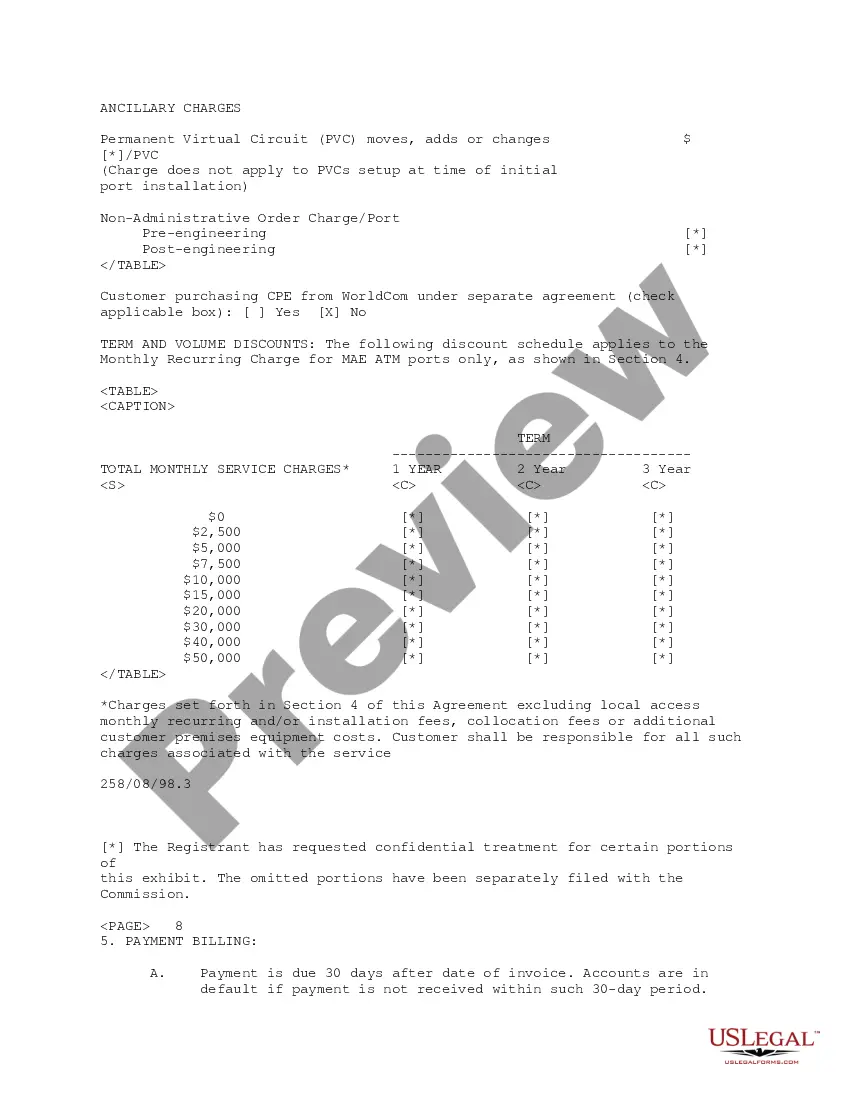

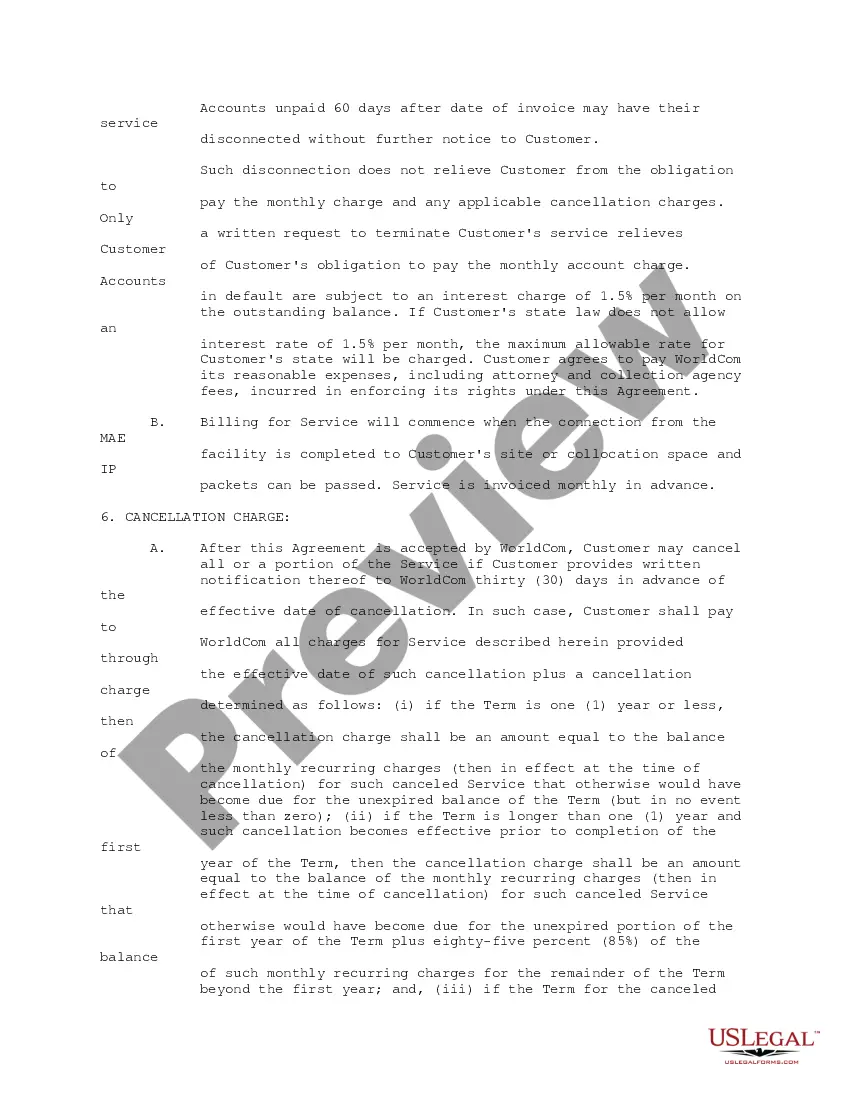

Nebraska ATM Service Agreement is a legally binding document that outlines the terms and conditions between a financial institution and a business owner or establishment in Nebraska, regarding the installation and usage of an Automated Teller Machine (ATM) on the premises. This agreement governs the relationship, responsibilities, and rights of both parties involved in providing ATM services to customers. The agreement typically includes various key provisions such as: 1. Terms and Conditions: The agreement defines the duration of the contract, the scope of services provided, and the responsibilities of each party. It outlines the fees and charges associated with the ATM services along with any additional charges such as maintenance, repair, or cash replenishment. 2. Ownership and Installation: This portion of the agreement specifies the ownership of the ATM, whether it is owned by the financial institution or jointly owned between both parties. It details the installation process, location considerations, and any requirements for electrical or internet connectivity. 3. ATM Operation: The agreement outlines the operational procedures including cash management, daily operational responsibilities, and security measures implemented by both parties to ensure the safe and efficient operation of the ATM. This may include guidelines on cash replenishment, cash balancing, branding, advertising, and reporting requirements. 4. Financial Settlement: This section covers the settlement terms between the financial institution and the business owner regarding the transactions made through the ATM. It establishes the timing and method of transferring funds collected from ATM transactions to the business owner's designated account, often including a summary of the fee structure. 5. Liability and Indemnity: The agreement highlights the responsibilities of each party concerning liabilities arising from ATM operations. It typically includes provisions that absolve the financial institution from any liability related to fraudulent or unauthorized transactions and places the responsibility on the business owner to ensure the security of the ATM premises. Different types of Nebraska ATM Service Agreements may exist based on the specific needs and requirements of the parties involved. These may include: 1. Full-Service ATM Agreement: In this type of agreement, the financial institution provides comprehensive services such as installation, maintenance, cash management, and transaction processing. The business owner may have limited responsibilities, primarily focused on ensuring the security and availability of the ATM location. 