Nebraska Approval of Restricted Share Plan for Directors with Copy of Plan: A Comprehensive Guide Overview: The Nebraska Approval of Restricted Share Plan for Directors is a vital framework that empowers companies to grant restricted shares to their esteemed directors. By establishing such a plan, businesses can effectively align the interests of directors with shareholders, bolstering their commitment towards achieving long-term organizational goals. This detailed description aims to delve into the key aspects of the Nebraska Approval of Restricted Share Plan for Directors, its benefits, and the various types of plans available. Benefits of an Approval of Restricted Share Plan for Directors in Nebraska: 1. Strengthening Director-Shareholder Alignment: The plan engenders a shared sense of purpose between company directors and shareholders by incentivizing directors to focus on driving sustainable growth and enhancing shareholder value. 2. Retention of High-Quality Directors: Offering restricted shares provides a compelling long-term incentive for seasoned directors to remain actively engaged and committed to the company's success. 3. Attraction of Top Talent: A robust restricted share plan can serve as an influential tool for attracting new directors who seek opportunities to share in the company's achievements. 4. Promotion of Accountability and Enhanced Governance: By enabling directors to earn company shares based on predetermined performance criteria, the plan promotes accountability, good governance, and responsible decision-making. Types of Nebraska Approval of Restricted Share Plans for Directors: 1. Performance-Based Restricted Share Plan: This type of plan bases the allocation of restricted shares on the achievement of predefined performance targets, such as financial metrics, earnings growth, or market share expansion. 2. Time-Based Restricted Share Plan: With this plan, directors become eligible for the allocation of restricted shares over a specified period, ensuring their ongoing commitment to the company's success. 3. Hybrid Restricted Share Plan: Combining elements of both performance-based and time-based plans, the hybrid plan incorporates multiple criteria, offering a balanced approach to incentivizing directors. Copy of Plan: To gain a comprehensive understanding of the Nebraska Approval of Restricted Share Plan for Directors, it is crucial for companies to obtain a copy of the plan. This document outlines the specific terms and conditions, eligibility criteria, vesting schedules, and calculation methods for restricted share allocation. Companies can consult legal professionals or access official Nebraska government resources to obtain the requisite copy, ensuring compliance with all applicable regulations and guidelines. By embracing the Nebraska Approval of Restricted Share Plan for Directors, businesses can cultivate a culture of shared success, attracting and retaining talented directors and propelling their growth trajectory. It is vital for companies to consider their specific objectives and consult with legal experts to select the most suitable type of plan that aligns with their organizational vision and fosters long-term value creation.

