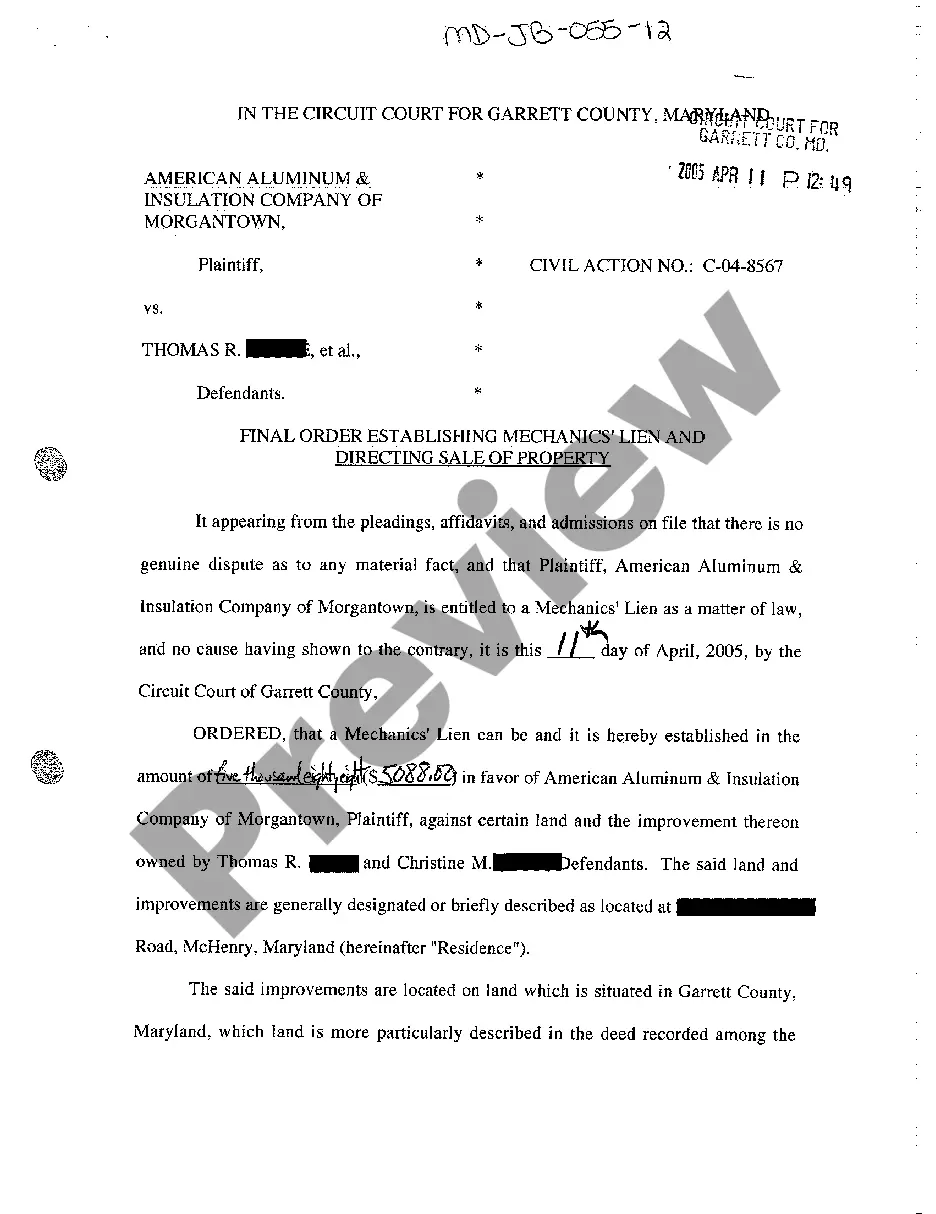

Nebraska Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC

Description

How to fill out Plan Of Merger Between Berkshire Energy Resources, Energy East Corporation And Mountain Merger, LLC?

It is possible to spend hrs online looking for the lawful document template which fits the federal and state requirements you require. US Legal Forms supplies a huge number of lawful varieties that are analyzed by experts. It is simple to download or produce the Nebraska Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC from the services.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Download option. Afterward, it is possible to complete, edit, produce, or sign the Nebraska Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC. Every lawful document template you buy is your own property forever. To acquire another backup of the obtained form, proceed to the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms internet site the first time, adhere to the basic recommendations beneath:

- Initially, ensure that you have selected the correct document template to the region/city of your choosing. Read the form description to make sure you have picked the appropriate form. If readily available, utilize the Review option to look through the document template at the same time.

- If you want to get another edition from the form, utilize the Search field to discover the template that fits your needs and requirements.

- Once you have located the template you want, just click Acquire now to continue.

- Pick the pricing program you want, type in your credentials, and sign up for your account on US Legal Forms.

- Full the transaction. You may use your charge card or PayPal accounts to purchase the lawful form.

- Pick the format from the document and download it to the system.

- Make modifications to the document if possible. It is possible to complete, edit and sign and produce Nebraska Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC.

Download and produce a huge number of document themes utilizing the US Legal Forms Internet site, which offers the greatest selection of lawful varieties. Use specialist and condition-particular themes to deal with your company or individual requires.