Nebraska Elimination of the Class A Preferred Stock

Description

How to fill out Elimination Of The Class A Preferred Stock?

Are you currently inside a position where you will need documents for possibly enterprise or person reasons virtually every day time? There are a lot of legal file themes accessible on the Internet, but locating versions you can trust isn`t easy. US Legal Forms provides a large number of kind themes, such as the Nebraska Elimination of the Class A Preferred Stock, which can be published in order to meet state and federal requirements.

When you are currently informed about US Legal Forms site and possess a merchant account, just log in. Afterward, you are able to acquire the Nebraska Elimination of the Class A Preferred Stock design.

Should you not offer an accounts and need to begin using US Legal Forms, follow these steps:

- Discover the kind you need and make sure it is for the proper city/area.

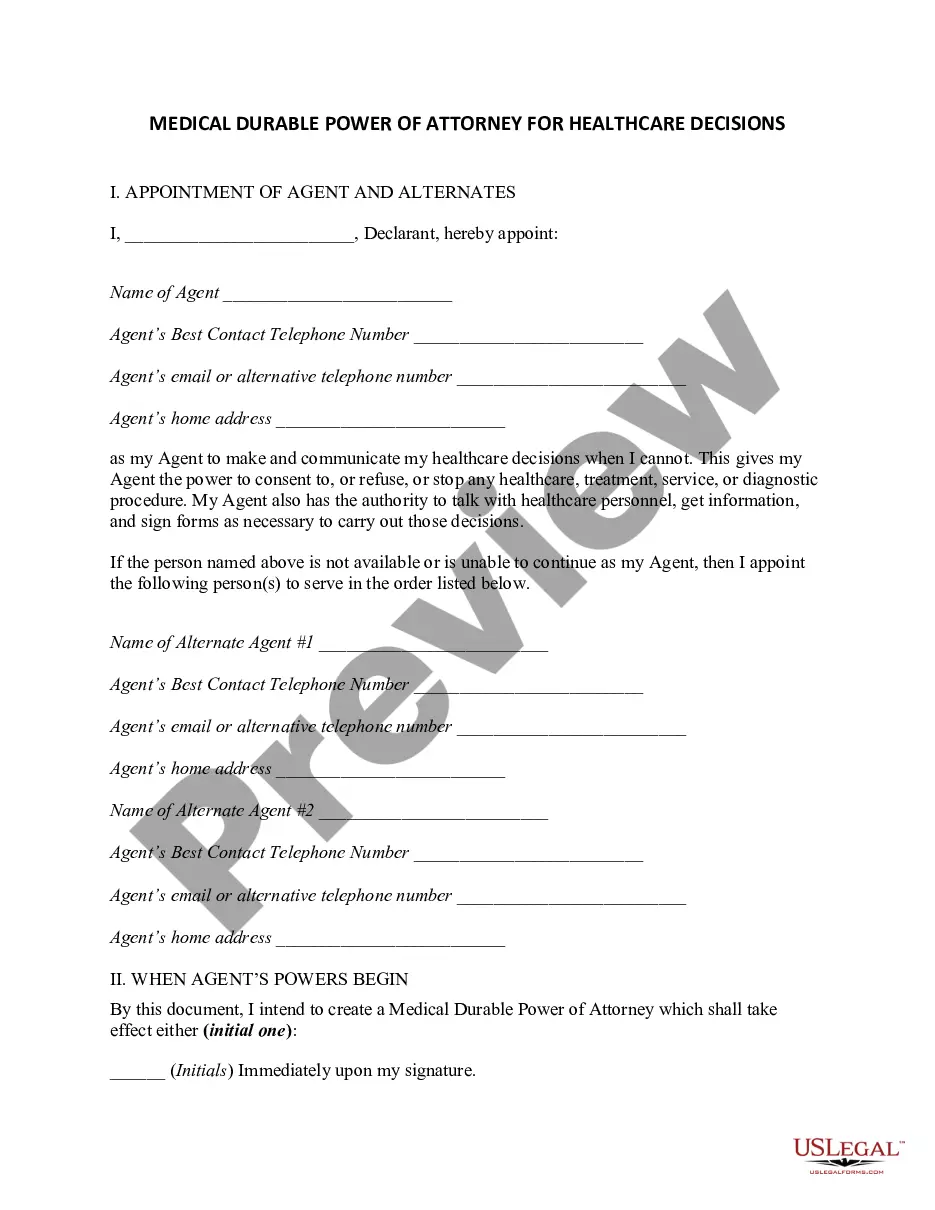

- Utilize the Preview button to examine the shape.

- Look at the description to actually have selected the proper kind.

- In the event the kind isn`t what you are looking for, utilize the Research industry to discover the kind that suits you and requirements.

- When you discover the proper kind, click Acquire now.

- Select the rates plan you want, fill in the desired details to make your bank account, and pay for your order with your PayPal or bank card.

- Decide on a handy paper formatting and acquire your duplicate.

Get each of the file themes you possess purchased in the My Forms food list. You may get a more duplicate of Nebraska Elimination of the Class A Preferred Stock at any time, if required. Just click the needed kind to acquire or print the file design.

Use US Legal Forms, one of the most extensive variety of legal kinds, to conserve time and stay away from errors. The service provides skillfully made legal file themes which you can use for a range of reasons. Produce a merchant account on US Legal Forms and initiate generating your way of life easier.