Nebraska Notice of Violation of Fair Debt Act - False Information Disclosed

Description

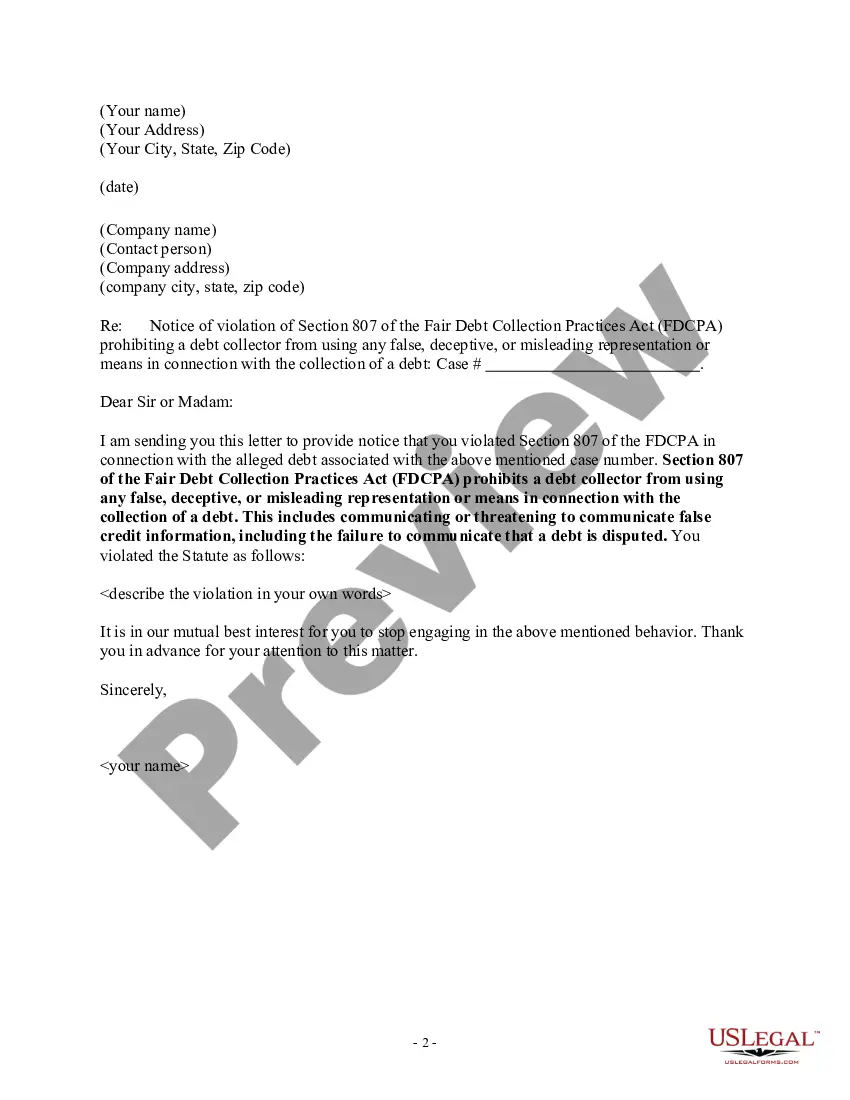

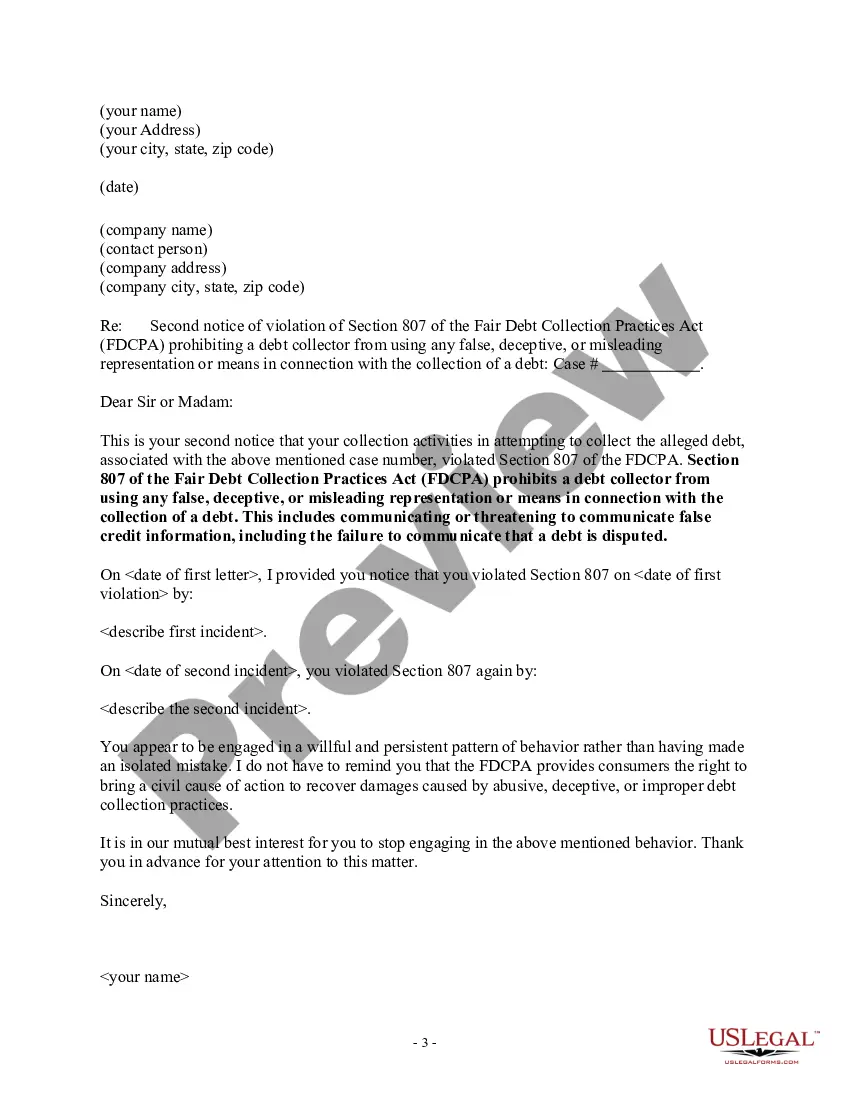

How to fill out Nebraska Notice Of Violation Of Fair Debt Act - False Information Disclosed?

You are able to invest several hours on the web attempting to find the legitimate record template that fits the federal and state requirements you need. US Legal Forms gives 1000s of legitimate varieties which are reviewed by pros. You can easily acquire or printing the Nebraska Notice of Violation of Fair Debt Act - False Information Disclosed from our support.

If you already possess a US Legal Forms accounts, you may log in and click on the Download switch. Afterward, you may comprehensive, modify, printing, or signal the Nebraska Notice of Violation of Fair Debt Act - False Information Disclosed. Each and every legitimate record template you purchase is the one you have eternally. To have another copy associated with a bought form, go to the My Forms tab and click on the related switch.

Should you use the US Legal Forms internet site for the first time, follow the easy recommendations under:

- First, make certain you have chosen the correct record template for that state/town of your choosing. Look at the form explanation to ensure you have picked the correct form. If offered, take advantage of the Preview switch to appear from the record template too.

- If you wish to discover another version from the form, take advantage of the Look for discipline to discover the template that meets your needs and requirements.

- When you have identified the template you need, click Get now to continue.

- Choose the prices strategy you need, type in your credentials, and register for your account on US Legal Forms.

- Comprehensive the purchase. You can utilize your Visa or Mastercard or PayPal accounts to pay for the legitimate form.

- Choose the structure from the record and acquire it for your device.

- Make alterations for your record if necessary. You are able to comprehensive, modify and signal and printing Nebraska Notice of Violation of Fair Debt Act - False Information Disclosed.

Download and printing 1000s of record themes using the US Legal Forms website, which provides the largest selection of legitimate varieties. Use skilled and condition-particular themes to handle your small business or individual requires.

Form popularity

FAQ

Time limits/Statute of LimitationsIf your creditor does not start the court action within 6 years of the debt being due, the action can be held to be statute-barred by the court.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Nebraska Criminal Statute of Limitations at a Glance Nebraska has no time limit for the state to file charges of murder, treason, arson, or forgery, but most felonies carry a three-year statute of limitations. There's an 18-month time limit for most misdemeanors.

When it comes to consumer debt in the state of Nebraska, the statute of limitations 5 years from the last payment made. This means that a creditor or debt collector may not sue you for debt after five years have passed.

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

A judgment becomes dormant and ceases to be a lien on real estate in five years from date thereof unless execution is sued out within such period, and a judgment revived is a lien on the real estate of judgment debtor from date of the order of revivor.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.