Nebraska Simple Agreement for Future Equity, or SAFE, is a legal document widely used in startup ecosystems to raise funds. Specifically, it is an investment contract between a company and an investor, aiming to provide a simple and standardized way to secure future equity in the company without determining an exact valuation at the time of investment. The Nebraska SAFE agreement offers flexibility for startups by deferring equity valuation until a predetermined future event, typically a priced equity financing round or a specific milestone. The Nebraska SAFE agreement consists of several essential elements. Firstly, the agreement defines the amount invested by the investor and outlines the terms for converting this investment into equity in the future. The investment amount is usually denominated in US dollars. Secondly, the agreement specifies the triggers or events that will determine the conversion into equity, such as the occurrence of a priced financing round or a significant milestone achievement. By utilizing the Nebraska SAFE agreement, startups can attract potential investors without the need to establish an immediate valuation of the company, which can be challenging for early-stage companies. It provides a simplified alternative to traditional convertible notes, which often have more complex terms and interest rates. The Nebraska SAFE agreement streamlines the investment process and ensures fairness for both parties involved, as it eliminates the need for lengthy negotiations around valuations. There are several variations of Nebraska SAFE, each suited for different investment scenarios. One type is the "Cap SAFE," which includes a valuation cap — a maximum valuation at which the agreed-upon investment will convert into equity. This cap protects the investor by providing an upper limit on the company's valuation when the conversion takes place, allowing them to secure a certain amount of equity even if the company's value skyrockets before the next funding round. Another type of Nebraska SAFE is the "Discount SAFE," which offers benefits to the investor by providing a discount upon conversion. This discount enables investors to acquire shares at a more favorable rate than future investors in the priced financing round, serving as an incentive to invest early and mitigate risk. Overall, Nebraska Simple Agreement for Future Equity (SAFE) is an innovative legal framework that facilitates investment in startups by deferring equity valuation until a specified future event. With its simplicity and flexibility, Nebraska SAFE has become increasingly popular in the startup community, offering a fair and efficient way for early-stage companies to secure funding while satisfying the needs of potential investors.

