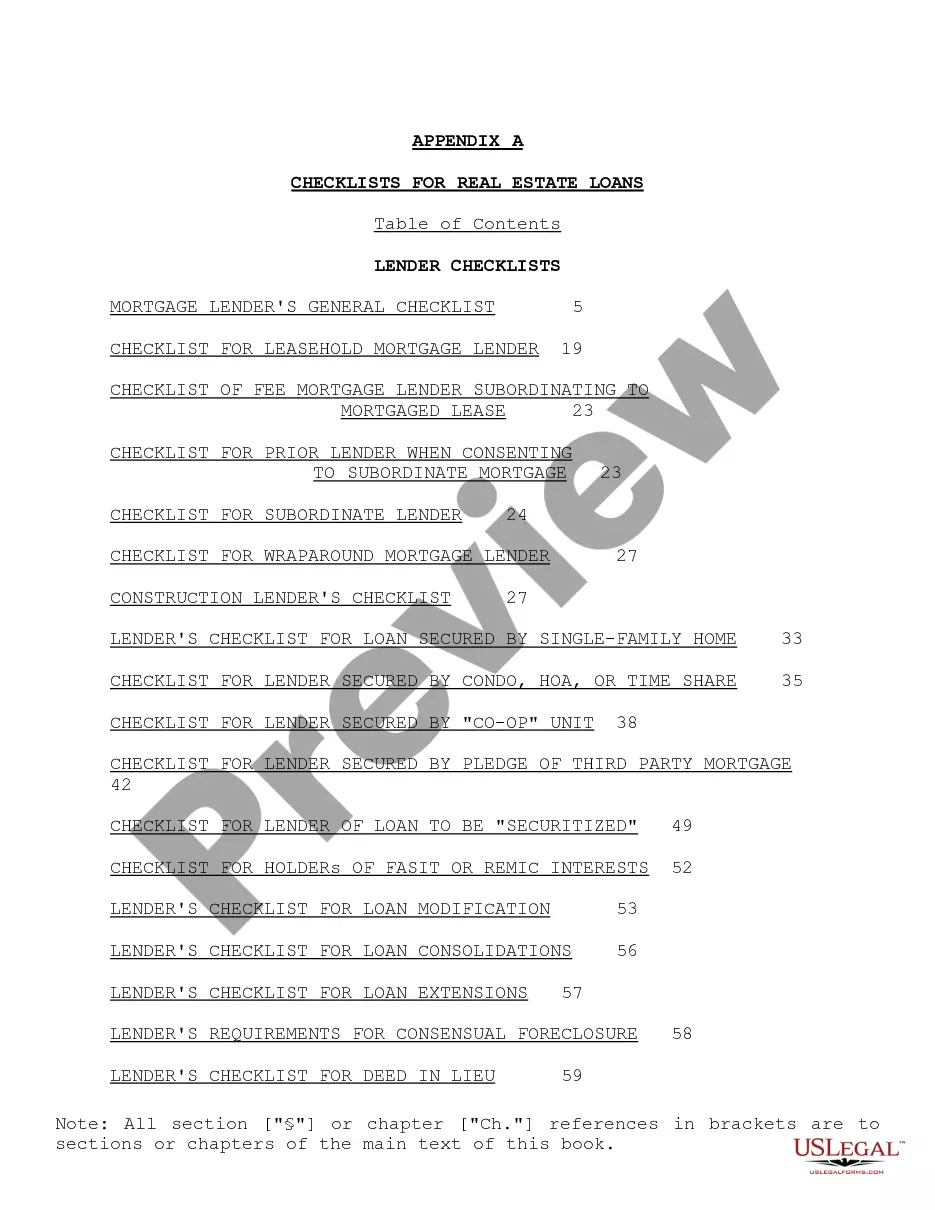

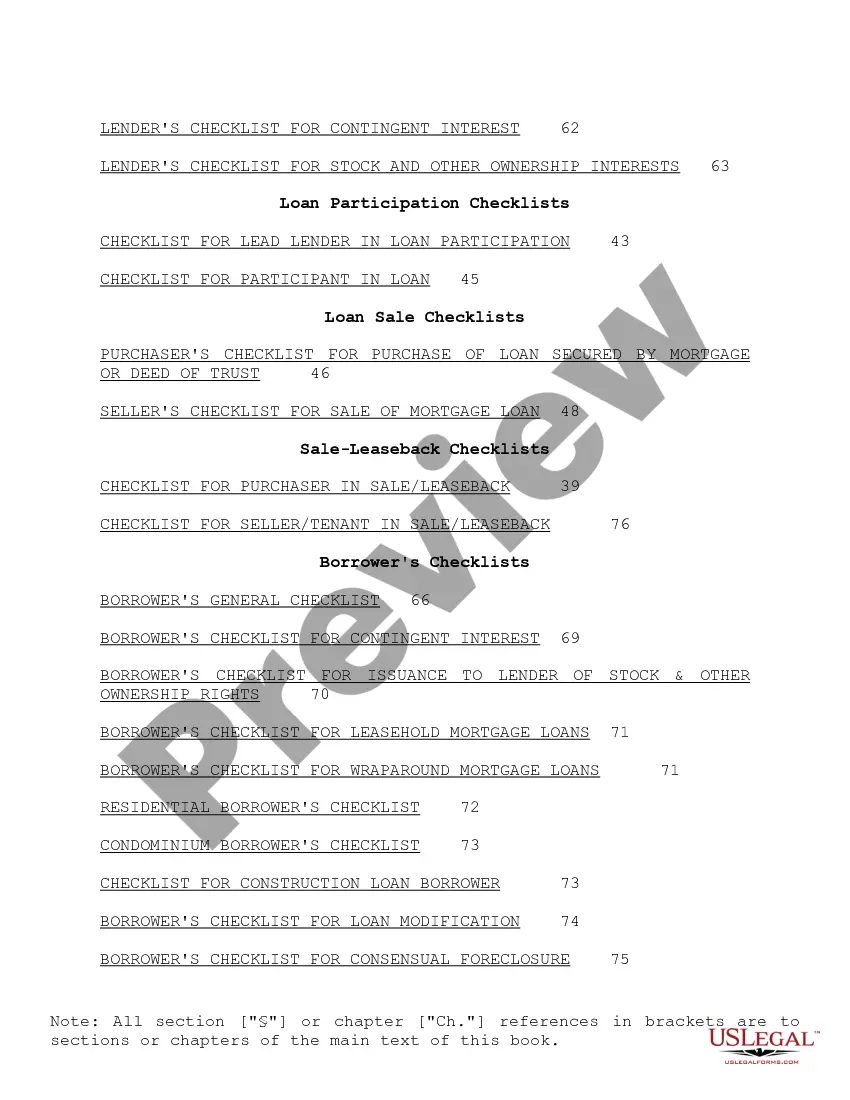

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

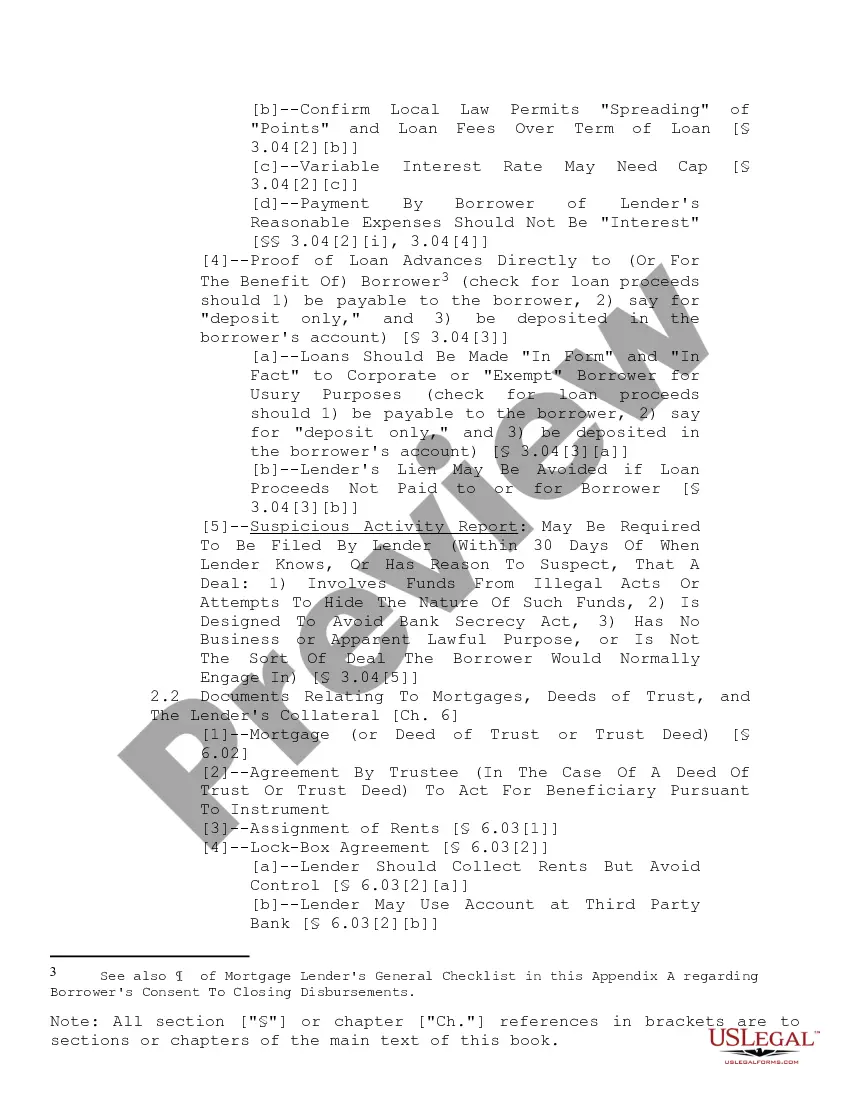

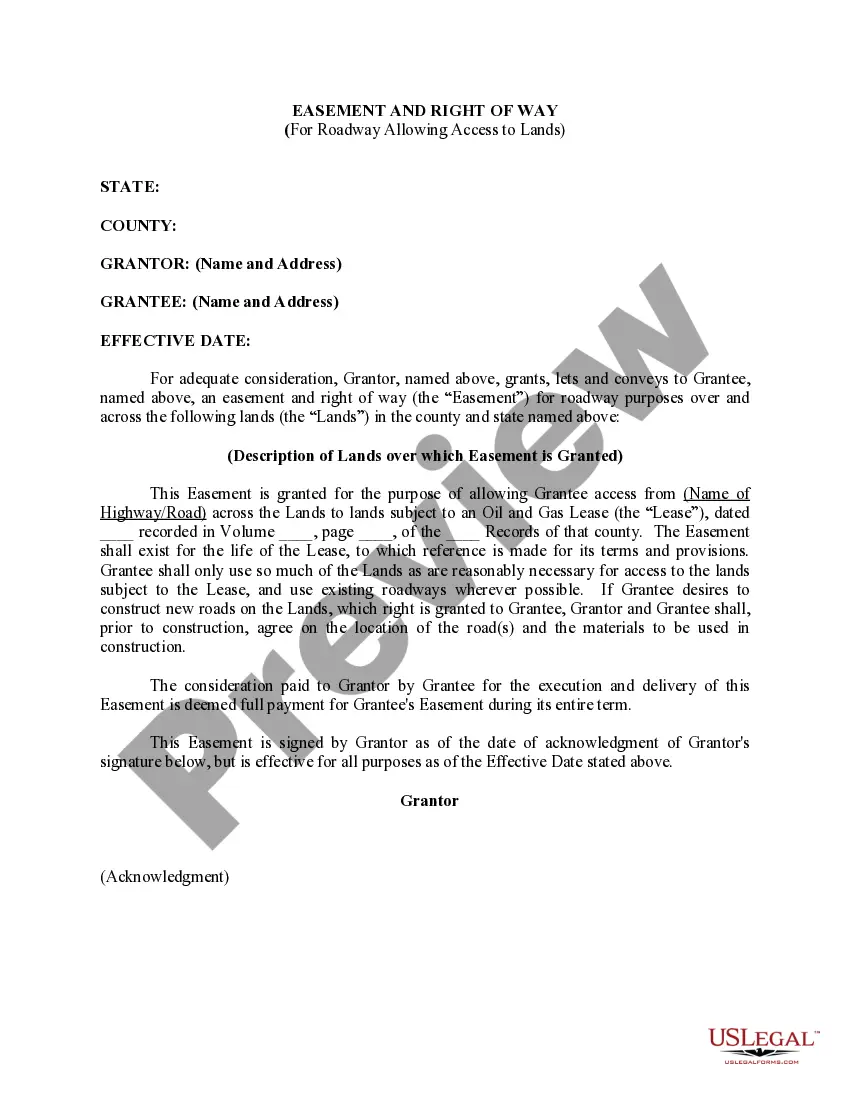

Nebraska Checklist for Real Estate Loans: A Comprehensive Guide for Buyers and Lenders When it comes to obtaining a real estate loan in Nebraska, there are several crucial steps and requirements that both borrowers and lenders need to consider. The Nebraska Checklist for Real Estate Loans serves as a valuable tool to ensure the smooth progress of the loan process, providing a detailed overview of the necessary documentation and tasks involved. Below, we outline the key elements that a Nebraska Checklist for Real Estate Loans should encompass, incorporating relevant keywords to assist buyers, lenders, and stakeholders in understanding the process better. 1. Loan Application: The checklist should emphasize the importance of a complete and accurate loan application, including crucial information such as the borrower's personal details, employment history, and financial information. 2. Credit History and Score: Highlight the significance of a satisfactory credit score and a clean credit history in securing a real estate loan in Nebraska. Explain the impact of creditworthiness on the loan's interest rate and terms. 3. Income and Employment Verification: Specify the documents required for verifying the borrower's income and employment status, such as pay stubs, tax returns, and employment verification letters. Emphasize the need for stable employment to build a strong case for loan approval. 4. Property Appraisal: Explain the necessity of obtaining a professional property appraisal to determine its market value. Mention the professional appraisers' qualifications and stress the importance of an unbiased opinion. 