Nebraska Approval of Restricted Share Plan for Directors with Copy of Plan

Description

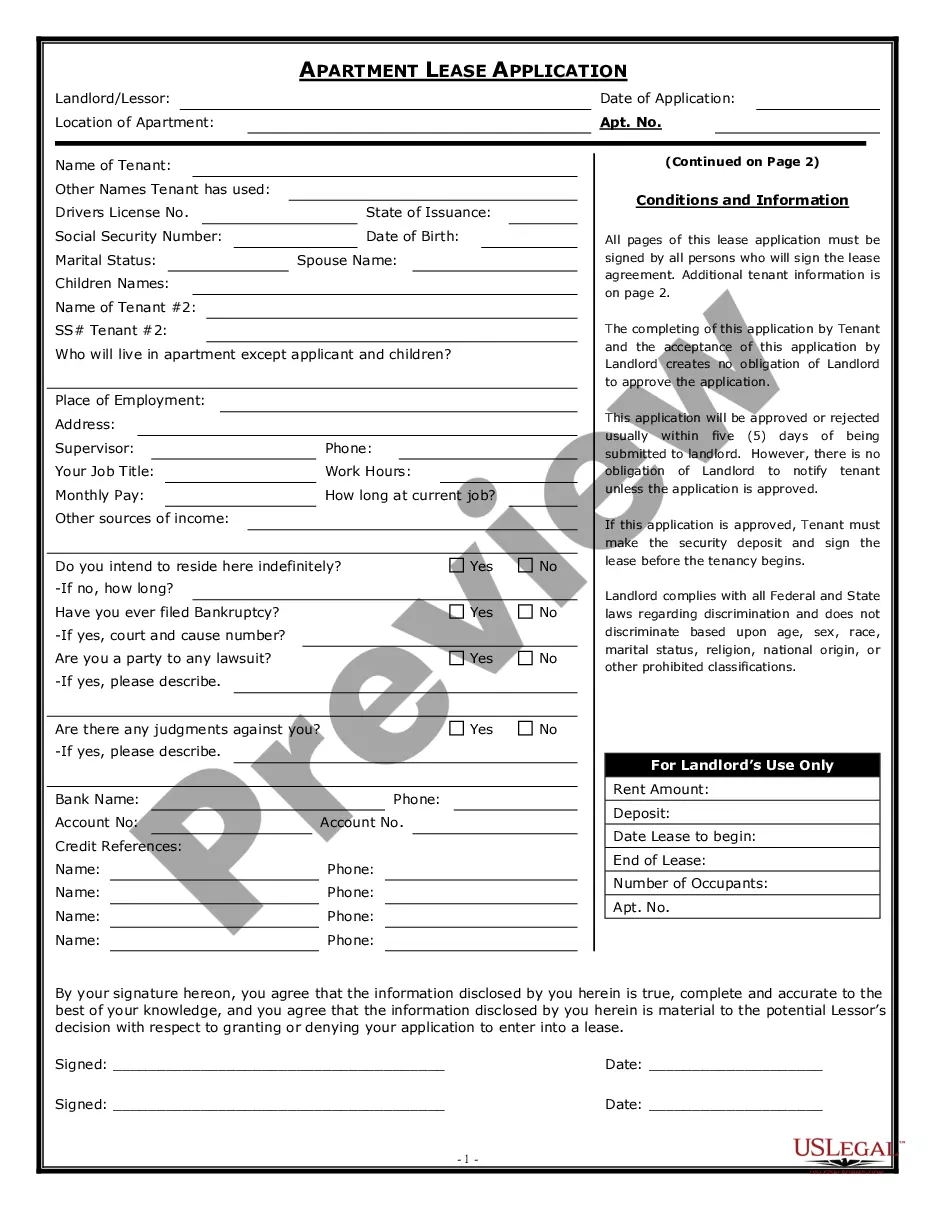

How to fill out Nebraska Approval Of Restricted Share Plan For Directors With Copy Of Plan?

