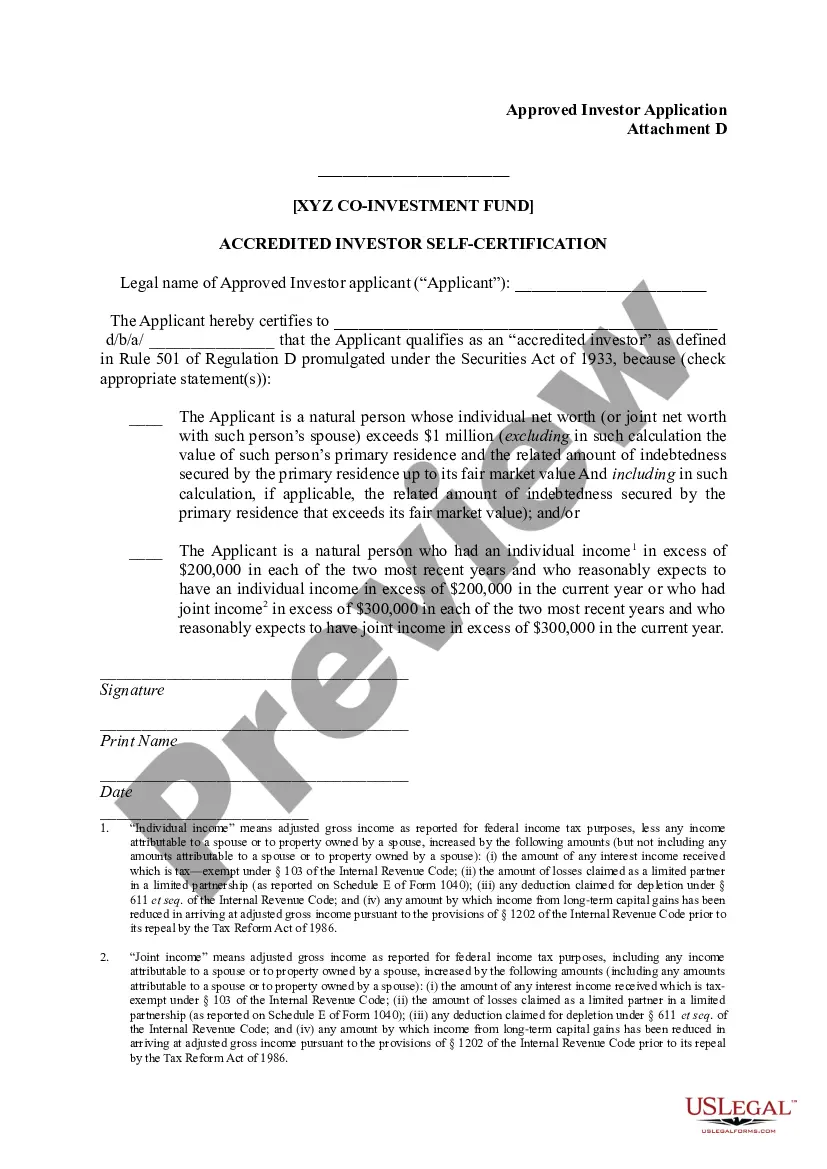

Title: Nebraska Accredited Investor Self-Certification Attachment D: A Comprehensive Overview Keywords: Nebraska Accredited Investor Self-Certification, Attachment D, SEC Regulation D, accredited investor, financial markets, investment opportunities, investment criteria, qualifying investors, self-certification process, types of Nebraska Accredited Investor Self-Certification Attachment D. Introduction: Nebraska Accredited Investor Self-Certification Attachment D is a crucial documentation requirement for individuals or entities seeking to assert their accredited investor status in accordance with SEC Regulation D. This self-certification process allows eligible investors to access various investment opportunities that may otherwise be restricted to non-accredited investors. In this article, we explore the details and different types of Nebraska Accredited Investor Self-Certification Attachment D, providing a comprehensive guide for investors. Overview of Nebraska Accredited Investor Self-Certification Attachment D: Attachment D is a standardized form that accredited investors in Nebraska must complete and submit to relevant parties, such as financial institutions, investment firms, or private issuers. By completing this form, individuals or entities can self-certify their accredited investor status, enabling them to participate in a range of sophisticated investment opportunities. Key Elements of Nebraska Accredited Investor Self-Certification Attachment D: 1. Personal Information: The form collects essential personal details of the investor, including their name, address, contact information, and Social Security number (or entity identifier, if applicable). 2. Accredited Investor Qualifications: This section requires the investor to indicate the specific criteria or categories that they meet to qualify as an accredited investor under SEC Regulation D. These qualifications may include income thresholds, net worth calculations, or professional certifications. 3. Supporting Documentation: To validate the self-certification, the form may ask investors to provide supporting documentation, such as financial statements, tax returns, or letters from qualified professionals. Types of Nebraska Accredited Investor Self-Certification Attachment D: 1. Individual Accredited Investor Self-Certification (Form D-I): This type pertains to individuals who meet the accredited investor criteria based on personal income, net worth, or other specified qualifications. 2. Entity Accredited Investor Self-Certification (Form D-E): This variant is designed for entities, including corporations, partnerships, limited liability companies, or trusts, which qualify as accredited investors under the specified SEC criteria. 3. Institutional Accredited Investor Self-Certification (Form D-Inst): This document caters to institutional investors, such as banks, insurance companies, registered investment companies, and certain employee benefit plans, as outlined in the SEC guidelines. Conclusion: Nebraska Accredited Investor Self-Certification Attachment D is an essential component of the investment landscape. By properly completing this form and submitting it, eligible investors gain access to a wider range of investment opportunities. Whether individuals, entities, or institutions, the self-certification process allows them to assert their accredited investor status, meeting the regulatory requirements set forth by the SEC. As investors navigate the financial markets and explore investment prospects, understanding and adhering to the self-certification process is crucial for maximizing participation in exclusive offerings.

Nebraska Accredited Investor Self-Certification Attachment D

Description

How to fill out Nebraska Accredited Investor Self-Certification Attachment D?

You can devote hrs on the Internet trying to find the authorized papers design that fits the federal and state needs you need. US Legal Forms gives a large number of authorized forms that happen to be examined by pros. It is possible to down load or produce the Nebraska Accredited Investor Self-Certification Attachment D from the services.

If you already possess a US Legal Forms account, you are able to log in and click the Down load switch. Afterward, you are able to comprehensive, revise, produce, or indication the Nebraska Accredited Investor Self-Certification Attachment D. Every single authorized papers design you buy is your own eternally. To acquire yet another version of the bought type, proceed to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms website the first time, adhere to the basic recommendations under:

- Very first, make certain you have selected the proper papers design for your area/city that you pick. Read the type information to make sure you have chosen the correct type. If readily available, utilize the Preview switch to search from the papers design also.

- In order to find yet another edition of the type, utilize the Look for industry to find the design that suits you and needs.

- Once you have found the design you want, just click Get now to continue.

- Find the prices prepare you want, type in your references, and sign up for an account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal account to purchase the authorized type.

- Find the file format of the papers and down load it to your product.

- Make changes to your papers if possible. You can comprehensive, revise and indication and produce Nebraska Accredited Investor Self-Certification Attachment D.

Down load and produce a large number of papers themes using the US Legal Forms web site, that provides the largest collection of authorized forms. Use expert and status-specific themes to tackle your business or personal requires.