The Nebraska Nonemployee Director Stock Option Plan is a program designed specifically for nonemployee directors of U.S. Ban corp, a leading financial services company headquartered in Nebraska. This plan is aimed at incentivizing and rewarding the contributions made by nonemployee directors towards the organization's growth and success. By offering stock options to these directors, U.S. Ban corp aims to align their interests with long-term shareholder value and create a sense of ownership among them. Under the Nebraska Nonemployee Director Stock Option Plan, eligible nonemployee directors are granted the opportunity to purchase a certain number of shares of U.S. Ban corp's common stock at a predetermined exercise price. These stock options generally have a vesting period during which the options cannot be exercised, encouraging directors to remain on the board for a specific duration. Once the vesting period has passed, directors can exercise their stock options, potentially becoming stockholders themselves. The Nebraska Nonemployee Director Stock Option Plan of U.S. Ban corp offers various types of stock options to cater to different needs and preferences. These may include: 1. Nonqualified Stock Options (SOS): Nonqualified stock options are one type of stock option commonly offered under this plan. They allow directors to purchase shares of U.S. Ban corp's common stock at a predetermined price, regardless of their market value at the time of exercise. SOS are subject to certain tax implications and are not eligible for special tax treatment. 2. Incentive Stock Options (SOS): Another type of stock option that may be available under the plan is the incentive stock option. SOS provide favorable tax treatment, as the potential gains from the exercise and sale of the underlying stock can be treated as long-term capital gains. However, SOS require compliance with specific Internal Revenue Service (IRS) regulations regarding exercise price, holding periods, and other criteria. 3. Time-Vested Options: Time-vested stock options are granted to nonemployee directors upon joining the board or at regular intervals during their tenure. These options typically vest over a predetermined period of time, encouraging continued service and alignment with long-term goals. 4. Performance-based Options: In addition to time-based options, U.S. Ban corp may also offer performance-based stock options that are tied to specific performance criteria, such as financial targets or shareholder return. These options provide incentives for directors to actively contribute to the company's growth and achievement of key objectives. The Nebraska Nonemployee Director Stock Option Plan of U.S. Ban corp is a valuable tool for attracting and retaining talented nonemployee directors, fostering their commitment to the company's success, and aligning their interests with those of shareholders. The specific terms, conditions, and types of stock options may vary based on individual director agreements and overall corporate objectives.

Nebraska Nonemployee Director Stock Option Plan of U.S. Bancorp

Description

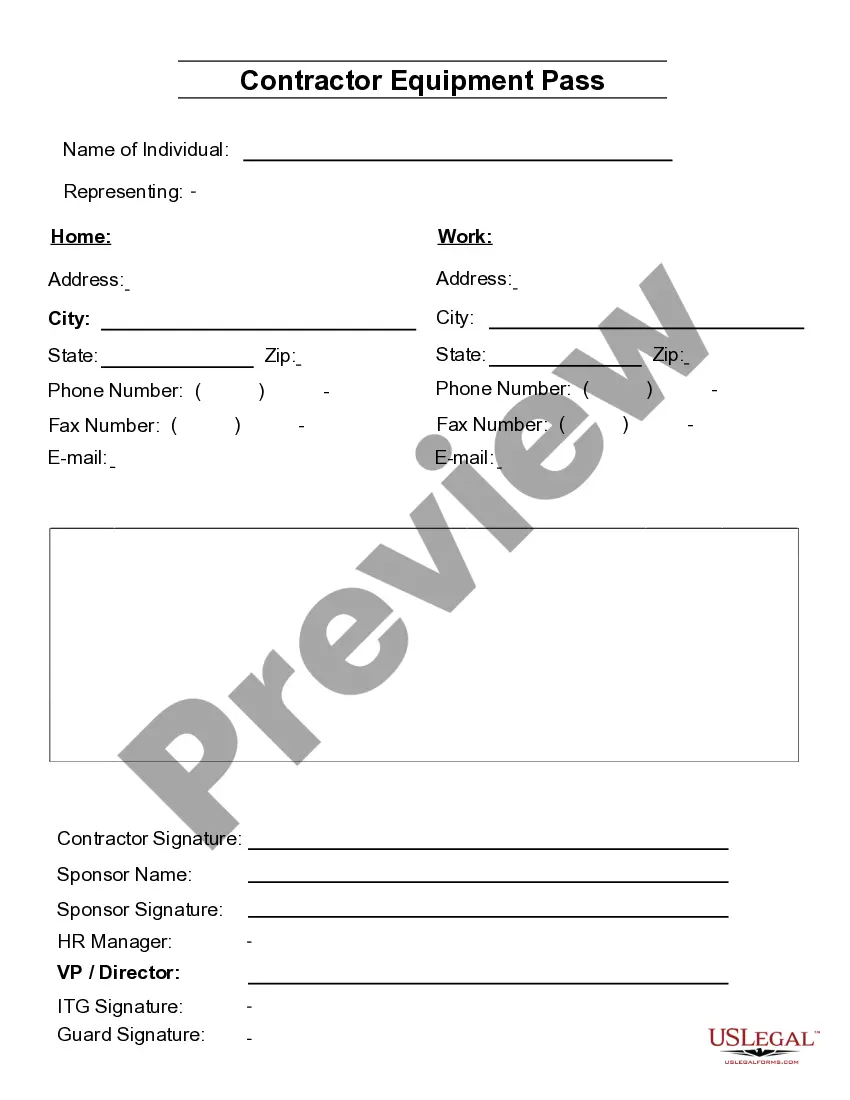

How to fill out Nebraska Nonemployee Director Stock Option Plan Of U.S. Bancorp?

You are able to spend several hours on the web looking for the lawful record template that suits the state and federal demands you will need. US Legal Forms supplies thousands of lawful kinds that are analyzed by specialists. You can actually down load or printing the Nebraska Nonemployee Director Stock Option Plan of U.S. Bancorp from the support.

If you have a US Legal Forms bank account, it is possible to log in and click the Acquire key. After that, it is possible to total, edit, printing, or signal the Nebraska Nonemployee Director Stock Option Plan of U.S. Bancorp. Every lawful record template you purchase is your own property permanently. To acquire yet another version associated with a bought form, proceed to the My Forms tab and click the corresponding key.

If you are using the US Legal Forms web site for the first time, follow the basic directions below:

- Very first, ensure that you have selected the proper record template for that region/metropolis of your liking. See the form outline to ensure you have selected the proper form. If available, utilize the Preview key to check through the record template at the same time.

- In order to find yet another edition of your form, utilize the Search area to obtain the template that fits your needs and demands.

- After you have discovered the template you would like, simply click Get now to proceed.

- Find the costs program you would like, type your accreditations, and sign up for your account on US Legal Forms.

- Full the purchase. You may use your charge card or PayPal bank account to fund the lawful form.

- Find the structure of your record and down load it for your product.

- Make alterations for your record if required. You are able to total, edit and signal and printing Nebraska Nonemployee Director Stock Option Plan of U.S. Bancorp.

Acquire and printing thousands of record web templates using the US Legal Forms website, which offers the largest selection of lawful kinds. Use expert and status-distinct web templates to tackle your organization or person requires.