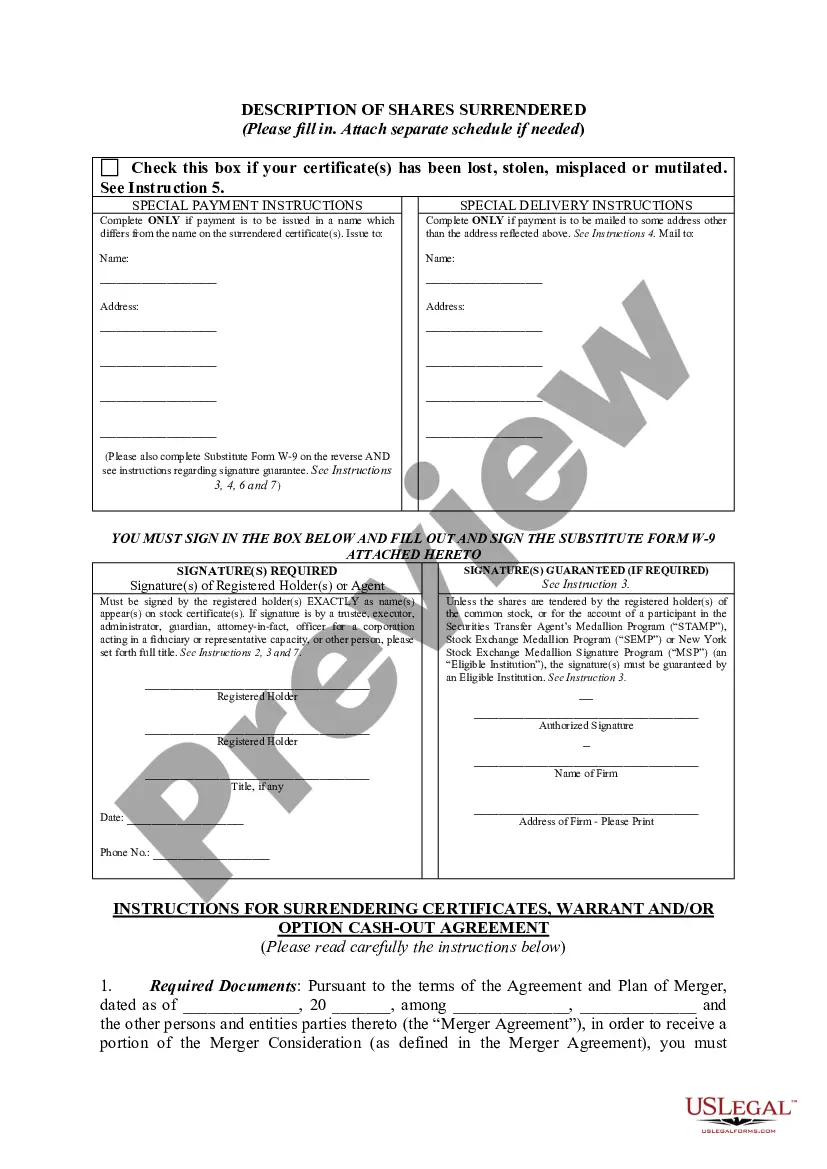

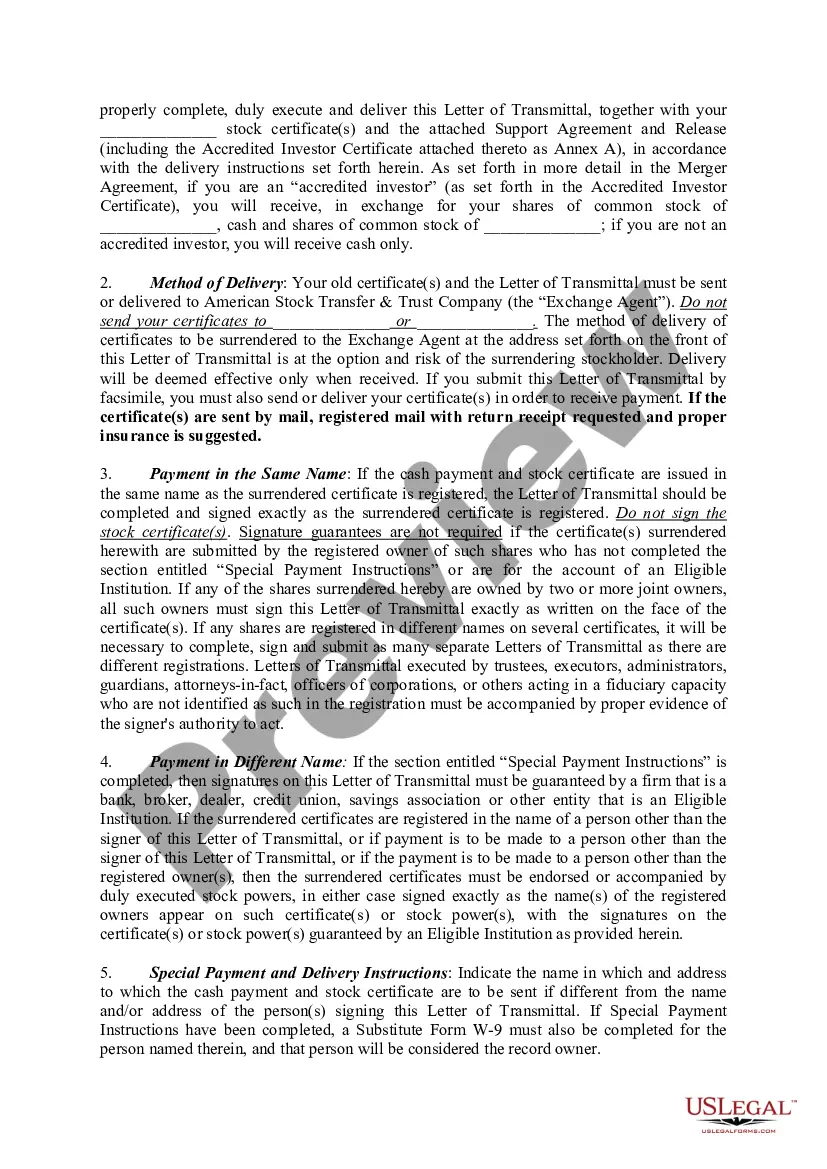

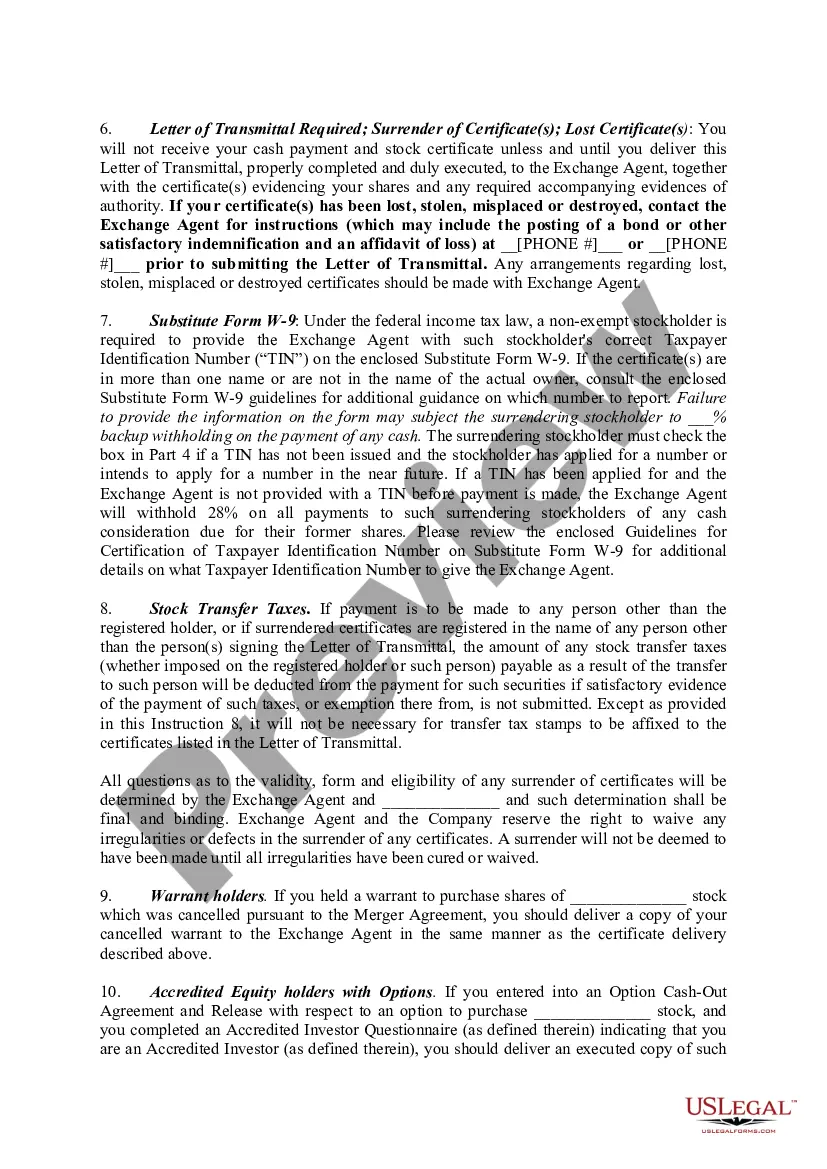

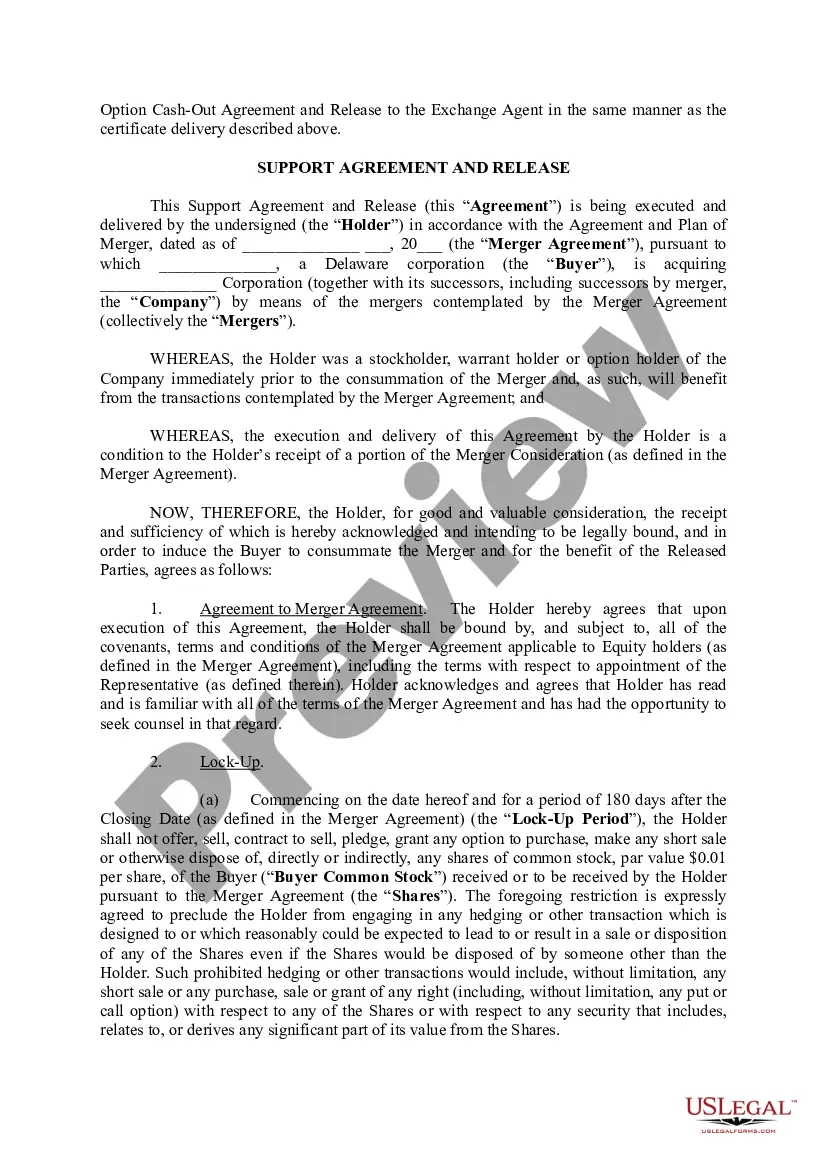

Title: Nebraska Letter of Transmittal to Accompany Certificates of Common Stock: A Comprehensive Overview Introduction: In the state of Nebraska, a Letter of Transmittal is a crucial document that accompanies the transfer of ownership of Common Stock certificates. This detailed description aims to provide a comprehensive understanding of the Nebraska Letter of Transmittal to Accompany Certificates of Common Stock, its purpose, contents, and potential types. 1. Purpose of the Nebraska Letter of Transmittal: The Nebraska Letter of Transmittal serves as a formal communication channel between shareholders and transfer agents during the transfer of Common Stock ownership. It facilitates the exchange of physical stock certificates for electronic shares or vice versa. 2. Contents of the Nebraska Letter of Transmittal: a. Shareholder Information: Includes the name, address, contact details, and social security number of the shareholder(s) submitting the stock certificate(s). b. Certificate Details: Contains a unique identification number for each stock certificate being transmitted along with the total number of shares and the corresponding par value. c. Signature(s) of Shareholder(s): The Letter of Transmittal typically requires the