Nebraska Sub-Advisory Agreement of Neuberger and Berman Management, Inc.

Description

How to fill out Sub-Advisory Agreement Of Neuberger And Berman Management, Inc.?

Finding the right authorized file format might be a have difficulties. Obviously, there are a variety of layouts available online, but how would you obtain the authorized type you will need? Take advantage of the US Legal Forms web site. The assistance provides a large number of layouts, such as the Nebraska Sub-Advisory Agreement of Neuberger and Berman Management, Inc., which you can use for company and private demands. All of the kinds are examined by experts and meet state and federal demands.

When you are presently registered, log in for your account and click the Down load switch to obtain the Nebraska Sub-Advisory Agreement of Neuberger and Berman Management, Inc.. Use your account to search from the authorized kinds you might have purchased in the past. Proceed to the My Forms tab of your account and acquire one more copy in the file you will need.

When you are a new user of US Legal Forms, listed here are straightforward guidelines that you can stick to:

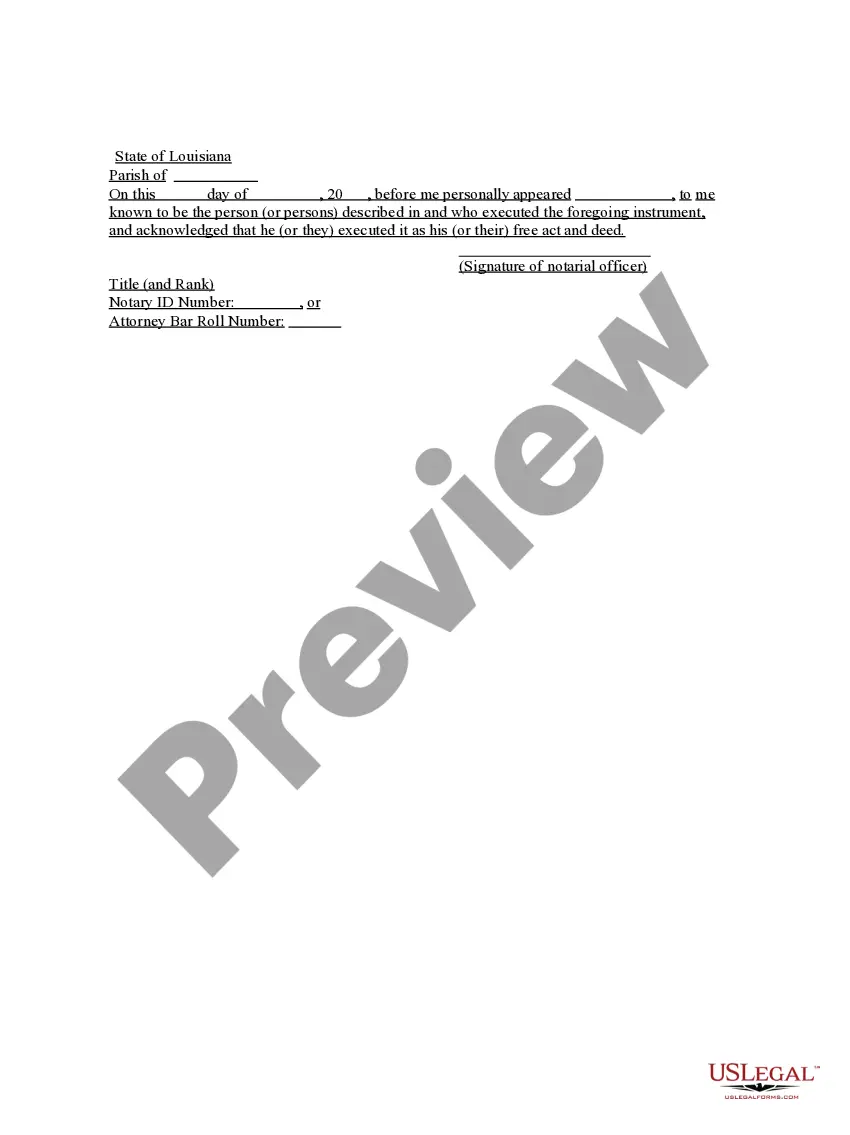

- Initially, make sure you have selected the correct type to your metropolis/region. You can examine the shape making use of the Review switch and read the shape description to make sure it will be the best for you.

- If the type does not meet your needs, use the Seach area to discover the proper type.

- Once you are positive that the shape is acceptable, select the Buy now switch to obtain the type.

- Opt for the prices plan you desire and enter in the essential info. Create your account and purchase the order with your PayPal account or Visa or Mastercard.

- Pick the document formatting and acquire the authorized file format for your device.

- Complete, change and produce and indicator the obtained Nebraska Sub-Advisory Agreement of Neuberger and Berman Management, Inc..

US Legal Forms is the largest library of authorized kinds for which you will find numerous file layouts. Take advantage of the company to acquire expertly-manufactured paperwork that stick to express demands.

Form popularity

FAQ

From offices in 39 cities across 26 countries, Neuberger Berman manages a range of equity, fixed income, private equity and hedge fund strategies on behalf of institutions, advisors and individual investors worldwide.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

NEUBERGER BERMAN BD LLC - Brokerage/Investment Adviser Firm.

Neuberger Berman is a private, independent, employee-owned investment manager?a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

Overview. Founded in 1939, Neuberger Berman is a privately held asset management firm, which is 100% owned by its employees.

With offices in 25 countries, Neuberger Berman's diverse team has over 2,400 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more).

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.

As a mutual fund registered under the Investment Company Act of 1940 (the "1940 Act"), the Fund is subject to certain restrictions under the 1940 Act and the Internal Revenue Code (the "Code") to which the Predecessors were not subject.