2. Partial-Service ATM Agreement: This agreement outlines a limited set of services provided by the financial institution, typically leaving certain aspects of ATM management, maintenance, or cash replenishment to the business owner or a third-party service provider. The responsibilities and liabilities are distributed accordingly. 3. Branding Partnership Agreement: In some cases, a financial institution may enter into a branding partnership agreement with a business owner where the ATM prominently displays the financial institution's logo, branding, and marketing materials. This agreement may have additional provisions related to branding guidelines, advertising, and revenue sharing. These are some key aspects of a Nebraska ATM Service Agreement, but it is important for both parties to carefully review and negotiate terms that meet their individual needs and protect their interests.

Nebraska ATM Service Agreement

Description

How to fill out Nebraska ATM Service Agreement?

Discovering the right authorized papers template could be a have difficulties. Obviously, there are tons of themes available online, but how can you find the authorized type you need? Use the US Legal Forms site. The services offers a huge number of themes, like the Nebraska ATM Service Agreement, which you can use for enterprise and private requires. Each of the types are examined by pros and satisfy state and federal requirements.

If you are already signed up, log in for your account and click on the Obtain switch to obtain the Nebraska ATM Service Agreement. Utilize your account to check through the authorized types you possess ordered previously. Proceed to the My Forms tab of your account and get yet another copy in the papers you need.

If you are a new customer of US Legal Forms, listed below are easy recommendations that you should comply with:

- First, ensure you have chosen the correct type for your personal metropolis/county. It is possible to look over the form using the Preview switch and look at the form description to guarantee it will be the right one for you.

- When the type will not satisfy your preferences, take advantage of the Seach industry to get the proper type.

- When you are certain that the form would work, go through the Purchase now switch to obtain the type.

- Opt for the prices strategy you want and type in the needed information. Build your account and pay for the order with your PayPal account or bank card.

- Select the data file format and obtain the authorized papers template for your device.

- Complete, edit and printing and sign the obtained Nebraska ATM Service Agreement.

US Legal Forms is definitely the greatest catalogue of authorized types that you can find numerous papers themes. Use the service to obtain skillfully-created papers that comply with state requirements.