5. Title and Title Insurance: Outline the need for a comprehensive title search to identify any potential liens or claims against the property. Emphasize the importance of purchasing title insurance to protect both the borrower and the lender from unforeseen legal issues. 6. Homeowners Insurance: Advise borrowers to secure homeowners insurance before finalizing the loan. Explain the coverage requirements and suggest obtaining multiple quotes for the best terms and premiums. 7. Down Payment and Closing Costs: Highlight the significance of saving for a down payment, as well as detailing the various options available to borrowers in Nebraska. Include information on closing costs, such as lender fees, attorney fees, and taxes, to facilitate better financial planning. 8. Loan Documentation: Enumerate the necessary loan documentation, including the loan agreement, promissory note, and any additional forms required by the lender. Emphasize the need for thorough review and understanding of each document before signing. 9. Loan Approval Process: Explain the steps involved in the loan approval process, ranging from application submission to underwriting, and the potential need for additional documentation or amendments. Stress the importance of clear communication between borrowers and lenders. 10. Special Loan Programs: Mention notable Nebraska-specific loan programs, such as the Nebraska First-Time Homebuyer Program or rural development loans, and their specific requirements if applicable. In Nebraska, variations of this checklist may exist depending on the lender or loan type. For instance, there might be separate checklists tailored for conventional loans, FHA loans, VA loans, or USDA loans, each outlining specific criteria and document requirements unique to those loan programs. By adapting the Nebraska Checklist for Real Estate Loans to fit the loan type and lender preferences, borrowers can stay organized and lenders can streamline the loan process, minimizing potential delays and complications. Ensuring transparency and understanding