shareholder(s) to provide their handwritten signatures to validate the document and ensure the legality of the stock transfer. d. Delivery Instructions: Specify the preferred method and address for the return or delivery of new certificates or electronic shares to the shareholder(s). e. Medallion Signature Guarantee: Often, the Letter of Transmittal necessitates a Medallion Signature Guarantee, a verification process performed by financial institutions to ensure the authenticity of the shareholder's signature. f. Additional Instructions: May include any specific instructions or special considerations related to the transfer, such as tax-related documents, beneficiary information, or power of attorney details. 3. Types of Nebraska Letter of Transmittal: a. Standard Letter of Transmittal: Refers to the most common type where shareholders transfer their Common Stock certificates to the transfer agent for conversion into electronic shares or for other related purposes. b. Restricted Letter of Transmittal: Describes a Letter of Transmittal used in special circumstances, such as restricted stock transfers due to employee lock-up agreements or securities laws/regulations. c. Lost Certificate Letter of Transmittal: Used when a shareholder misplaces or loses their stock certificate(s) and wishes to obtain new ones. d. Estate Letter of Transmittal: Applies in cases of inherited stocks or transfers due to the passing of a shareholder. It facilitates the transfer of ownership to the designated heirs or beneficiaries. Conclusion: Understanding the Nebraska Letter of Transmittal to Accompany Certificates of Common Stock is crucial for shareholders involved in stock transfers in the state. Adhering to the specific requirements and providing accurate information within this document ensures a smooth transfer process. Whether it is a standard, restricted, lost certificate, or estate letter, shareholders and transfer agents must consider the appropriate Letter of Transmittal type for a successful stock transfer.

Nebraska Letter of Transmittal to Accompany Certificates of Common Stock

Description

How to fill out Nebraska Letter Of Transmittal To Accompany Certificates Of Common Stock?

Have you been inside a situation where you need to have paperwork for sometimes organization or individual uses virtually every day? There are a lot of authorized document layouts accessible on the Internet, but discovering types you can trust isn`t effortless. US Legal Forms offers thousands of type layouts, just like the Nebraska Letter of Transmittal to Accompany Certificates of Common Stock, that happen to be composed to fulfill state and federal needs.

In case you are presently familiar with US Legal Forms internet site and possess your account, just log in. Afterward, you are able to acquire the Nebraska Letter of Transmittal to Accompany Certificates of Common Stock web template.

If you do not offer an bank account and need to begin to use US Legal Forms, follow these steps:

- Discover the type you need and make sure it is for your appropriate metropolis/region.

- Utilize the Preview key to examine the form.

- Look at the explanation to ensure that you have chosen the correct type.

- In case the type isn`t what you`re looking for, utilize the Research discipline to find the type that meets your needs and needs.

- Once you get the appropriate type, click on Acquire now.

- Select the rates strategy you desire, submit the specified info to generate your bank account, and purchase your order with your PayPal or credit card.

- Choose a handy data file formatting and acquire your copy.

Locate every one of the document layouts you have bought in the My Forms menus. You can obtain a additional copy of Nebraska Letter of Transmittal to Accompany Certificates of Common Stock anytime, if possible. Just click the essential type to acquire or print the document web template.

Use US Legal Forms, the most comprehensive collection of authorized varieties, to conserve efforts and steer clear of blunders. The assistance offers expertly created authorized document layouts which you can use for a variety of uses. Make your account on US Legal Forms and commence generating your daily life easier.