Nebraska Simple Agreement for Future Equity

Description

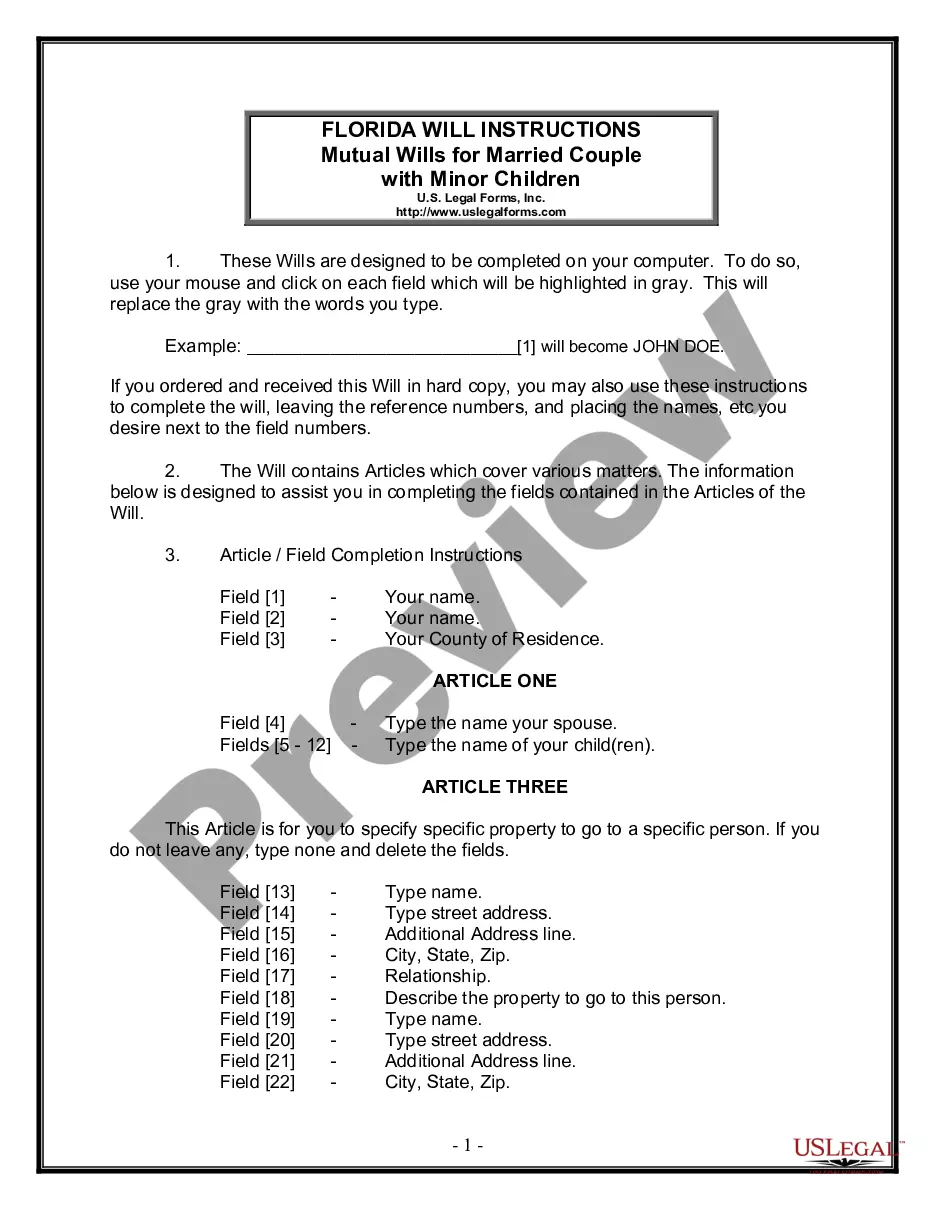

How to fill out Nebraska Simple Agreement For Future Equity?

Are you presently inside a place where you need documents for sometimes organization or individual functions nearly every day? There are a lot of authorized document web templates available on the Internet, but getting kinds you can rely on isn`t effortless. US Legal Forms gives a large number of develop web templates, just like the Nebraska Simple Agreement for Future Equity, that happen to be published to fulfill federal and state needs.

If you are currently familiar with US Legal Forms website and also have a merchant account, merely log in. After that, you are able to down load the Nebraska Simple Agreement for Future Equity template.

Should you not have an account and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you will need and make sure it is for that correct town/state.

- Use the Review key to check the form.

- Read the description to actually have chosen the right develop.

- When the develop isn`t what you are searching for, take advantage of the Research discipline to obtain the develop that meets your needs and needs.

- Once you discover the correct develop, click on Buy now.

- Select the rates prepare you want, fill out the specified details to produce your bank account, and buy an order using your PayPal or Visa or Mastercard.

- Choose a practical data file structure and down load your duplicate.

Locate each of the document web templates you may have purchased in the My Forms food selection. You can obtain a extra duplicate of Nebraska Simple Agreement for Future Equity whenever, if needed. Just click the required develop to down load or printing the document template.

Use US Legal Forms, probably the most substantial collection of authorized varieties, in order to save time as well as steer clear of faults. The service gives appropriately produced authorized document web templates that you can use for an array of functions. Make a merchant account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

A simple agreement for future equity (SAFE) is a financing contract that may be used by a start-up company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes because a SAFE is quicker and easier to negotiate and has fewer terms.

SAFEs are generally considered taxable at the time of the triggering event, when the SAFE converts into equity (i.e. stock in the company).

Cons: SAFE investors assume most, if not all, of the risk, in that there is no guarantee of any equity ownership in the company. ... A SAFE holder is not entitled to any company assets in the event of a liquidation.

Calculation ing to the Discount Rate The total shares are calculated ing to the SAFE money invested divided by the share price in the next round, multiplied by the discount rate. If we take our example above, if during the next financing round, the company raises money ing to a share price of $10.

A simple agreement for future equity (SAFE) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment.

A simple agreement for future equity delays valuation of a company until it has more performance data on which to base a valuation. At the same time, it promises an investor the right to buy future equity when a valuation is made. A SAFE can be converted into preferred stock in the future.

Determine valuation cap for SAFE. The SAFE discount is derived by dividing the valuation cap by the typical equity financing valuation and then removing that value from one (representing no discount). In this case, $2 million / $4 million = 0.5 and 1 ? 0.5 = 0.5 would be the mathematical representations.