Nebraska Liquidation Proposal is a legal process designed to address the liquidation of a company's assets in Nebraska. It is typically initiated when a company is facing financial distress and is unable to repay its debts. Under this proposal, the company presents a detailed plan outlining the liquidation process to creditors, aiming to maximize the value of the assets and distribute the proceeds equitably among the creditors. Keywords: Nebraska, Liquidation Proposal, assets, financial distress, debts, plan, creditors, maximize value, distribute proceeds, equitably. There are two primary types of Nebraska Liquidation Proposals: 1. Voluntary Liquidation Proposal: This type of proposal is executed voluntarily by a company's management when they recognize the company's inability to continue its operations due to insurmountable financial challenges. The management takes the initiative to present a proposal to creditors, indicating their intention to liquidate the company's assets and distribute the proceeds among the creditors. This proposal aims to ensure an organized liquidation process and fair treatment of the creditors. 2. Court-Ordered Liquidation Proposal: In some cases, when creditors file a petition against a company for non-payment of debts, the court may intervene and order the liquidation of the company's assets. In such instances, the court usually appoints a liquidator to oversee the entire liquidation process. The liquidator then presents a comprehensive Nebraska Liquidation Proposal to the court, outlining the strategy for asset liquidation, debt repayment, and distribution of proceeds to creditors. This proposal is subject to court approval to ensure fairness and adherence to legal requirements. In summary, Nebraska Liquidation Proposal refers to a comprehensive plan executed voluntarily or through court intervention to facilitate the liquidation of a company's assets in Nebraska. It aims to address financial distress, repay debts, and distribute the proceeds among creditors in an equitable manner.

Nebraska Liquidation Proposal

Description

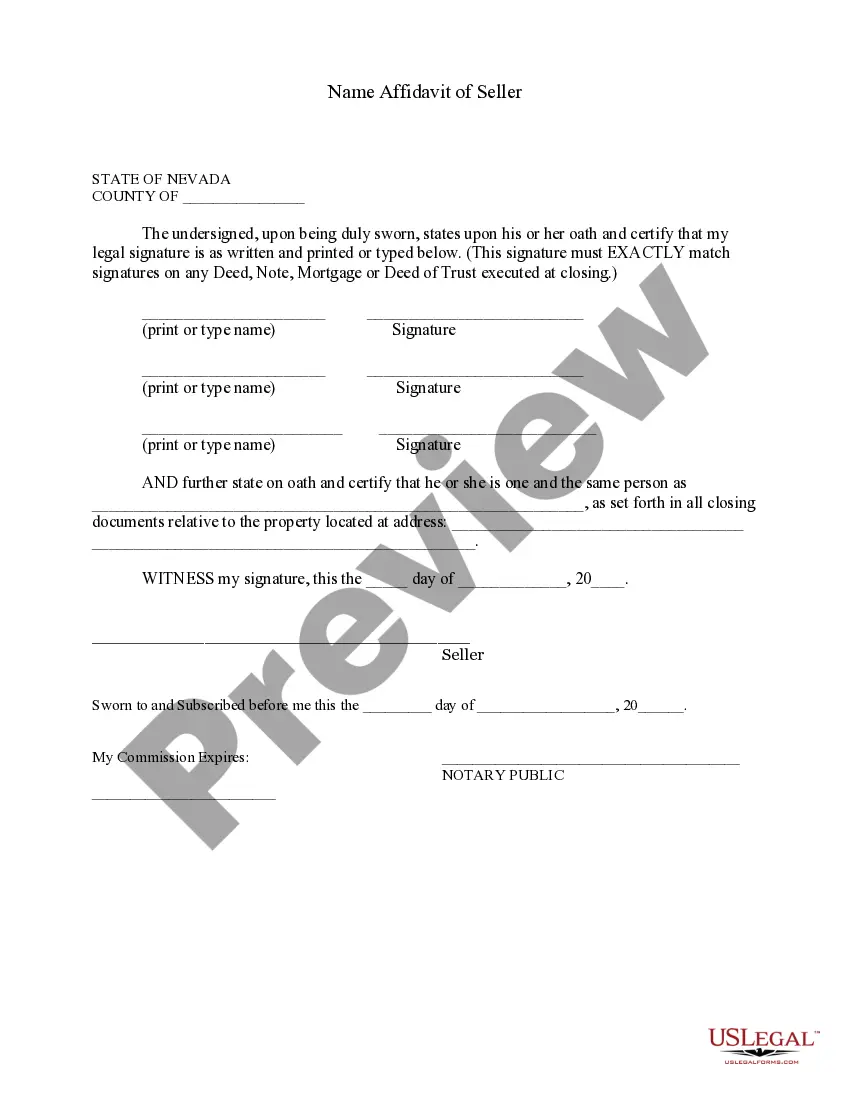

How to fill out Nebraska Liquidation Proposal?

You are able to invest hours on-line looking for the legal document web template which fits the federal and state requirements you want. US Legal Forms provides a large number of legal varieties which can be evaluated by specialists. It is possible to obtain or print out the Nebraska Liquidation Proposal from our service.

If you have a US Legal Forms bank account, you may log in and then click the Obtain option. Next, you may complete, edit, print out, or indicator the Nebraska Liquidation Proposal. Each legal document web template you get is your own property for a long time. To obtain yet another version for any obtained kind, check out the My Forms tab and then click the related option.

If you are using the US Legal Forms website for the first time, follow the easy directions below:

- Initially, ensure that you have chosen the right document web template for that area/metropolis of your liking. See the kind outline to ensure you have selected the right kind. If accessible, utilize the Review option to look throughout the document web template also.

- If you would like locate yet another version in the kind, utilize the Research field to find the web template that meets your requirements and requirements.

- When you have identified the web template you desire, click Acquire now to carry on.

- Pick the prices program you desire, enter your credentials, and sign up for an account on US Legal Forms.

- Full the financial transaction. You may use your Visa or Mastercard or PayPal bank account to pay for the legal kind.

- Pick the formatting in the document and obtain it for your product.

- Make modifications for your document if possible. You are able to complete, edit and indicator and print out Nebraska Liquidation Proposal.

Obtain and print out a large number of document templates using the US Legal Forms website, that offers the most important selection of legal varieties. Use specialist and state-particular templates to handle your company or person needs.

Form popularity

FAQ

A partnership can be dissolved or liquidated to legally terminate. A dissolution occurs when partners change, but the partnership continues operations. A liquidation occurs when the business ceases to exist.

No, a company is not dissolved after liquidation. Dissolving a company and liquidating it are two separate procedures. Liquidating a company means selling off its assets to claimants whereas dissolving a company is deregistering it.

First, file a Statement of Intent to Dissolve. The Nebraska Secretary of State (SOS) requires duplicate originals. The SOS will determine whether the LLC is current on all fees and taxes, if so, they will send the duplicate original back to the company.

Once a company is dissolved, it no longer exists as a legal entity and cannot conduct business or enter into contracts. Dissolution may also trigger a number of certain legal obligations, such as the distribution of remaining assets to creditors or shareholders. It also might involve the filing of final tax returns.

Simply put, a dissolution is a (typically) voluntary legal closure of a business while a liquidation involves the selling of a company's assets in order to pay creditors.