Preferred stock pays fixed dividends and has also the potential to appreciate in price. That is to say, it combines features of debt and equity.

Preferred stock usually yields more than common stock, and it can be paid every month or every quarter. The dividends are fixed or set according to a benchmark interest rate. The dividend yield is influenced by adjustable-rate shares, and participating shares are able to pay more dividends that calculated by common stock dividends or business profits.

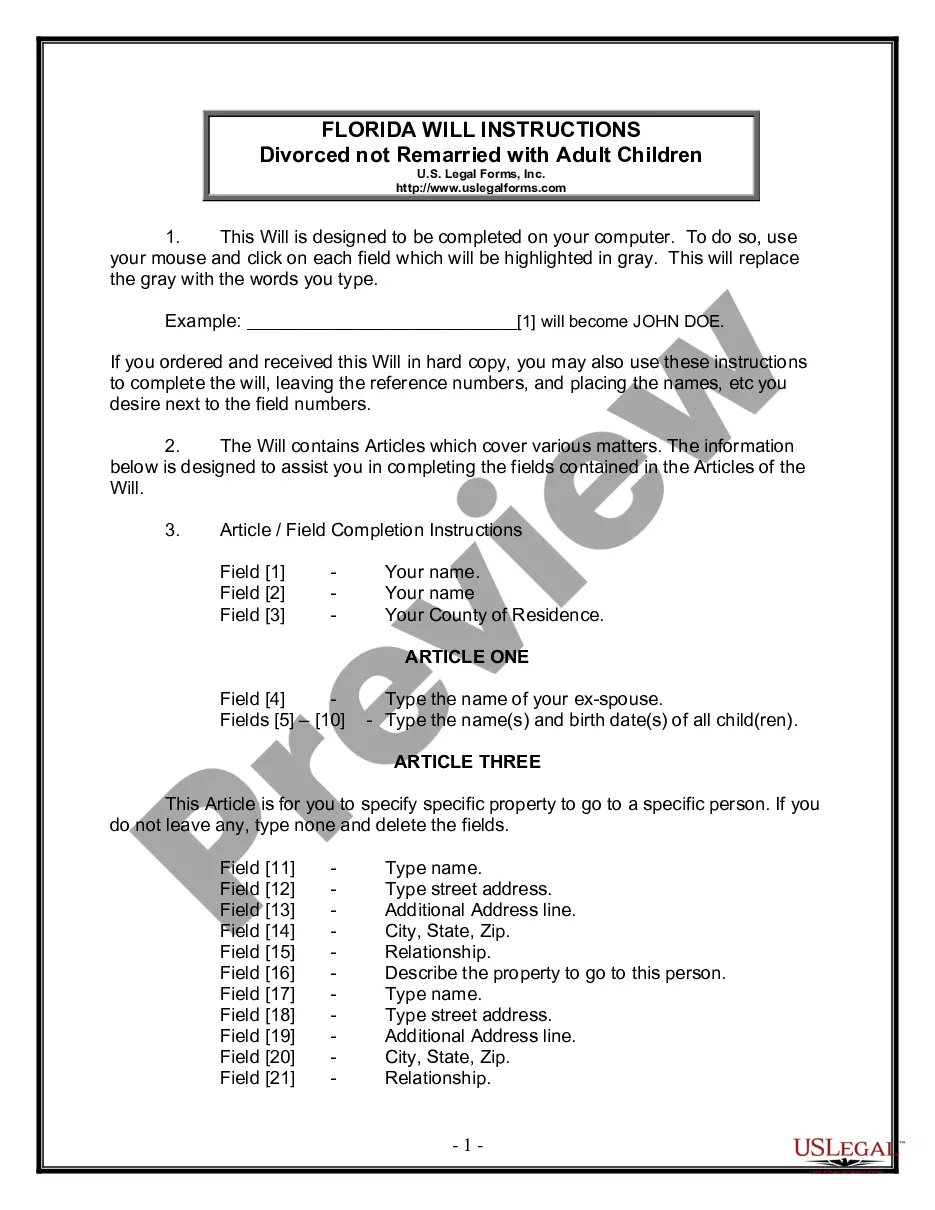

This is a template for agreeing on preferred stock purchases for your company to use when working with investors."

Nebraska Series Seed Preferred Stock Purchase Agreement is a legally binding document that outlines the terms and conditions of the purchase of preferred stock in a startup company. The agreement is specific to the state of Nebraska and is commonly used in venture capital transactions. The Nebraska Series Seed Preferred Stock Purchase Agreement is designed to provide investors with certain rights and protections while offering startup companies a streamlined and standardized investment process. It typically caters to early-stage companies seeking financing and venture capitalists looking to invest in high-growth potential businesses. This agreement sets forth the details of the investment, including the number of shares being acquired, the purchase price per share, and the total investment amount. It also covers various provisions related to the rights, preferences, and privileges attached to the preferred stock. These provisions may include voting rights, liquidation preferences, anti-dilution protection, conversion rights, and participation rights in future financings. While the Nebraska Series Seed Preferred Stock Purchase Agreement follows a standardized format, there may be variations or specific versions tailored to the needs of different parties or circumstances. Some common variations include: 1. Nebraska Series Seed Preferred Stock Purchase Agreement with Restricted Stock Conditions: This type of agreement imposes certain restrictions on the sale or transfer of the purchased preferred stock. It may include lock-up periods where the investor cannot sell the stock for a specific period. 2. Nebraska Series Seed Preferred Stock Purchase Agreement with Board Observer Rights: In this variation, the investor may secure the right to appoint an observer to the company's board of directors. The board observer acts as a non-voting representative, providing valuable insights and monitoring the investor's interests. 3. Nebraska Series Seed Preferred Stock Purchase Agreement with Tag-Along Rights: This type of agreement offers additional protection to the investor by granting them the right to join in the sale of the company's common stock in the event the majority shareholder (founder or other investors) decides to sell their shares. 4. Nebraska Series Seed Preferred Stock Purchase Agreement with Drag-Along Rights: This variation confers the investor with the right to compel other shareholders to sell their stock during an acquisition if a predetermined threshold of shares has already been sold to the acquirer. It ensures that minority shareholders do not obstruct a potential sale of the company. In conclusion, the Nebraska Series Seed Preferred Stock Purchase Agreement is an essential legal framework for financing startup companies and attracting investment in Nebraska. The agreement protects investors while offering startups a standardized investment process. Its variations allow for customization to meet the specific needs and expectations of different parties involved in venture capital transactions.