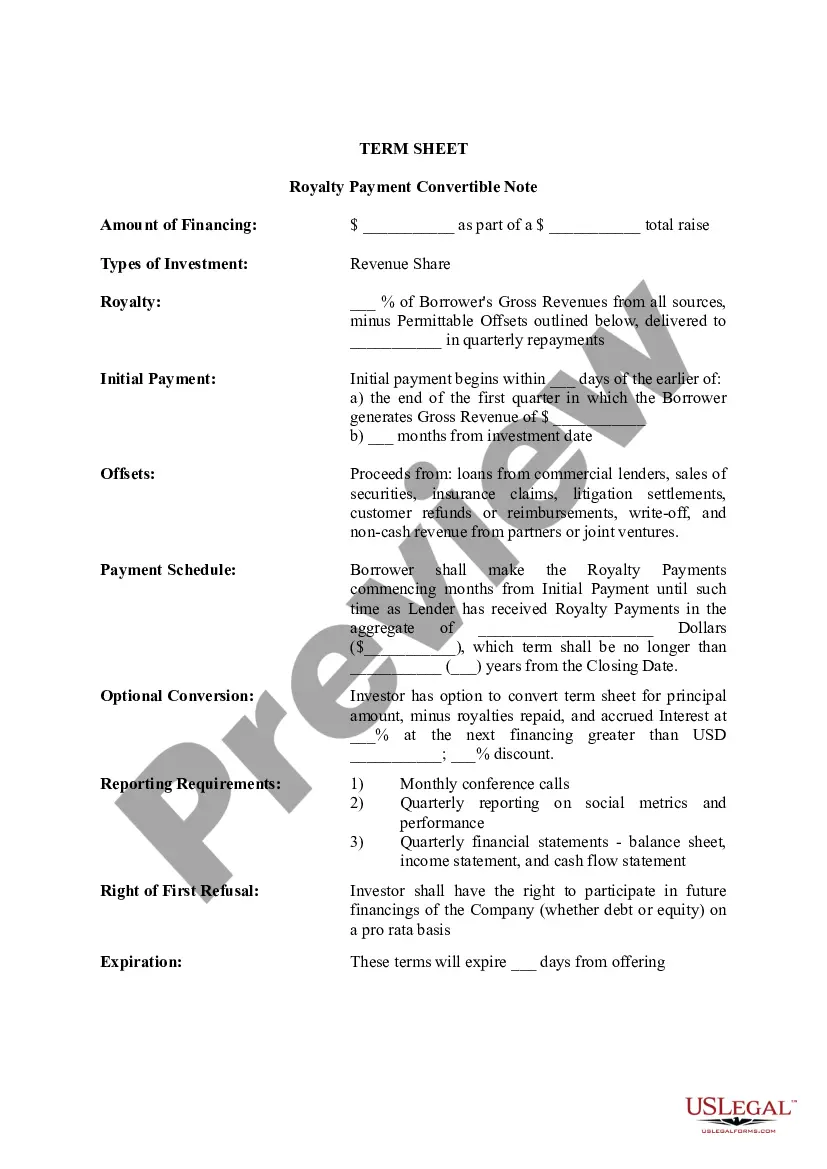

Nebraska Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

If you want to full, acquire, or printing legal papers themes, use US Legal Forms, the greatest assortment of legal forms, that can be found on the web. Use the site`s simple and convenient research to discover the files you require. Numerous themes for enterprise and individual reasons are categorized by categories and claims, or search phrases. Use US Legal Forms to discover the Nebraska Term Sheet - Royalty Payment Convertible Note in just a number of click throughs.

When you are presently a US Legal Forms buyer, log in for your bank account and click on the Acquire key to get the Nebraska Term Sheet - Royalty Payment Convertible Note. You can also entry forms you in the past saved from the My Forms tab of your own bank account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for your correct town/nation.

- Step 2. Use the Review option to look through the form`s content material. Don`t overlook to read through the explanation.

- Step 3. When you are unsatisfied with the kind, use the Research discipline on top of the monitor to find other variations of the legal kind format.

- Step 4. Once you have found the shape you require, select the Buy now key. Choose the pricing program you favor and put your qualifications to sign up to have an bank account.

- Step 5. Process the purchase. You can use your charge card or PayPal bank account to perform the purchase.

- Step 6. Choose the structure of the legal kind and acquire it on the product.

- Step 7. Total, change and printing or sign the Nebraska Term Sheet - Royalty Payment Convertible Note.

Every single legal papers format you acquire is your own for a long time. You might have acces to every single kind you saved inside your acccount. Select the My Forms segment and decide on a kind to printing or acquire once more.

Remain competitive and acquire, and printing the Nebraska Term Sheet - Royalty Payment Convertible Note with US Legal Forms. There are millions of expert and status-specific forms you can utilize for your personal enterprise or individual demands.

Form popularity

FAQ

The basic concept for valuing a convertible note is the same in theory as the valuation of any other financial asset. The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk. Valuation of Convertible Notes - Eqvista eqvista.com ? resources ? valuation-of-convertible... eqvista.com ? resources ? valuation-of-convertible...

A valuation cap is applied during the pre-money valuation period of an investment which is when the convertible debt becomes equity. Is a Valuation Cap Pre or Post-Money? - Westchester Angels westchesterangels.com ? is-a-valuation-cap-pre-or... westchesterangels.com ? is-a-valuation-cap-pre-or...

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

The simplest approach is to strip the equity component from the convertible note and treat the value as a sum-of-the-parts. The equity is most commonly valued in straight Black-Scholes option pricing model, and this value is deducted from the convertible note's notional amount to imply the ?value? of the straight-debt. Convertible Notes Valuation valuationresearch.com ? pure-perspectives valuationresearch.com ? pure-perspectives

Calculating post-money valuation Post-money valuation = Pre-money valuation + Size of investment. ... Share price = New investment amount / # of new shares received. ... Post-money valuation / total # of shares post-investment = New investment amount / # of new shares received.

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

It's very easy to determine the post-money valuation. To do so, use this formula: Post-money valuation = Investment dollar amount ÷ percent investor receives. Pre-Money vs. Post-Money: What's the Difference? - Investopedia investopedia.com ? ask ? answers ? differen... investopedia.com ? ask ? answers ? differen...