Nebraska Split-Dollar Life Insurance

Description

How to fill out Split-Dollar Life Insurance?

It is possible to commit hours on-line searching for the legal file format that meets the state and federal requirements you want. US Legal Forms offers a huge number of legal varieties which are analyzed by pros. It is possible to acquire or produce the Nebraska Split-Dollar Life Insurance from your services.

If you have a US Legal Forms account, you may log in and then click the Obtain switch. After that, you may complete, revise, produce, or signal the Nebraska Split-Dollar Life Insurance. Each legal file format you acquire is your own property for a long time. To obtain another version of the purchased form, check out the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms website initially, follow the basic recommendations listed below:

- Initially, make certain you have selected the right file format for your state/city of your liking. Read the form information to ensure you have picked out the right form. If available, take advantage of the Preview switch to search through the file format also.

- If you wish to get another model in the form, take advantage of the Look for area to discover the format that meets your needs and requirements.

- Once you have identified the format you desire, simply click Get now to continue.

- Find the rates plan you desire, type your references, and sign up for a merchant account on US Legal Forms.

- Full the deal. You can use your Visa or Mastercard or PayPal account to cover the legal form.

- Find the formatting in the file and acquire it to the device.

- Make alterations to the file if required. It is possible to complete, revise and signal and produce Nebraska Split-Dollar Life Insurance.

Obtain and produce a huge number of file templates utilizing the US Legal Forms site, that provides the largest variety of legal varieties. Use skilled and condition-specific templates to deal with your company or individual requirements.

Form popularity

FAQ

Life insurance policies can be split in several ways, depending on the type of policy you have. Most policies include equity, or cash value. In some cases, the cash value, as well as the death benefit, can be considerably large.

If the policy has a cash value, you can elect to cash it out and split the proceeds with your ex. If there are children and one spouse takes primary custody and receives alimony or child support, maintaining a life insurance policy on the other ex-spouse can be a good idea.

Multiple beneficiaries For example, if you name your spouse, child and a local charity as primary beneficiaries, you might allocate 50% to your spouse, 30% to your child and 20% to the charity. No matter how you divide a life insurance payout among beneficiaries, the percentages must add up to 100%.

Split the policy In some cases, it's possible to split a joint life insurance policy into two single policies in the event of a separation. This is a known as a 'separation benefit' or 'separation agreement'. It allows you to easily split the policy without having to provide any new medical information.

You might each decide to be both the owner and beneficiary for the other person's policy. If you have a cash value life insurance policy, you and your spouse may decide to terminate the policy and then divide the cash value equally.

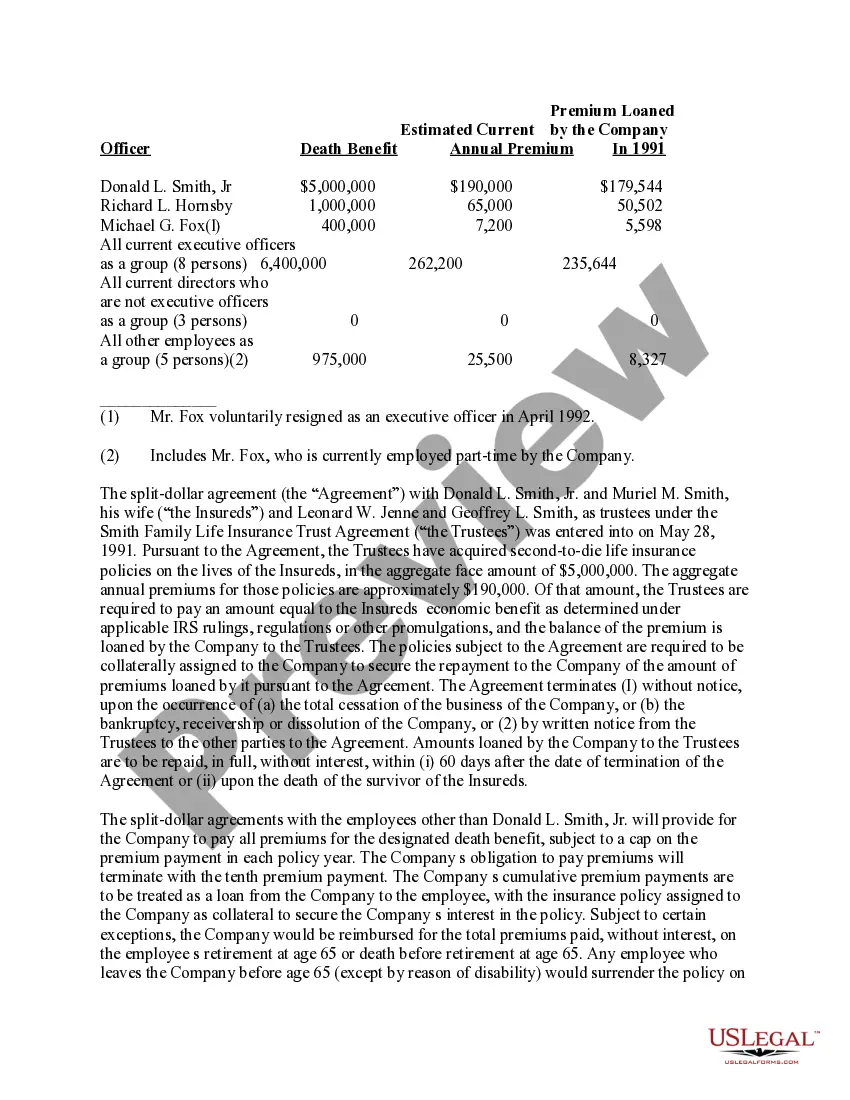

Split-dollar life insurance can be a mutually beneficial arrangement for employers and employees, with each party gaining different advantages. For example, employees receive quality life insurance for little cost and may be able to access tax-efficient income through withdrawals or loans.

Yes, you can designate multiple beneficiaries when you purchase your life insurance policy. When doing so, you will assign each beneficiary a percentage of the death benefit.

Reverse Split-Dollar Arrangements In a reverse split-dollar arrangement, the employer owns the death benefit and the employee owns the cash value.