Nebraska Prospectus of Scudder Growth and Income Fund — A Comprehensive Overview The Nebraska Prospectus of Scudder Growth and Income Fund provides potential investors with crucial information about this investment opportunity. As the name suggests, the fund emphasizes both the growth and income aspects of investment, making it an attractive option for those seeking a balanced and diversified portfolio. With the objective of long-term capital appreciation and current income, the Scudder Growth and Income Fund aims to achieve these goals by investing primarily in a diverse range of equity securities. These securities may include common stocks of established large-cap companies with the potential for growth and stability, as well as fixed-income securities, such as corporate bonds and preferred stocks. This fund is managed by Scudder Funds, a renowned investment management firm with an extensive track record and expertise in generating consistent returns for investors. Their experienced team of portfolio managers and researchers carefully analyze market trends, company financials, and economic indicators to identify potential investment opportunities that align with the fund's growth and income objectives. In terms of different types of Nebraska Prospectus of Scudder Growth and Income Fund, investors may come across various share classes. These share classes offer distinct fee structures, allowing investors to choose the one that best suits their investment goals and preferences. Some examples of different share classes offered in Nebraska Prospectus of Scudder Growth and Income Fund may include Class A shares, Class B shares, Class C shares, and Institutional shares. Class A shares typically have a front-end sales charge, but offer lower ongoing expenses compared to other share classes. Class B shares may not have an initial sales charge, but usually have higher ongoing expenses and may impose a contingent deferred sales charge (CDs) if the shares are redeemed within a specific period. Class C shares often have no front-end sales charge, but higher ongoing expenses as well as a CD if the shares are redeemed within a designated time frame. Institutional shares are usually available to institutional investors and may have lower expenses due to larger investment amounts. Investors evaluating the Nebraska Prospectus of Scudder Growth and Income Fund should carefully consider their investment objectives, risk tolerance, and time horizon. It is crucial to review the prospectus thoroughly, which contains detailed information about the fund's investment strategy, risks involved, charges and expenses, management team, and historical performance. Investing in the Nebraska Prospectus of Scudder Growth and Income Fund offers potential benefits of diversification, professional management, and the opportunity for long-term capital appreciation and current income. However, as with any investment, there are risks involved, such as market volatility, economic uncertainties, and potential fluctuations in the value of securities held within the fund. By conducting thorough research, analyzing the prospectus carefully, and consulting with a financial advisor if needed, investors can make informed decisions regarding the Nebraska Prospectus of Scudder Growth and Income Fund, aligning their investment goals with the potential benefits and risks associated with this investment opportunity.

