Nebraska Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Nebraska Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

Have you been in a place in which you require documents for both company or personal uses just about every working day? There are a variety of legal document web templates available on the Internet, but finding versions you can depend on is not effortless. US Legal Forms delivers thousands of form web templates, like the Nebraska Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, that are published in order to meet state and federal demands.

If you are already knowledgeable about US Legal Forms website and possess your account, basically log in. Next, you may download the Nebraska Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself template.

Should you not have an accounts and need to start using US Legal Forms, adopt these measures:

- Get the form you want and make sure it is to the right metropolis/state.

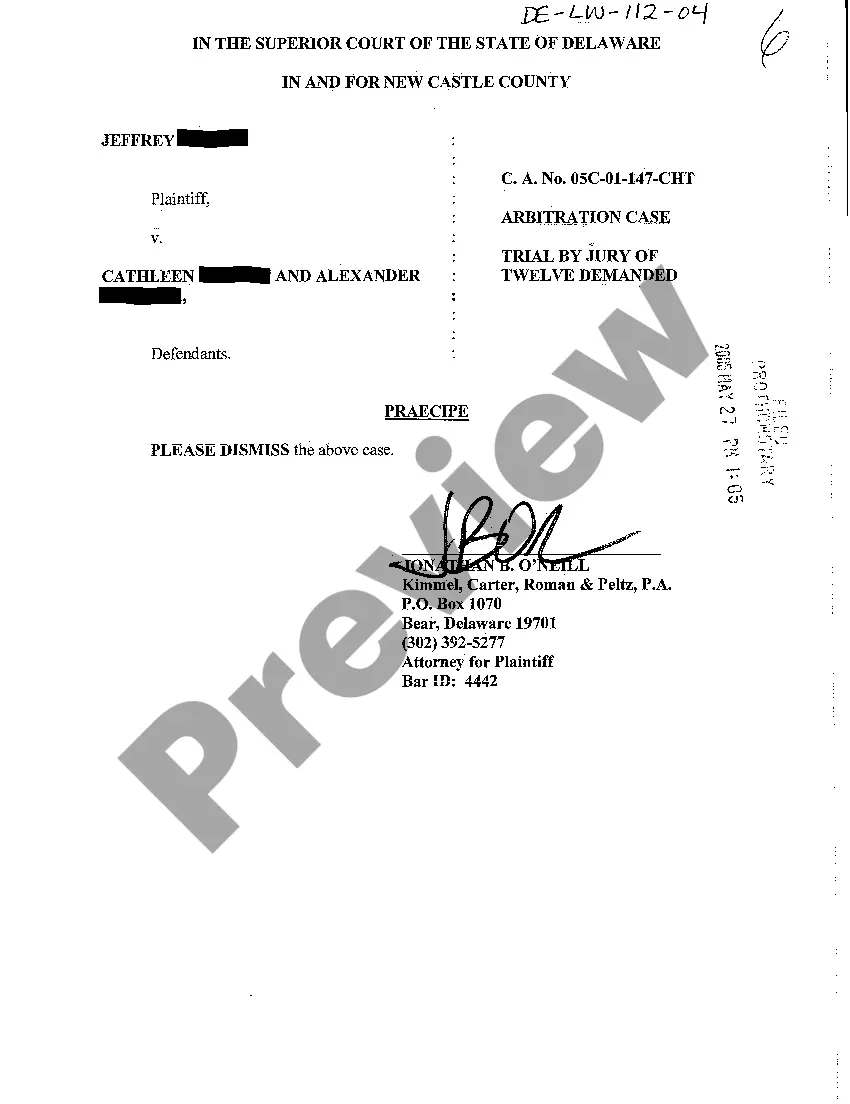

- Use the Preview option to analyze the form.

- Look at the outline to ensure that you have chosen the appropriate form.

- In the event the form is not what you are seeking, take advantage of the Lookup area to get the form that suits you and demands.

- When you discover the right form, click on Get now.

- Opt for the prices program you would like, complete the desired info to create your money, and pay money for your order making use of your PayPal or charge card.

- Decide on a practical file formatting and download your duplicate.

Find every one of the document web templates you may have purchased in the My Forms menu. You can aquire a additional duplicate of Nebraska Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself at any time, if required. Just select the necessary form to download or print out the document template.

Use US Legal Forms, the most substantial variety of legal kinds, to save some time and avoid errors. The services delivers appropriately manufactured legal document web templates which can be used for a variety of uses. Generate your account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Yes, the FDCPA allows for legal action against certain collectors that don't comply with the rules in the law. If you're sent to collections for a debt you don't owe or a collector otherwise ignores the FDCPA, you might be able to sue that collector.

Are debts really written off after six years? After six years have passed, your debt may be declared statute barred - this means that the debt still very much exists but a CCJ cannot be issued to retrieve the amount owed and the lender cannot go through the courts to chase you for the debt.

A judgment becomes dormant and ceases to be a lien on real estate in five years from date thereof unless execution is sued out within such period, and a judgment revived is a lien on the real estate of judgment debtor from date of the order of revivor.

When it comes to consumer debt in the state of Nebraska, the statute of limitations 5 years from the last payment made. This means that a creditor or debt collector may not sue you for debt after five years have passed. If the agreement was verbal, then that number is reduced to 4 years in the state of Nebraska.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.