Nebraska Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

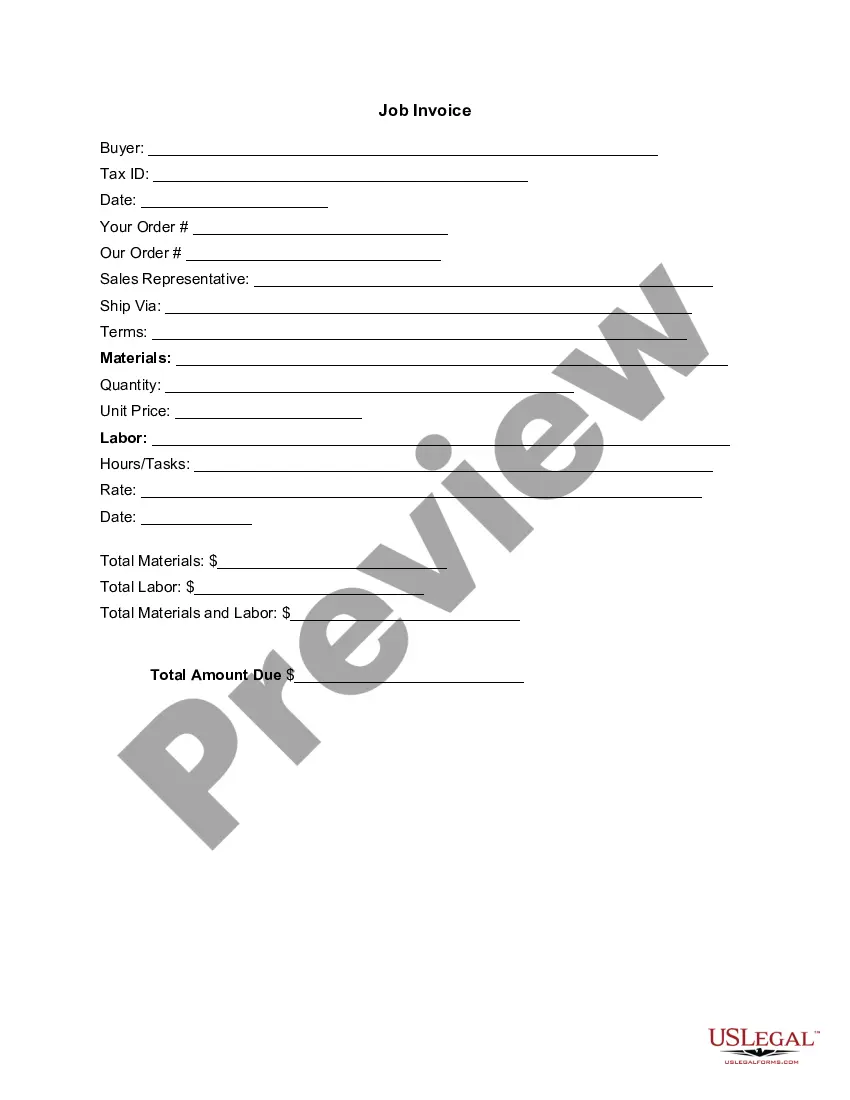

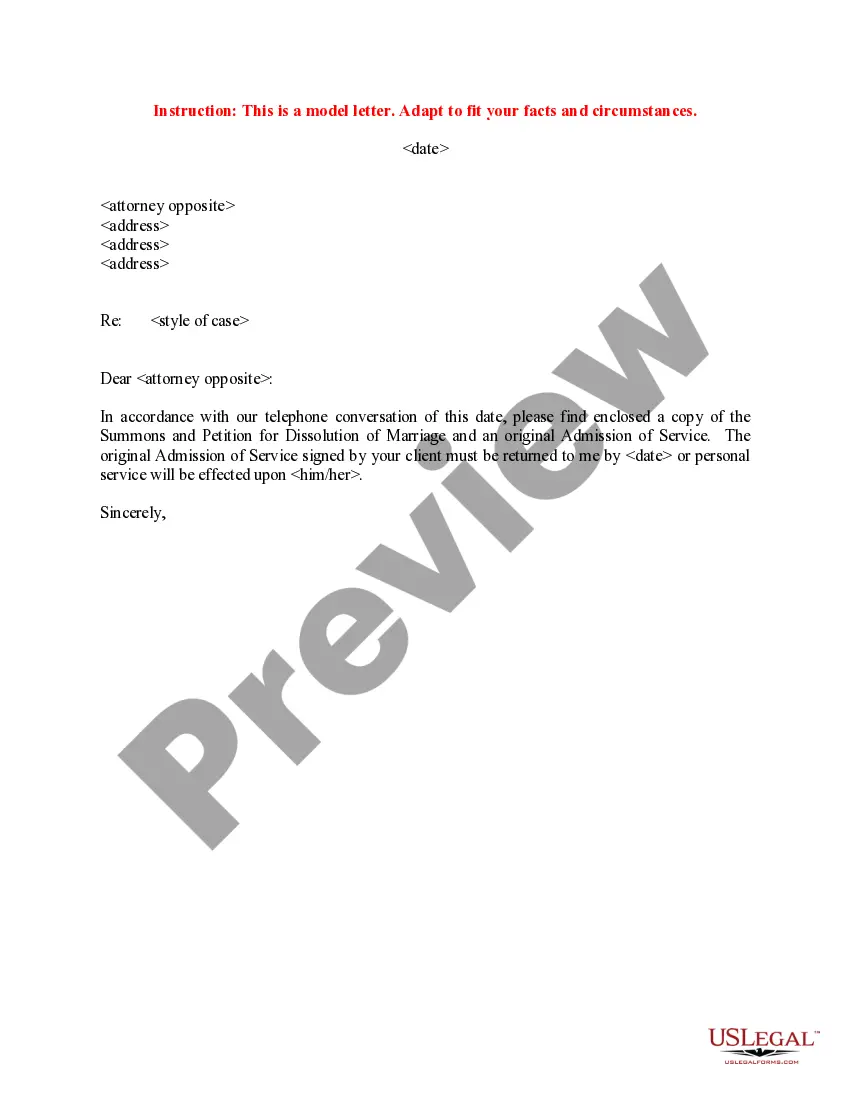

How to fill out Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

If you want to full, obtain, or printing legitimate papers layouts, use US Legal Forms, the biggest collection of legitimate varieties, that can be found on the Internet. Make use of the site`s easy and convenient search to get the files you require. Different layouts for enterprise and person uses are sorted by groups and states, or key phrases. Use US Legal Forms to get the Nebraska Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company with a few click throughs.

In case you are previously a US Legal Forms client, log in for your profile and click the Acquire button to find the Nebraska Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company. You can even entry varieties you formerly downloaded inside the My Forms tab of your own profile.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the correct town/region.

- Step 2. Use the Review method to check out the form`s content. Do not neglect to learn the information.

- Step 3. In case you are not happy with all the develop, utilize the Lookup field on top of the monitor to discover other versions of the legitimate develop design.

- Step 4. Once you have discovered the shape you require, go through the Purchase now button. Opt for the rates prepare you favor and put your references to register for an profile.

- Step 5. Process the deal. You can utilize your credit card or PayPal profile to perform the deal.

- Step 6. Find the file format of the legitimate develop and obtain it on your gadget.

- Step 7. Complete, edit and printing or sign the Nebraska Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

Every single legitimate papers design you get is yours permanently. You may have acces to each and every develop you downloaded in your acccount. Select the My Forms area and choose a develop to printing or obtain again.

Be competitive and obtain, and printing the Nebraska Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company with US Legal Forms. There are millions of professional and state-specific varieties you may use for the enterprise or person requires.

Form popularity

FAQ

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages.

What is a Loan Servicing Agreement? A loan servicing agreement is a legal agreement between a lender and a third party, the servicer, that outlines the terms and conditions for which that third party will provide loan servicing services.

Your servicer also handles the day-to-day tasks for managing your loan. Your loan servicer typically processes your loan payments, responds to borrower inquiries, keeps track of principal and interest paid, manages your escrow account (if you have one).

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

A Servicing Agreement (or Loan Servicing Agreement) is a document entered into in connection with a facility established for the securitization of various types of assets, most often loans, receivables or leases.

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

Mortgage servicers collect homeowners' mortgage payments and pass on those payments to investors, tax authorities, and insurers, often through escrow accounts. Servicers also work to protect investors' interests in mortgaged properties, for example, by ensuring homeowners maintain proper insurance coverage.