Nebraska Approval of Stock Retainer Plan for Nonemployee Directors: A Comprehensive Overview Nebraska Stock Retainer Plan Nonemployee Directors Approval Nebraska Approval of Stock Retainer Plan for Nonemployee Directors is an essential legal process that allows corporations to compensate their nonemployee directors through stock retainers. These stock retainer plans not only provide directors with financial incentive but also align their interests with the shareholders' by making them shareholders themselves. The approval of such plans in Nebraska requires adherence to specific guidelines to ensure transparency and fairness. The state's laws emphasize the importance of safeguarding shareholders' interests while establishing a framework for compensating nonemployee directors for their services. The Stock Retainer Plan for Nonemployee Directors typically includes several key provisions and components. It is crucial for corporations to provide a detailed copy of the plan, highlighting all the relevant clauses and instructions. It should cover the following essential aspects: 1. Purpose: The plan should clearly define its purpose, indicating the company's objective of attracting and retaining qualified directors via stock-based compensation. 2. Eligibility: The plan should outline the eligibility criteria for directors to participate in the stock retainer program. This may include tenure, independence criteria, or specific qualifications. 3. Stock Grants: The plan should clearly specify the number and type of shares granted to nonemployee directors. It may include terms like restricted stock units (RSS), stock options, or full shares, dependent on the company's policy. 4. Vesting and Restrictions: The plan should outline the vesting schedule for stock grants, including any restrictions or limitations that may apply. This ensures that directors remain committed to the organization and its long-term success. 5. Dividend Payments: If applicable, the plan may address the entitlement of nonemployee directors to receive dividends or other distributions on their stock grants during the vesting period. 6. Termination Provisions: While it is important to reward directors for their services, the plan should also establish provisions in case of termination, retirement, or change in control situations. These provisions may include acceleration of vesting or restricted stock release. 7. Plan Amendments: The plan should provide a mechanism for making amendments or modifications to the stock retainer program, subject to regulatory requirements and shareholder approval, if necessary. 8. Limitations and Compliance: The plan should comply with Nebraska state laws and regulations, avoiding any violations or infringement of relevant provisions. It may also include limitations on the number of shares that can be granted under the plan and any other compliance-related clauses. Different variations of Nebraska Approval of Stock Retainer Plans for Nonemployee Directors may exist, depending on individual company needs and preferences. Some common types include: 1. Performance-Based Stock Retainer Plan: This type of plan links the stock grants to predetermined performance metrics, ensuring that directors' compensation aligns directly with the company's financial success. 2. Restricted Stock Unit Vesting Plan: In this plan, directors receive restricted stock units that vest over time, providing motivation for them to continue their service and share in the value appreciation of the company's stock. 3. Stock Option Grant Plan: This plan offers directors the opportunity to purchase company stock at a specified price, known as the exercise price, within a predetermined period. Upon exercising the option, directors can benefit from any increase in the stock price. In conclusion, Nebraska Approval of Stock Retainer Plan for Nonemployee Directors is a crucial process that empowers corporations to compensate their directors effectively through stock-based incentives. By adhering to the relevant regulations and providing a comprehensive plan, companies can attract and retain qualified directors, align their interests with shareholders, and ultimately contribute to the success of the organization.

