Nebraska Executive Director Loan Plan: Detailed Description and Copy of Promissory Note by Hathaway Instruments, Inc. The Nebraska Executive Director Loan Plan, offered by Hathaway Instruments, Inc., is an innovative financial solution designed to assist executive-level professionals in Nebraska in achieving their financial goals. This loan plan provides executives with a reliable avenue to secure funds for personal or business-related expenses, offering various attractive features. One type of Nebraska Executive Director Loan Plan is the "Standard Loan Plan." This plan allows executives to borrow a specific amount of money, based on their financial needs and creditworthiness. The loan is provided through a detailed process that includes the applicant's financial evaluation, credit history review, and collateral assessment (if applicable). Upon approval, borrowers receive a copy of the Promissory Note, which outlines the terms and conditions of the loan. Key features of the Nebraska Executive Director Loan Plan include competitive interest rates, flexible repayment terms, and personalized loan amounts. The interest rates are determined based on market conditions and the borrower's creditworthiness, ensuring a fair and beneficial agreement for both parties. The repayment terms can be tailored to the borrower's preferences, allowing for shorter or longer durations, depending on their financial capabilities and objectives. Additionally, the personalized loan amounts ensure that executives can secure funds that match their specific financial requirements. Another type of Nebraska Executive Director Loan Plan is the "Prime Rate Loan Plan." This plan offers executives the opportunity to access funds at a rate based on the prevailing prime rate. With this option, fluctuations in market interest rates can be taken advantage of, enabling executives to potentially secure lower interest rates, hence reducing borrowing costs. The Promissory Note, a vital legal document provided by Hathaway Instruments, Inc. for the Nebraska Executive Director Loan Plan, outlines the terms and conditions agreed upon between the borrower and the lender. It includes crucial information such as the loan amount, interest rate, repayment schedule, late payment consequences, and other considerations. It serves as a binding agreement, safeguarding the interests of both parties involved. In conclusion, the Nebraska Executive Director Loan Plan offered by Hathaway Instruments, Inc. is a comprehensive financial solution tailored for executive-level professionals in Nebraska. With its flexible terms, attractive interest rates, and customizable loan amounts, this plan provides executives with the means to meet their personal and business-related financial objectives. The accompanying Promissory Note ensures transparency and legal compliance, fostering a trusting relationship between borrowers and Hathaway Instruments, Inc.

Nebraska Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

Are you in the placement in which you require files for possibly business or individual reasons virtually every day time? There are a lot of legitimate file templates available on the net, but discovering ones you can trust isn`t simple. US Legal Forms offers a huge number of type templates, much like the Nebraska Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc., that happen to be written to satisfy state and federal demands.

In case you are previously familiar with US Legal Forms internet site and get a free account, simply log in. After that, you are able to obtain the Nebraska Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. web template.

If you do not offer an bank account and would like to start using US Legal Forms, abide by these steps:

- Obtain the type you will need and make sure it is to the appropriate metropolis/area.

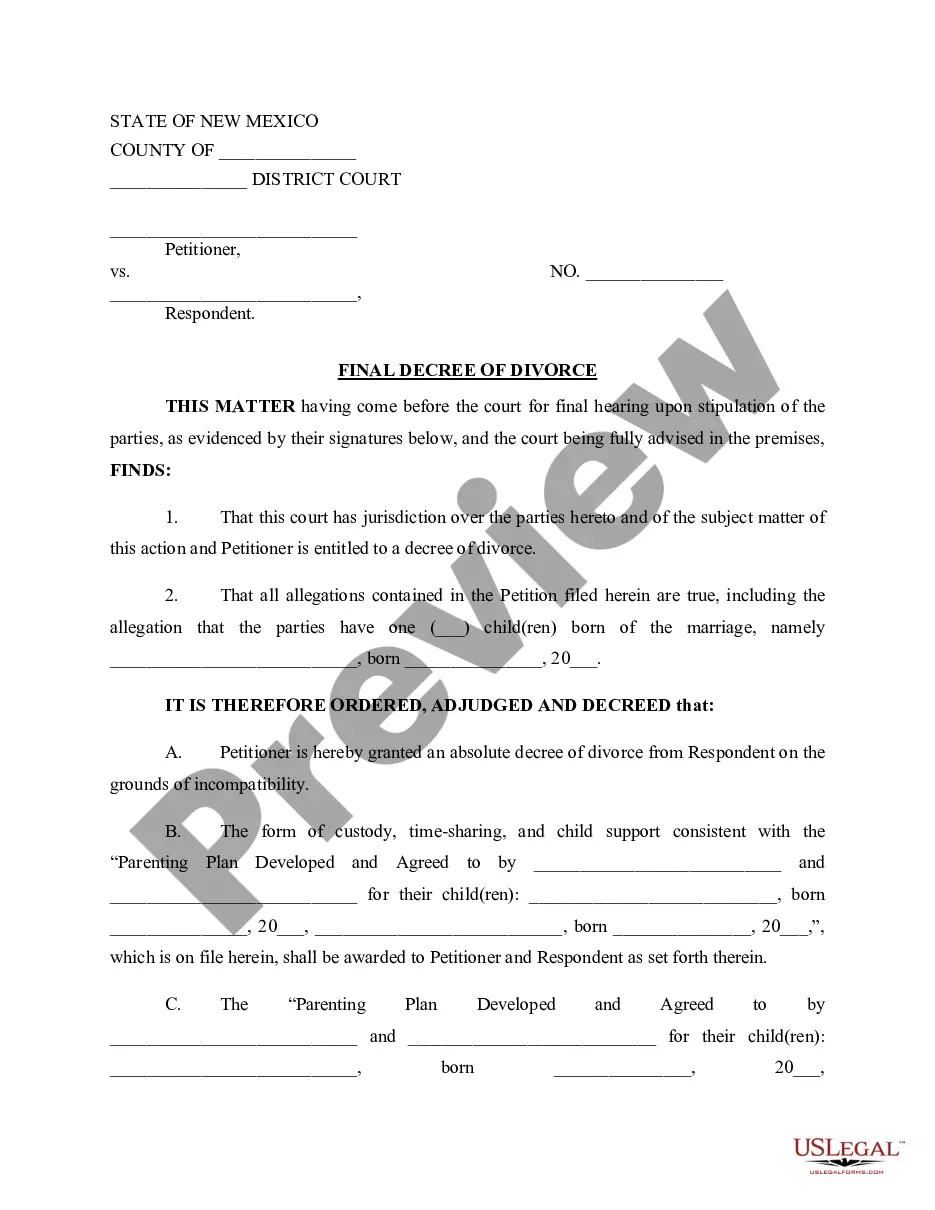

- Utilize the Review key to examine the shape.

- See the outline to actually have chosen the proper type.

- When the type isn`t what you are searching for, use the Lookup discipline to find the type that meets your requirements and demands.

- When you get the appropriate type, simply click Purchase now.

- Select the prices plan you desire, fill out the specified information and facts to produce your account, and pay money for the transaction with your PayPal or credit card.

- Select a hassle-free paper formatting and obtain your copy.

Get each of the file templates you have bought in the My Forms menu. You can obtain a more copy of Nebraska Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. any time, if possible. Just click on the required type to obtain or produce the file web template.

Use US Legal Forms, the most substantial assortment of legitimate forms, to save some time and avoid mistakes. The assistance offers appropriately created legitimate file templates which you can use for a selection of reasons. Create a free account on US Legal Forms and begin producing your life a little easier.