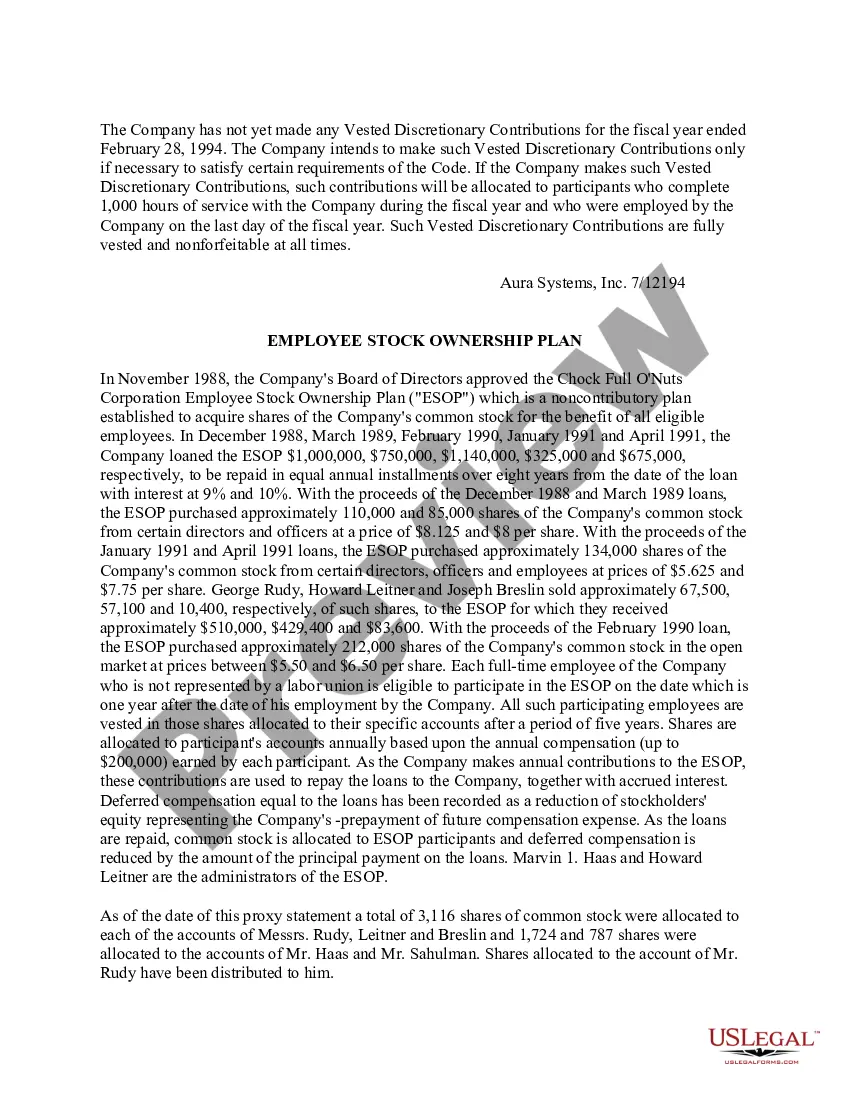

Nebraska Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Employee Stock Ownership Plan Of Aura Systems, Inc.?

US Legal Forms - one of many greatest libraries of authorized forms in the States - gives a wide range of authorized file templates you can down load or produce. While using website, you can get a large number of forms for company and person functions, categorized by groups, claims, or key phrases.You will find the most recent types of forms such as the Nebraska Employee Stock Ownership Plan of Aura Systems, Inc. in seconds.

If you already possess a membership, log in and down load Nebraska Employee Stock Ownership Plan of Aura Systems, Inc. in the US Legal Forms catalogue. The Obtain key can look on every form you see. You have access to all previously saved forms within the My Forms tab of your respective profile.

If you wish to use US Legal Forms the very first time, listed below are straightforward recommendations to get you started off:

- Be sure you have picked the correct form for your area/area. Click the Preview key to review the form`s content material. See the form information to ensure that you have chosen the proper form.

- If the form doesn`t fit your needs, make use of the Look for area near the top of the screen to obtain the one who does.

- Should you be satisfied with the form, affirm your option by clicking the Buy now key. Then, choose the pricing strategy you like and provide your references to register on an profile.

- Approach the deal. Use your credit card or PayPal profile to perform the deal.

- Select the format and down load the form in your system.

- Make adjustments. Fill up, edit and produce and indication the saved Nebraska Employee Stock Ownership Plan of Aura Systems, Inc..

Each and every design you added to your money does not have an expiry day and is your own property for a long time. So, if you wish to down load or produce yet another copy, just go to the My Forms portion and click on the form you will need.

Obtain access to the Nebraska Employee Stock Ownership Plan of Aura Systems, Inc. with US Legal Forms, probably the most extensive catalogue of authorized file templates. Use a large number of professional and state-distinct templates that meet up with your company or person needs and needs.

Form popularity

FAQ

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

ESOPs can be a good retirement benefit for employees, providing an additional source of income in the form of company stock. It also aligns their interests with those of the company. However, investing too heavily in one stock is risky. Diversification is necessary.

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.

ESOPs encourage employees to give their all as the company's success translates into financial rewards. They also help staff to feel more appreciated and better compensated for the work they do.

Equity and Debt of the Company ESOPs can impact the cost of equity capital of a company as they often issue new stocks for ESOP, increasing the number of outstanding shares. As a result, it dilutes the existing shareholders' ownership stake and impacts the company's overall market capitalisation.

A Heavy Financial Burden on The Company Depending upon the size of your business, an ESOP may not be a cost-effective option. A clear disadvantage of ESOPs is that they can cost upwards of $100,000 to set up, and the initial cost may end up outweighing any eventual tax benefits.

Distributions when you leave the company If you retire or terminate employment, you may be eligible to take distributions from your ESOP account vested balance. If the balance is $5,000 or less, it will often be paid in a lump sum.

There are many advantages to ESOPs, including the following: Flexibility: Shareholders have the option of withdrawing funds slowly over time or only selling a portion of their shares. They can stay active even after releasing their portion of the company.