of the loan requirements ultimately leads to a successful real estate transaction for all parties involved.Nebraska Checklist for Real Estate Loans: A Comprehensive Guide for Buyers and Lenders When it comes to obtaining a real estate loan in Nebraska, there are several crucial steps and requirements that both borrowers and lenders need to consider. The Nebraska Checklist for Real Estate Loans serves as a valuable tool to ensure the smooth progress of the loan process, providing a detailed overview of the necessary documentation and tasks involved. Below, we outline the key elements that a Nebraska Checklist for Real Estate Loans should encompass, incorporating relevant keywords to assist buyers, lenders, and stakeholders in understanding the process better. 1. Loan Application: The checklist should emphasize the importance of a complete and accurate loan application, including crucial information such as the borrower's personal details, employment history, and financial information. 2. Credit History and Score: Highlight the significance of a satisfactory credit score and a clean credit history in securing a real estate loan in Nebraska. Explain the impact of creditworthiness on the loan's interest rate and terms. 3. Income and Employment Verification: Specify the documents required for verifying the borrower's income and employment status, such as pay stubs, tax returns, and employment verification letters. Emphasize the need for stable employment to build a strong case for loan approval. 4. Property Appraisal: Explain the necessity of obtaining a professional property appraisal to determine its market value. Mention the professional appraisers' qualifications and stress the importance of an unbiased opinion. 5. Title and Title Insurance: Outline the need for a comprehensive title search to identify any potential liens or claims against the property. Emphasize the importance of purchasing title insurance to protect both the borrower and the lender from unforeseen legal issues. 