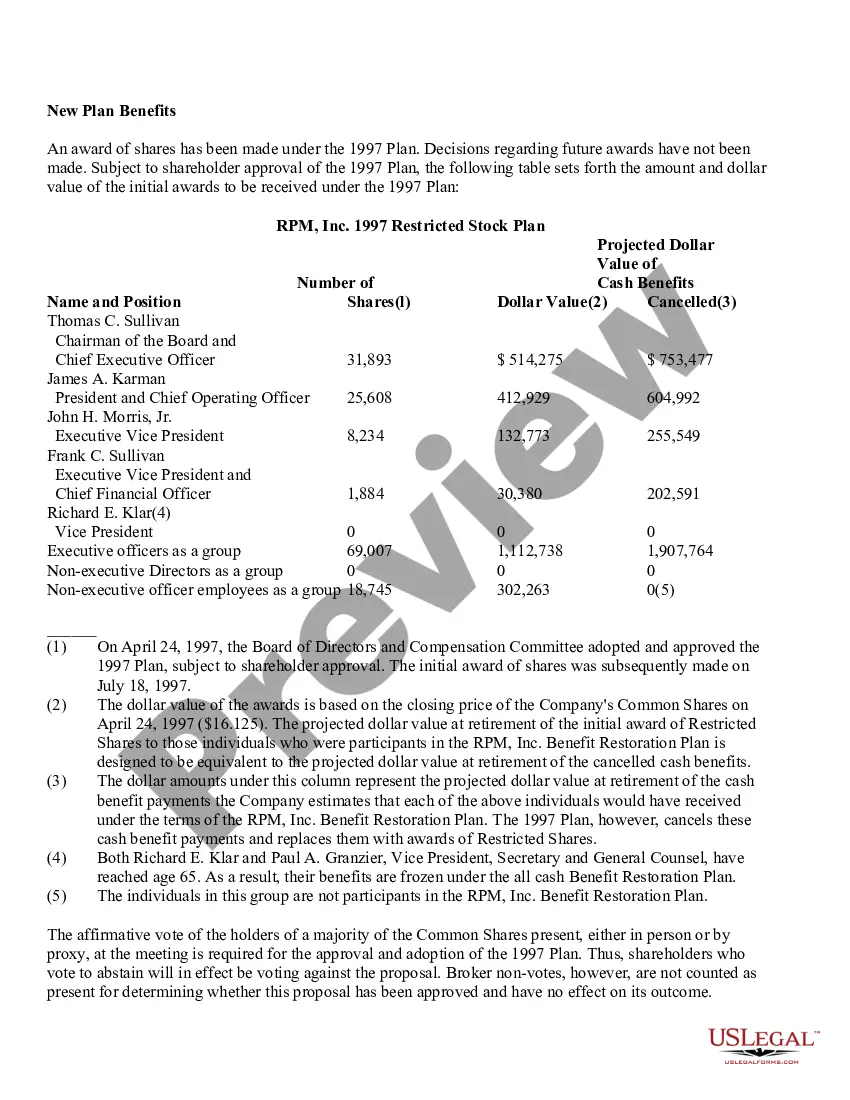

Nebraska Adoption of Restricted Stock Plan of RPM, Inc. The Nebraska Adoption of Restricted Stock Plan of RPM, Inc. is a comprehensive equity compensation strategy implemented by RPM, Inc., a prominent company operating in Nebraska. This plan aims to incentivize and reward eligible employees by granting them restricted stock awards. Under this program, RPM, Inc. designates a specific number of shares as restricted stock units (RSS) to be awarded to eligible employees. This RSS has certain conditions and restrictions on their vesting and transferability. The plan is carefully designed to align the interests of employees with the long-term success and growth of RPM, Inc. The Nebraska Adoption of Restricted Stock Plan offers several key benefits. Firstly, it provides employees with an opportunity to participate in the company's growth and success. As the stock value grows, the recipients of the RSS may receive substantial financial rewards. Secondly, these awards serve as an effective retention tool, encouraging talented individuals to stay and contribute to the company's development. To qualify for participation in the plan, employees typically need to meet specific criteria determined by RPM, Inc., such as job tenure, performance targets, or leadership positions. Once an individual becomes eligible, they are granted a specific number of RSS based on their role and contribution to the company. The vesting period varies depending on the specific terms of the plan, but it commonly ranges from one to five years. During the vesting period, the RSS are subject to forfeiture if the employee leaves RPM, Inc. However, upon successful completion of the vesting period, the employees are entitled to receive the full value of the vested RSS, either in cash or stock. It's important to note that there might be different variations of the Nebraska Adoption of Restricted Stock Plan of RPM, Inc. Depending on the specific needs and objectives of the company, different types of restricted stock plans may exist. These could include: 1. Performance-Based Restricted Stock Plans: In these plans, the vesting of RSS is tied to predefined performance goals, such as achieving certain financial targets or meeting specific operational milestones. This approach further aligns employee performance with company performance. 2. Employee Stock Purchase Plans (ESPN): ESPN allow employees to purchase shares of RPM, Inc. at a discounted price, providing them with an opportunity to acquire ownership in the company directly. These plans often have specific rules and periods during which employees can exercise their stock purchasing options. 3. Equity Incentive Plans: Equity incentive plans encompass a broader range of equity-based awards, including stock options, stock appreciation rights (SARS), or phantom stock. These plans provide employees with flexibility in choosing their preferred form of equity compensation. In conclusion, the Nebraska Adoption of Restricted Stock Plan of RPM, Inc. is a robust equity compensation strategy aimed at motivating, rewarding, and retaining eligible employees. It provides them with an opportunity to acquire company stock and benefit from its future growth. With various types of plans available, RPM, Inc. can customize their approach to suit their specific goals and objectives.

Nebraska Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Nebraska Adoption Of Restricted Stock Plan Of RPM, Inc.?

Discovering the right lawful document template can be a struggle. Naturally, there are plenty of templates available on the net, but how do you obtain the lawful kind you want? Take advantage of the US Legal Forms website. The services gives a large number of templates, such as the Nebraska Adoption of Restricted Stock Plan of RPM, Inc., which can be used for company and personal needs. Each of the forms are checked out by professionals and satisfy federal and state specifications.

If you are previously signed up, log in to the profile and click the Obtain option to get the Nebraska Adoption of Restricted Stock Plan of RPM, Inc.. Utilize your profile to look throughout the lawful forms you have ordered formerly. Visit the My Forms tab of your profile and obtain an additional backup of your document you want.

If you are a fresh customer of US Legal Forms, here are easy guidelines for you to adhere to:

- Very first, ensure you have chosen the correct kind for the area/region. You can look through the shape while using Preview option and look at the shape description to ensure this is the best for you.

- In the event the kind does not satisfy your requirements, use the Seach field to find the correct kind.

- Once you are certain the shape is proper, click the Purchase now option to get the kind.

- Opt for the pricing strategy you desire and type in the needed info. Make your profile and purchase the order using your PayPal profile or bank card.

- Select the data file structure and down load the lawful document template to the gadget.

- Total, revise and printing and indicator the obtained Nebraska Adoption of Restricted Stock Plan of RPM, Inc..

US Legal Forms is the greatest catalogue of lawful forms in which you will find different document templates. Take advantage of the service to down load appropriately-created documents that adhere to express specifications.