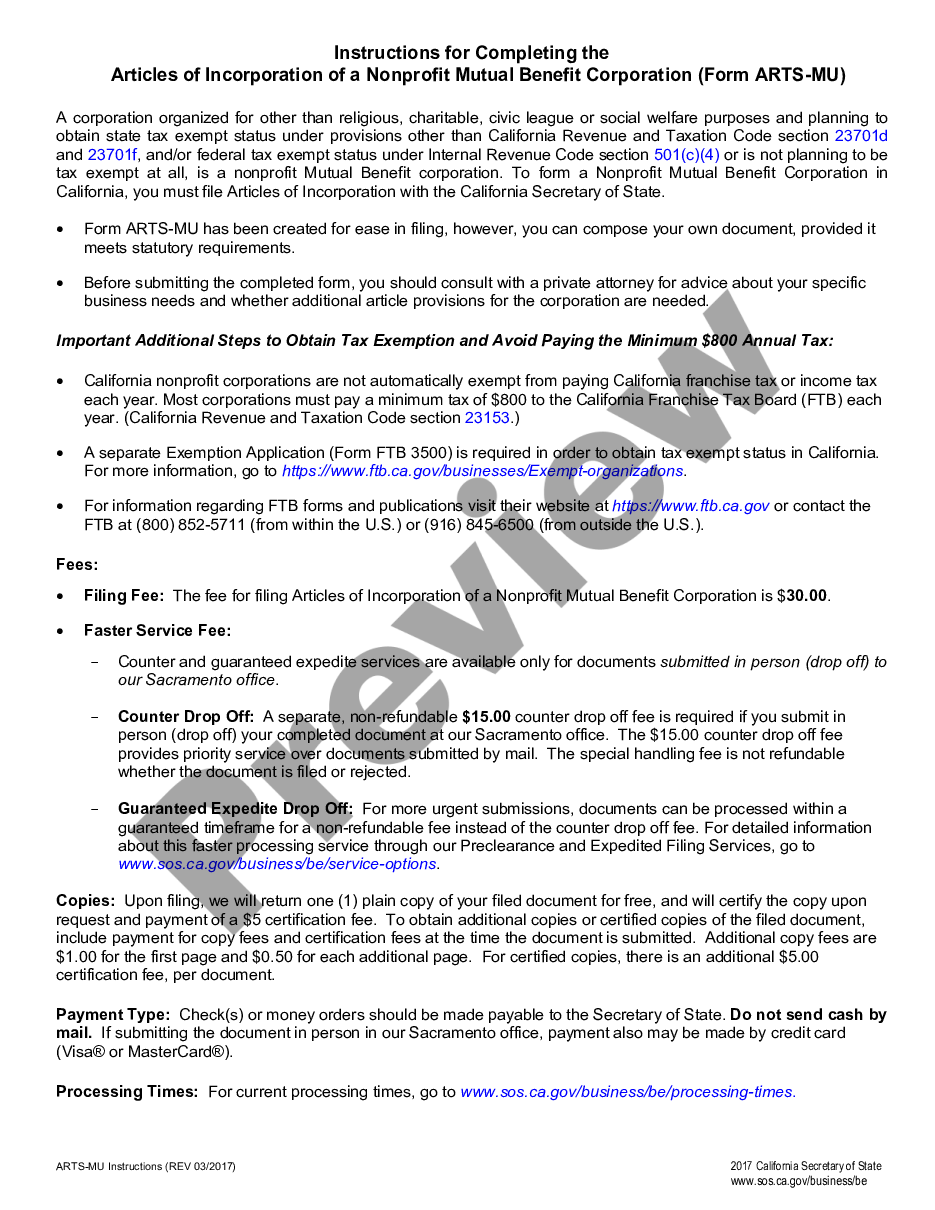

Choosing the best legitimate record web template could be a battle. Of course, there are tons of web templates available on the Internet, but how will you find the legitimate kind you will need? Make use of the US Legal Forms website. The service delivers a huge number of web templates, like the Nebraska Approval of Restricted Share Plan for Directors with Copy of Plan, that can be used for company and private requires. All of the kinds are checked out by experts and fulfill federal and state specifications.

If you are previously registered, log in to your account and click on the Obtain button to obtain the Nebraska Approval of Restricted Share Plan for Directors with Copy of Plan. Utilize your account to look with the legitimate kinds you may have purchased earlier. Proceed to the My Forms tab of your respective account and have an additional version from the record you will need.

If you are a new user of US Legal Forms, listed below are easy guidelines that you should stick to:

- Very first, ensure you have selected the proper kind for the town/state. You may look through the shape making use of the Preview button and browse the shape explanation to guarantee this is basically the right one for you.

- In the event the kind fails to fulfill your requirements, use the Seach discipline to find the right kind.

- Once you are sure that the shape would work, go through the Get now button to obtain the kind.

- Pick the pricing prepare you desire and enter in the essential information and facts. Make your account and pay for the transaction making use of your PayPal account or Visa or Mastercard.

- Opt for the submit formatting and acquire the legitimate record web template to your system.

- Comprehensive, change and printing and indicator the received Nebraska Approval of Restricted Share Plan for Directors with Copy of Plan.

US Legal Forms may be the greatest library of legitimate kinds that you will find different record web templates. Make use of the company to acquire professionally-made papers that stick to condition specifications.

Form popularity

FAQ

Vesting Schedule The restricted stock units are assigned a fair market value when they vest. Upon vesting, they are considered income, and often a portion of the shares is withheld to pay income taxes. The employees receive the remaining shares and can sell them at their discretion.

Restricted shares are unregistered, non-transferable shares issued to a company's employees. They give employees incentives to help companies attain success. They are most common in established companies that want to motivate people with an equity stake. Their sale is usually restricted by a vesting schedule.

RSUs have no actual financial value to the employee when issued. However, once they vest, employees can receive shares of stock or, less commonly, an equivalent value in cash. Until the RSUs vest, they remain an unfunded promise to compensate the recipient at some point in the future.

RSUs are a type of equity compensation that grants employees a specific number of company shares subject to a vesting schedule and potentially other stipulations. The vesting schedule dictates when ownership rights are activated, typically upon completing a certain number of service years.

Once they are vested, RSUs can be sold or kept like any other shares of company stock. Unlike stock options or warrants, RSUs always have some value based on the underlying shares. For tax purposes, the entire value of vested RSUs must be included as ordinary income in the year of vesting.

The main difference between restricted stock and performance shares is that restricted stock is typically awarded to employees with the condition that they remain with the company for a certain period of time, while performance shares are awarded to employees based on the company's performance.

RSUs are a type of equity compensation that grants employees a specific number of company shares subject to a vesting schedule and potentially other stipulations. The vesting schedule dictates when ownership rights are activated, typically upon completing a certain number of service years.

If you are on track toward meeting a retirement goal that is 10+ years out, it makes sense to choose options over RSUs. On the other hand, if you want to earmark this equity compensation for a retirement or education goal that is in five years or less, opting for more RSUs might be a better choice.