The Nebraska Directors' Stock Deferral Plan is a program specifically implemented by Nor west Corp. to provide its directors in Nebraska with an opportunity to defer compensation in the form of company stock. This plan allows directors to delay receiving their compensation until a later date to take advantage of potential future growth in the stock value. Under this program, directors are given the option to defer a portion of their director fees or retainers, and instead, receive it in the form of company stock. By doing so, directors have the potential to benefit from any increase in the stock's value over time. The Nebraska Directors' Stock Deferral Plan offers flexibility to participants by allowing them to choose the exact amount of compensation they wish to defer and the duration of the deferral period. This flexibility enables directors to customize their compensation to align with their personal financial goals and objectives. Additionally, the plan allows directors to defer the payment of income taxes on the deferred compensation until a later date when they receive it. This feature provides potential tax advantages, as directors may be in a lower tax bracket during their retirement years. Furthermore, the plan may include various investment options for participants to allocate their deferred stock. These options could include diversified investment funds, individual stocks, or other investment vehicles. Directors have the ability to choose the investment strategy that best suits their risk tolerance and investment preferences. It is important to note that while this description pertains specifically to the Nebraska Directors' Stock Deferral Plan for Nor west Corp., other variations of the directors' stock deferral plan may exist for different states or jurisdictions. These variations could include different eligibility criteria, deferral periods, vesting schedules, or investment options, tailored to comply with specific regulations or requirements. However, for the purpose of this description, the focus remains on the Nebraska version of the plan implemented by Nor west Corp.

Nebraska Directors' Stock Deferral Plan for Norwest Corp.

Description

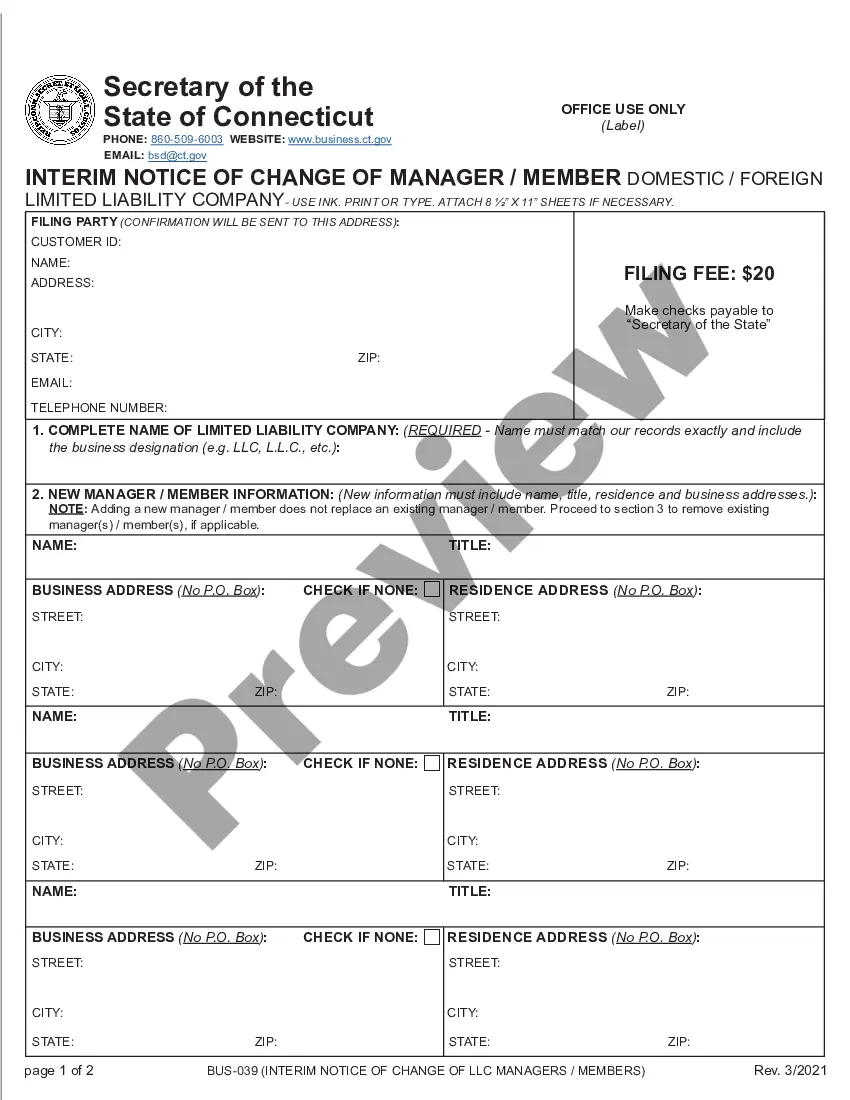

How to fill out Nebraska Directors' Stock Deferral Plan For Norwest Corp.?

US Legal Forms - one of many biggest libraries of lawful forms in the United States - gives an array of lawful document themes you can down load or print. While using internet site, you will get a huge number of forms for enterprise and specific purposes, categorized by classes, claims, or keywords and phrases.You can find the latest variations of forms such as the Nebraska Directors' Stock Deferral Plan for Norwest Corp. within minutes.

If you already possess a registration, log in and down load Nebraska Directors' Stock Deferral Plan for Norwest Corp. through the US Legal Forms library. The Obtain button will appear on every develop you view. You have access to all formerly acquired forms from the My Forms tab of your respective accounts.

If you wish to use US Legal Forms initially, listed below are easy instructions to help you get started:

- Be sure you have chosen the proper develop to your city/area. Go through the Preview button to analyze the form`s articles. Read the develop outline to actually have chosen the appropriate develop.

- In the event the develop doesn`t fit your specifications, take advantage of the Lookup area near the top of the display to find the one which does.

- If you are content with the form, validate your choice by simply clicking the Acquire now button. Then, pick the rates program you prefer and give your references to sign up to have an accounts.

- Procedure the purchase. Use your credit card or PayPal accounts to perform the purchase.

- Select the format and down load the form on the product.

- Make changes. Fill up, edit and print and signal the acquired Nebraska Directors' Stock Deferral Plan for Norwest Corp..

Every web template you included in your money lacks an expiration date and is your own forever. So, if you would like down load or print another copy, just visit the My Forms segment and then click around the develop you will need.

Obtain access to the Nebraska Directors' Stock Deferral Plan for Norwest Corp. with US Legal Forms, probably the most considerable library of lawful document themes. Use a huge number of skilled and condition-particular themes that meet your small business or specific needs and specifications.