forms consumer, log in in your bank account and click the Download switch to have the Nebraska Management Agreement between a Trust and a Corporation. You may also gain access to kinds you in the past downloaded in the My Forms tab of your respective bank account.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the appropriate metropolis/nation.

- Step 2. Make use of the Preview method to check out the form`s content material. Don`t neglect to learn the description.

- Step 3. In case you are not satisfied together with the develop, utilize the Lookup field on top of the screen to get other types of the authorized develop format.

- Step 4. Upon having found the form you require, go through the Buy now switch. Choose the rates strategy you choose and add your credentials to sign up on an bank account.

- Step 5. Procedure the financial transaction. You may use your bank card or PayPal bank account to complete the financial transaction.

- Step 6. Find the formatting of the authorized develop and acquire it in your gadget.

- Step 7. Total, change and print out or sign the Nebraska Management Agreement between a Trust and a Corporation.

Each and every authorized papers format you buy is the one you have eternally. You might have acces to every single develop you downloaded inside your acccount. Select the My Forms portion and pick a develop to print out or acquire once more.

Be competitive and acquire, and print out the Nebraska Management Agreement between a Trust and a Corporation with US Legal Forms. There are thousands of professional and condition-certain kinds you can utilize for your personal business or personal needs.

Form popularity

FAQ

The term Irrevocable Trust refers to a trust whose conditions cannot be changed, altered, or terminated without the grantor's beneficiary or beneficiaries' agreement.

001.02 A trust or portion of a trust becomes irrevocable when the person whose property constitutes such trust may no longer exercise the power to revest the title to such property in himself or herself.

In Nebraska, trustee fees are not dictated by statutory guidelines but are typically determined based on a "reasonable fee" standard. This standard is subjective and relies on various factors such as the complexity of the trust, the level of responsibility, the expertise required, and the time commitment involved.

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.

The UDTA provides clear, functional rules that allow a settlor to freely structure a directed trust for any situation while preserving key fiduciary safeguards for beneficiaries.

With an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again. You can still act as the trustee but you'd be limited to withdrawing money only on an as-needed basis to cover necessary expenses.

The downside of irrevocable trust is that you can't change it. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them, which can be a huge danger if you aren't confident about the reason you're setting up the trust to begin with.

Sign: Sign the trust agreement in front of a notary public. Transfer assets: Move assets into your trust by retitling them. You can do this yourself, but it's recommended that you do it with the help of a professional to make sure it's done correctly.