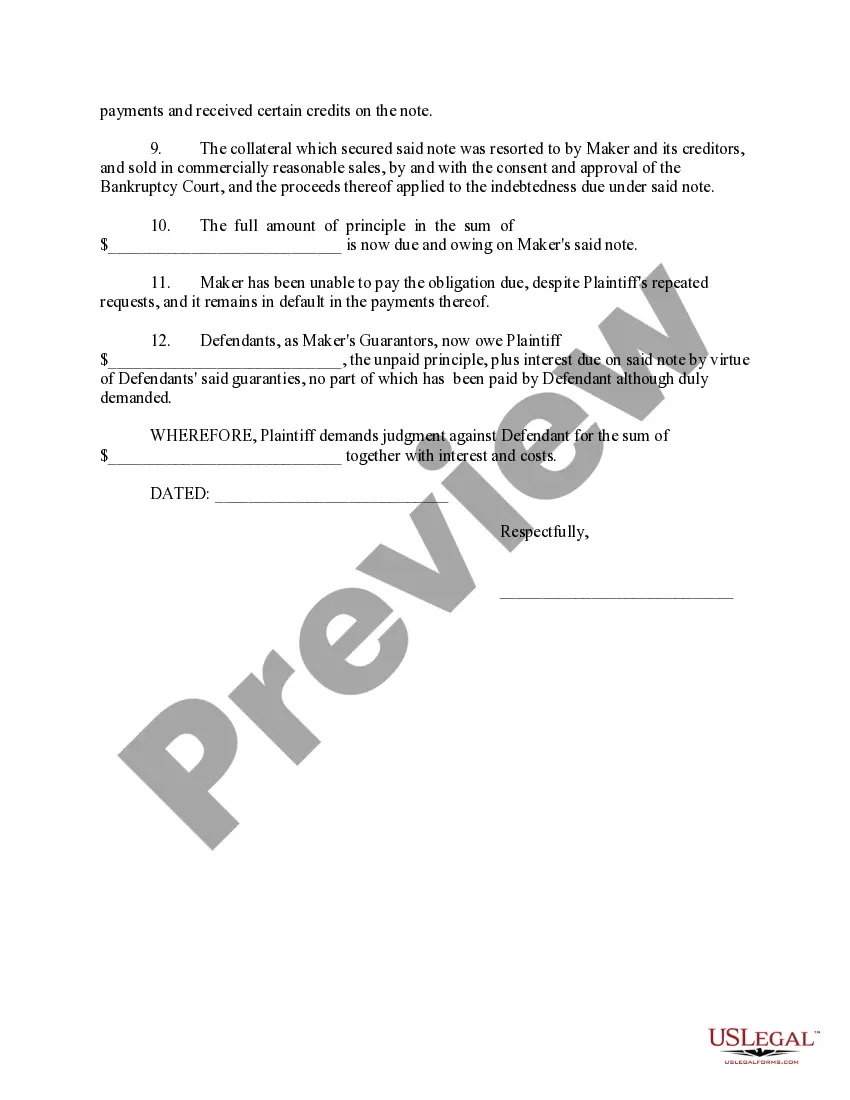

Nebraska Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

How to fill out Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

If you need to full, down load, or produce legitimate record templates, use US Legal Forms, the most important assortment of legitimate varieties, that can be found on-line. Utilize the site`s simple and easy hassle-free research to discover the files you require. Various templates for organization and specific reasons are categorized by types and claims, or search phrases. Use US Legal Forms to discover the Nebraska Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds in just a number of click throughs.

When you are previously a US Legal Forms buyer, log in for your bank account and then click the Download switch to obtain the Nebraska Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds. Also you can access varieties you earlier downloaded within the My Forms tab of your bank account.

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for your correct city/nation.

- Step 2. Take advantage of the Preview option to examine the form`s content material. Do not neglect to read through the outline.

- Step 3. When you are unsatisfied with the develop, make use of the Search discipline at the top of the screen to get other versions of your legitimate develop format.

- Step 4. Once you have located the form you require, click on the Buy now switch. Opt for the prices program you favor and put your references to register for an bank account.

- Step 5. Approach the purchase. You may use your charge card or PayPal bank account to complete the purchase.

- Step 6. Find the formatting of your legitimate develop and down load it on your own product.

- Step 7. Complete, revise and produce or signal the Nebraska Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

Each legitimate record format you purchase is your own forever. You may have acces to every single develop you downloaded in your acccount. Go through the My Forms segment and decide on a develop to produce or down load yet again.

Contend and down load, and produce the Nebraska Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds with US Legal Forms. There are millions of skilled and state-certain varieties you can utilize for your personal organization or specific requires.

Form popularity

FAQ

You may also file a complaint via the FDIC's FDIC Information and Support Center. State your inquiry or complaint, making certain to include the name and street address of the bank. Provide a brief description of your complaint. Enclose copies of related documentation.

In the unlikely event of a bank failure, the FDIC acts quickly to protect insured depositors by arranging a sale to a healthy bank, or by paying depositors directly for their deposit accounts to the insured limit.

Where can I complain if I have a problem with my Bank? You can raise your grievance on the Digital Complaint Management System (CMS) Portal: .

The department has multiple options for communicating securely online with regard to your complaint. Please contact the Department via email or call 402-471-2171 if you have a question or want to get started.

To determine your deposit insurance coverage or ask any other specific deposit insurance questions, call 1-877-ASK-FDIC (1-877-275-3342).

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

Section 10(c) of the FDI Act authorizes the FDIC to conduct a formal investigation to obtain needed information or evidence.

How can I file a complaint with the Federal Reserve Board (FRB)? If your problem concerns a state-chartered bank that is a member of the Federal Reserve System, contact the Federal Reserve Consumer Help unit. You may also contact the relevant state attorneys general or state banking department.