Nebraska Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

Finding the right lawful papers design could be a struggle. Needless to say, there are plenty of layouts accessible on the Internet, but how do you get the lawful kind you will need? Make use of the US Legal Forms website. The service provides 1000s of layouts, like the Nebraska Proposal to Approve Adoption of Employees' Stock Option Plan, that you can use for organization and personal requires. All the forms are checked by specialists and satisfy state and federal requirements.

In case you are presently authorized, log in in your bank account and then click the Obtain key to have the Nebraska Proposal to Approve Adoption of Employees' Stock Option Plan. Make use of your bank account to search with the lawful forms you have purchased in the past. Check out the My Forms tab of your own bank account and get another backup of your papers you will need.

In case you are a fresh end user of US Legal Forms, listed below are simple recommendations that you should follow:

- First, make certain you have chosen the appropriate kind for your city/county. You may check out the shape making use of the Review key and read the shape explanation to guarantee it is the best for you.

- When the kind does not satisfy your preferences, utilize the Seach area to find the proper kind.

- When you are certain the shape would work, select the Acquire now key to have the kind.

- Select the pricing plan you would like and type in the necessary information and facts. Build your bank account and pay money for the transaction utilizing your PayPal bank account or charge card.

- Opt for the file structure and down load the lawful papers design in your product.

- Full, revise and produce and signal the obtained Nebraska Proposal to Approve Adoption of Employees' Stock Option Plan.

US Legal Forms is definitely the most significant local library of lawful forms where you can find numerous papers layouts. Make use of the service to down load appropriately-manufactured documents that follow status requirements.

Form popularity

FAQ

Allotment of ESOP Grant: Grant means the issue of stocks to the employees. It means informing the employee that he is eligible for ESOP. ... Vest: Vest means the right of the employees to apply for the shares granted to them. ... Exercise: The exercise period is where the employees can exercise the option of buying the shares.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company.

There are two main ways to allocate options to your team: As a percentage of the salary - companies offer options to their team based on their salary, seniority, and type of role. As a percentage of the company - in this case, key people might get allocated a fixed % of the company's total equity.

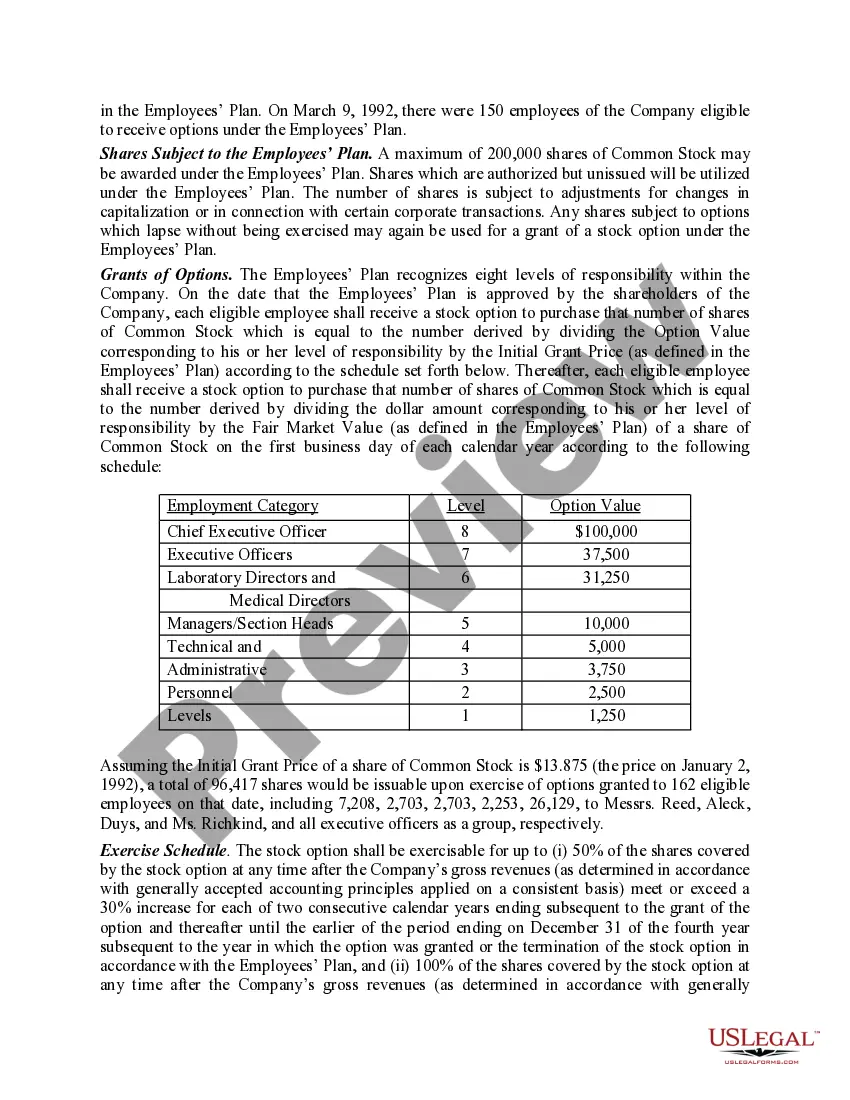

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.