Nebraska Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan

Description

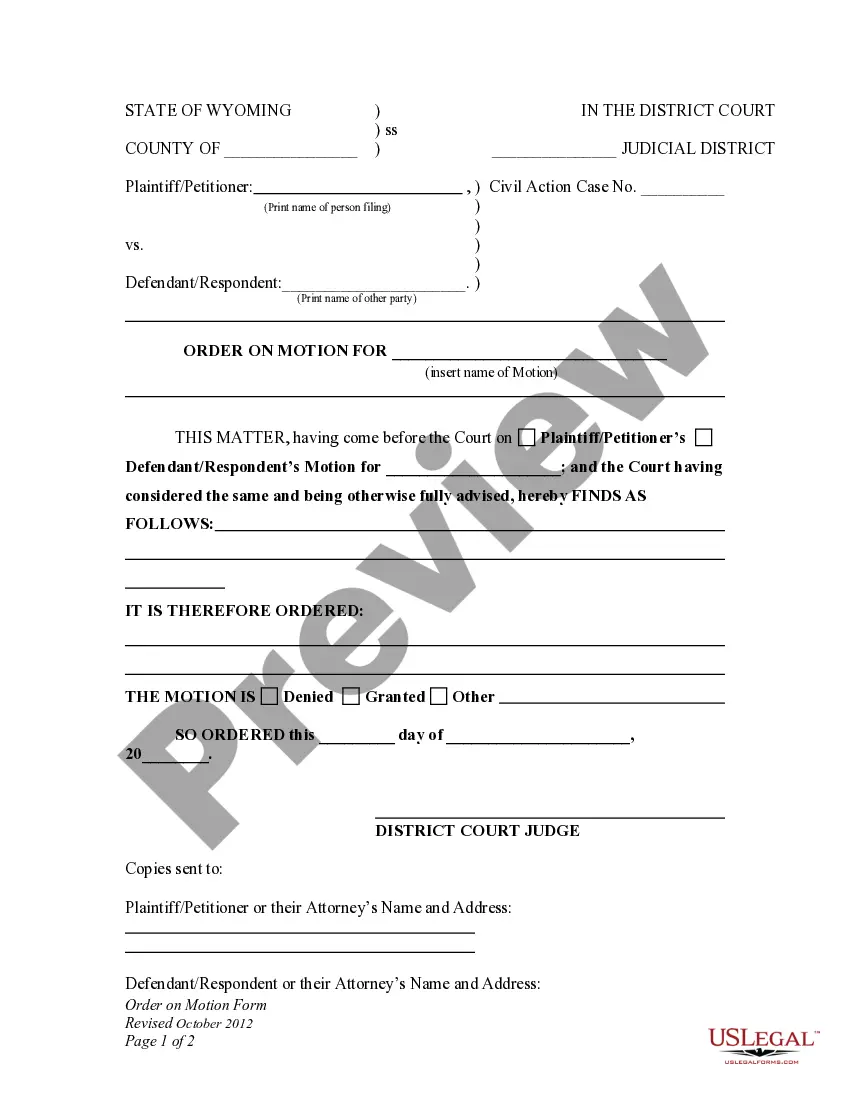

How to fill out Nebraska Approval Of Stock Retainer Plan For Nonemployee Directors With Copy Of Plan?

Have you been within a placement in which you will need files for sometimes company or person reasons just about every day? There are tons of legal papers templates available on the Internet, but discovering ones you can rely isn`t simple. US Legal Forms provides a huge number of develop templates, like the Nebraska Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan, that are composed to fulfill federal and state requirements.

In case you are currently knowledgeable about US Legal Forms internet site and get an account, just log in. Next, you can down load the Nebraska Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan format.

If you do not provide an accounts and would like to start using US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is to the appropriate metropolis/state.

- Utilize the Review key to check the shape.

- Look at the explanation to ensure that you have chosen the correct develop.

- In case the develop isn`t what you are seeking, utilize the Look for discipline to obtain the develop that fits your needs and requirements.

- When you find the appropriate develop, click Purchase now.

- Pick the prices strategy you would like, complete the necessary information to make your account, and purchase the order utilizing your PayPal or credit card.

- Choose a convenient data file formatting and down load your copy.

Find all the papers templates you may have purchased in the My Forms food selection. You may get a further copy of Nebraska Approval of Stock Retainer Plan for Nonemployee Directors with copy of plan at any time, if possible. Just select the needed develop to down load or produce the papers format.

Use US Legal Forms, one of the most substantial collection of legal kinds, to save time as well as steer clear of faults. The service provides expertly produced legal papers templates that you can use for an array of reasons. Generate an account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

Equity Retainer means the designated annual stock retainer, payable quarterly, for Non-Employee Directors established from time to time by the Board as equity compensation for services rendered.

?NON-EMPLOYEE DIRECTOR? means a member of the Board who is not an employee of the Company or any of its Subsidiaries. ?OPTION? means an option to purchase Shares awarded to a Non-Employee Director under the Plan.

This board member isn't a company employee, which means they don't engage in the day-to-day management of the organization. Rather, most non-executive directors act as independent advisors and are involved in policymaking and planning exercises.

In general, directors who have a service agreement, or employment contract, will be classed as employees. But Non-Executive Directors or NEDs ? who often act in more of an advisory or mentorship role ? may not intend to have any employment relationship with the company.

Directors of a corporation - members of the governing board - are defined by statute as non-employees.

Nonprofit: Nonprofit board members usually serve as volunteers. They often don't get salaries but may receive reimbursements for attending meetings. On the other hand, for-profit organizations compensate board members through retainers or other financial benefits.