Nebraska Prospectus of Scudder growth and income fund

Description

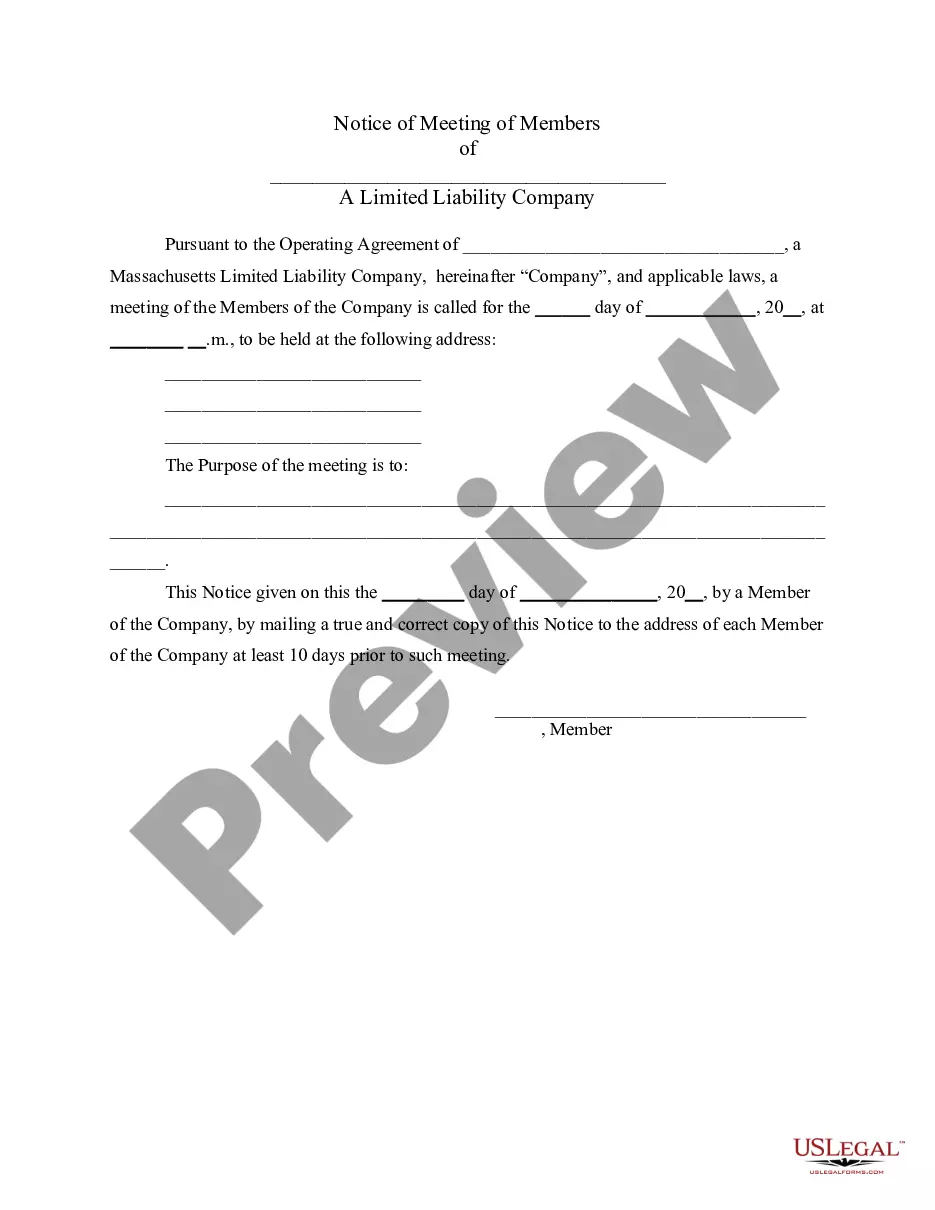

How to fill out Nebraska Prospectus Of Scudder Growth And Income Fund?

Are you within a placement in which you need documents for sometimes enterprise or personal reasons almost every working day? There are a lot of legitimate file web templates accessible on the Internet, but finding ones you can depend on is not simple. US Legal Forms provides thousands of develop web templates, like the Nebraska Prospectus of Scudder growth and income fund, that are written to satisfy federal and state specifications.

In case you are already informed about US Legal Forms web site and also have your account, merely log in. Following that, you may obtain the Nebraska Prospectus of Scudder growth and income fund format.

Unless you provide an account and need to start using US Legal Forms, follow these steps:

- Find the develop you want and make sure it is to the right metropolis/state.

- Use the Preview option to examine the shape.

- Look at the outline to ensure that you have selected the right develop.

- When the develop is not what you are trying to find, utilize the Research area to obtain the develop that suits you and specifications.

- When you discover the right develop, just click Acquire now.

- Choose the prices plan you need, complete the necessary details to produce your account, and purchase an order utilizing your PayPal or bank card.

- Decide on a handy document file format and obtain your version.

Locate each of the file web templates you possess purchased in the My Forms menus. You can aquire a additional version of Nebraska Prospectus of Scudder growth and income fund at any time, if necessary. Just click the necessary develop to obtain or printing the file format.

Use US Legal Forms, one of the most extensive collection of legitimate types, to save lots of some time and stay away from blunders. The support provides skillfully produced legitimate file web templates which you can use for an array of reasons. Make your account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

DWS Scudder changed its name to DWS Investments, completing a rebranding started two years ago to align with Deutsche Bank Asset Management (DeAM).

Deutsche Bank buys Scudder Investments.

A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk, stability of capital and typically higher yields than some other cash products.

Effective February 6, 2006, Scudder Investments will change its name to DWS Scudder and the Scudder funds will be renamed DWS funds. The Trusts/Corporations that the funds are organized under will also be renamed DWS.