6. Homeowners Insurance: Advise borrowers to secure homeowners insurance before finalizing the loan. Explain the coverage requirements and suggest obtaining multiple quotes for the best terms and premiums. 7. Down Payment and Closing Costs: Highlight the significance of saving for a down payment, as well as detailing the various options available to borrowers in Nebraska. Include information on closing costs, such as lender fees, attorney fees, and taxes, to facilitate better financial planning. 8. Loan Documentation: Enumerate the necessary loan documentation, including the loan agreement, promissory note, and any additional forms required by the lender. Emphasize the need for thorough review and understanding of each document before signing. 9. Loan Approval Process: Explain the steps involved in the loan approval process, ranging from application submission to underwriting, and the potential need for additional documentation or amendments. Stress the importance of clear communication between borrowers and lenders. 10. Special Loan Programs: Mention notable Nebraska-specific loan programs, such as the Nebraska First-Time Homebuyer Program or rural development loans, and their specific requirements if applicable. In Nebraska, variations of this checklist may exist depending on the lender or loan type. For instance, there might be separate checklists tailored for conventional loans, FHA loans, VA loans, or USDA loans, each outlining specific criteria and document requirements unique to those loan programs. By adapting the Nebraska Checklist for Real Estate Loans to fit the loan type and lender preferences, borrowers can stay organized and lenders can streamline the loan process, minimizing potential delays and complications. Ensuring transparency and understanding of the loan requirements ultimately leads to a successful real estate transaction for all parties involved.