Nebraska Stock Option Grants and Exercises and Fiscal Year-End Values

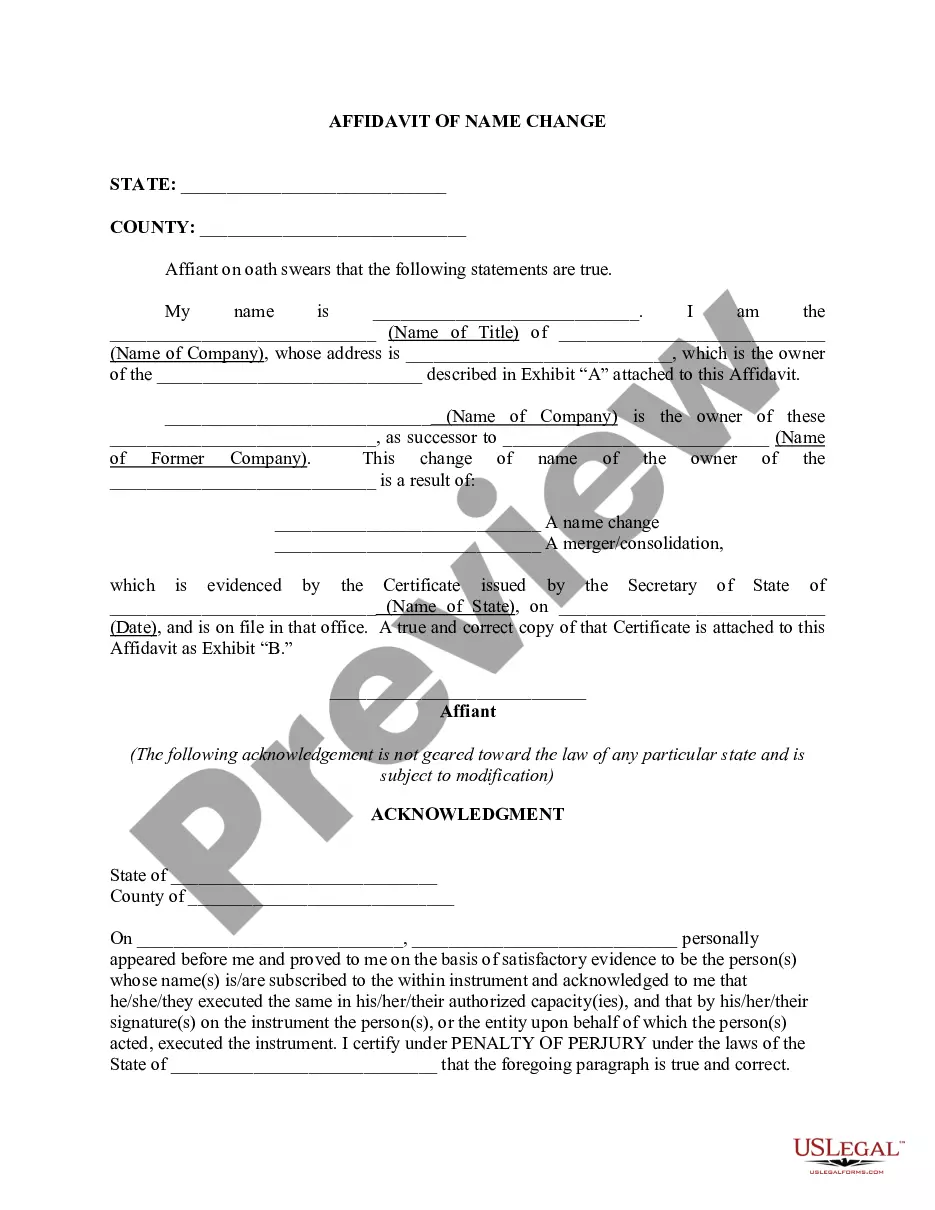

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

Finding the right legal record format could be a struggle. Of course, there are a variety of themes available on the Internet, but how will you obtain the legal type you want? Utilize the US Legal Forms web site. The assistance offers a large number of themes, like the Nebraska Stock Option Grants and Exercises and Fiscal Year-End Values, which you can use for organization and private requirements. All of the types are checked out by experts and meet federal and state requirements.

In case you are previously authorized, log in to the profile and click the Acquire key to have the Nebraska Stock Option Grants and Exercises and Fiscal Year-End Values. Use your profile to look through the legal types you might have bought in the past. Visit the My Forms tab of your respective profile and obtain yet another version from the record you want.

In case you are a fresh end user of US Legal Forms, listed here are simple guidelines so that you can comply with:

- First, be sure you have selected the correct type for the city/state. You may check out the shape making use of the Review key and read the shape explanation to guarantee it will be the best for you.

- When the type will not meet your requirements, take advantage of the Seach field to obtain the correct type.

- When you are positive that the shape is suitable, click the Acquire now key to have the type.

- Pick the costs program you would like and enter the needed details. Design your profile and pay money for the order making use of your PayPal profile or charge card.

- Select the data file structure and obtain the legal record format to the device.

- Complete, edit and print and indication the received Nebraska Stock Option Grants and Exercises and Fiscal Year-End Values.

US Legal Forms is the most significant local library of legal types in which you can see numerous record themes. Utilize the service to obtain appropriately-created files that comply with status requirements.

Form popularity

FAQ

The cost basis, generally speaking, is equal to the exercise price, multiplied by the number of shares exercised. In our example above, the cost basis is equal to 2,000 shares times $50/share, or $100,000.

Economic Nexus legislation generally requires an out-of-state retailer to collect and remit sales tax once the retailer meets a set level of sales transactions or gross receipts activity (a threshold) within the state. No physical presence is required.

US Nexus means where there is any US involvement or connection, including (without limitation): (i) any US dollar denominated transaction; (ii) any payment in any currency that is cleared through the US financial system, including foreign branches of US banks, and US branches, agency or representative offices or US ...

The Nebraska Advantage Microenterprise Tax Credit is a 20 percent refundable tax credit for up to $20,000. To qualify for the credit, an applicant must make an investment which will grow their business.

Nebraska Tax Nexus Generally, a business has nexus in Nebraska when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.

Nebraska's special capital gains exclusion was adopted in 1987 as part of the Employment and Investment Growth Act. This allows individual taxpayers to make a one-time election to exclude Nebraska income capital gains from the sale of the stock of a qualified corporation.

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Food for human consumptionNoneMeals provided by hospitals or other institutions to patients or inmatesNoneMeals provided to students and campersNoneSchools and school-related organizationsNone4 more rows

Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount. The threshold in Nebraska is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first.