Nebraska Investment-Grade Bond Optional Redemption (without a Par Call) is a type of investment instrument offered by the state of Nebraska that allows investors to participate in the growth of the state's economy while enjoying a fixed-income stream. These investment-grade bonds provide a relatively safe investment option for individuals and institutions looking for stable returns. Nebraska Investment-Grade Bond Optional Redemption (without a Par Call) offers investors the opportunity to purchase bonds with maturities ranging from short-term to long-term durations. The bonds are issued with a fixed interest rate, which provides investors with guaranteed periodic interest payments over the bond's term. One distinguishing feature of Nebraska Investment-Grade Bond Optional Redemption (without a Par Call) is the absence of a Par Call option. Unlike some other bond types, these particular bonds do not provide an issuer the right to redeem the bonds prior to maturity at par value. This allows investors to enjoy a steady stream of income for the full term of the bond without the risk of early redemption. These bonds are designed to be investment-grade, meaning they have received a high credit rating by reputable credit rating agencies. This rating indicates that the issuer has a low risk of defaulting on interest or principal payments, providing investors with confidence and security. Investors interested in Nebraska Investment-Grade Bond Optional Redemption (without a Par Call) may choose from various types based on their investment objectives and risk tolerance. These include short-term investment-grade bonds, medium-term investment-grade bonds, and long-term investment-grade bonds. Each type offers different maturities and interest rates to cater to a diverse range of investor preferences. Short-term investment-grade bonds typically have maturities ranging from one to three years, making them suitable for investors who prefer shorter investment horizons or seek liquidity in the near term. Medium-term investment-grade bonds have durations of three to seven years, striking a balance between income generation and capital preservation. Long-term investment-grade bonds, as the name suggests, have maturities that extend beyond seven years, offering potential higher returns for patient investors willing to hold their investments for an extended period. Investors looking to diversify their portfolio or seek a reliable income stream with lower risk often find Nebraska Investment-Grade Bond Optional Redemption (without a Par Call) a suitable option. These bonds allow individuals and institutions to support Nebraska's economic growth while receiving fixed returns, making them an attractive investment avenue.

Nebraska Investment - Grade Bond Optional Redemption (without a Par Call)

Description

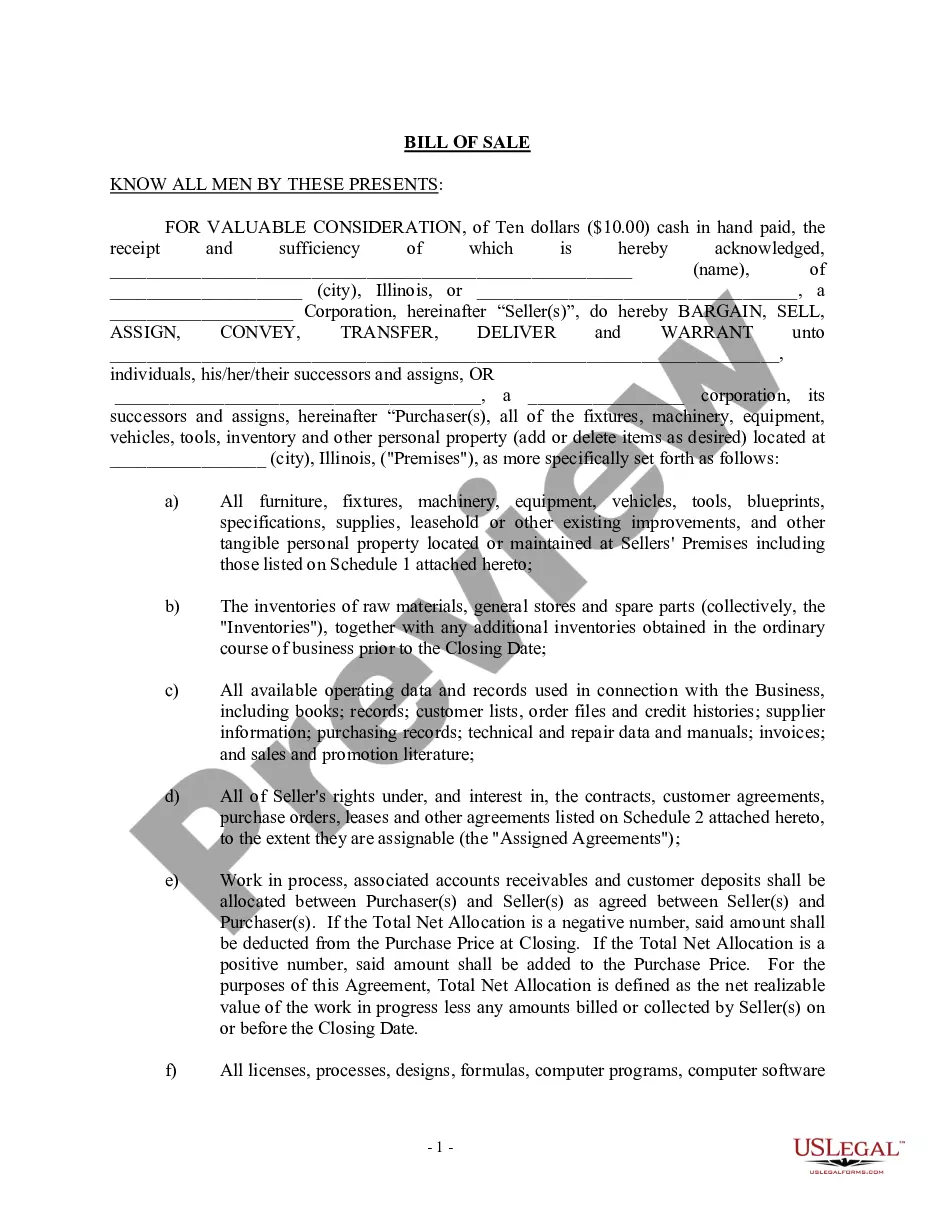

How to fill out Nebraska Investment - Grade Bond Optional Redemption (without A Par Call)?

You are able to commit hrs on the web trying to find the authorized record design that meets the state and federal specifications you want. US Legal Forms provides a huge number of authorized varieties that are analyzed by pros. It is possible to download or print the Nebraska Investment - Grade Bond Optional Redemption (without a Par Call) from my service.

If you have a US Legal Forms bank account, you can log in and click on the Down load option. Next, you can comprehensive, edit, print, or signal the Nebraska Investment - Grade Bond Optional Redemption (without a Par Call). Every authorized record design you acquire is yours for a long time. To acquire an additional duplicate for any bought form, go to the My Forms tab and click on the related option.

Should you use the US Legal Forms internet site the very first time, keep to the easy guidelines listed below:

- Initially, make certain you have chosen the proper record design to the state/city of your choice. See the form description to ensure you have selected the right form. If available, utilize the Preview option to search throughout the record design at the same time.

- If you would like get an additional model of your form, utilize the Look for area to obtain the design that suits you and specifications.

- When you have identified the design you want, simply click Acquire now to move forward.

- Pick the pricing program you want, enter your qualifications, and register for an account on US Legal Forms.

- Full the deal. You may use your bank card or PayPal bank account to cover the authorized form.

- Pick the formatting of your record and download it to your device.

- Make alterations to your record if necessary. You are able to comprehensive, edit and signal and print Nebraska Investment - Grade Bond Optional Redemption (without a Par Call).

Down load and print a huge number of record templates using the US Legal Forms website, that provides the most important collection of authorized varieties. Use specialist and status-distinct templates to take on your company or person requires.

Form popularity

FAQ

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date. What is bond redemption? - Help Centre - Crowdcube crowdcube.com ? en-us ? articles ? 3600006... crowdcube.com ? en-us ? articles ? 3600006...

Optional Redemption. Allows the issuer, at its option, to redeem the bonds. Many municipal bonds, for example, have optional call features that issuers may exercise after a certain number of years, often 10 years. Sinking Fund Redemption.

In finance, redemption describes the repayment of a fixed-income security?such as a Treasury note, certificate of deposit, or bond?on or before its maturity date. Mutual fund investors can request redemptions for all or part of their shares from their fund manager.

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date.

Bond Redemption Date means, with respect to any Bond, the date on which such Bond is redeemed pursuant to the applicable Bond Documents. Bond Redemption Date means any date, other than an Interest Payment Date, upon which Bonds shall be redeemed pursuant to the Indenture. Bond Redemption Date Definition | Law Insider lawinsider.com ? dictionary ? bond-redempt... lawinsider.com ? dictionary ? bond-redempt...

Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond's maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back the principal amount of the bond to the bondholder. Bond Redemption and Types of Bond Redemption | IndiaBonds indiabonds.com ? news-and-insight ? bond-... indiabonds.com ? news-and-insight ? bond-...