Nebraska Retail Web Site Service Agreement

Description

How to fill out Retail Web Site Service Agreement?

Are you currently in the placement the place you require files for either enterprise or specific purposes almost every day time? There are a lot of lawful file web templates available on the net, but getting kinds you can rely on isn`t straightforward. US Legal Forms provides thousands of form web templates, such as the Nebraska Retail Web Site Service Agreement, which are published in order to meet federal and state needs.

In case you are presently knowledgeable about US Legal Forms website and also have an account, merely log in. After that, you are able to download the Nebraska Retail Web Site Service Agreement design.

If you do not have an profile and would like to begin to use US Legal Forms, follow these steps:

- Discover the form you will need and make sure it is to the right town/area.

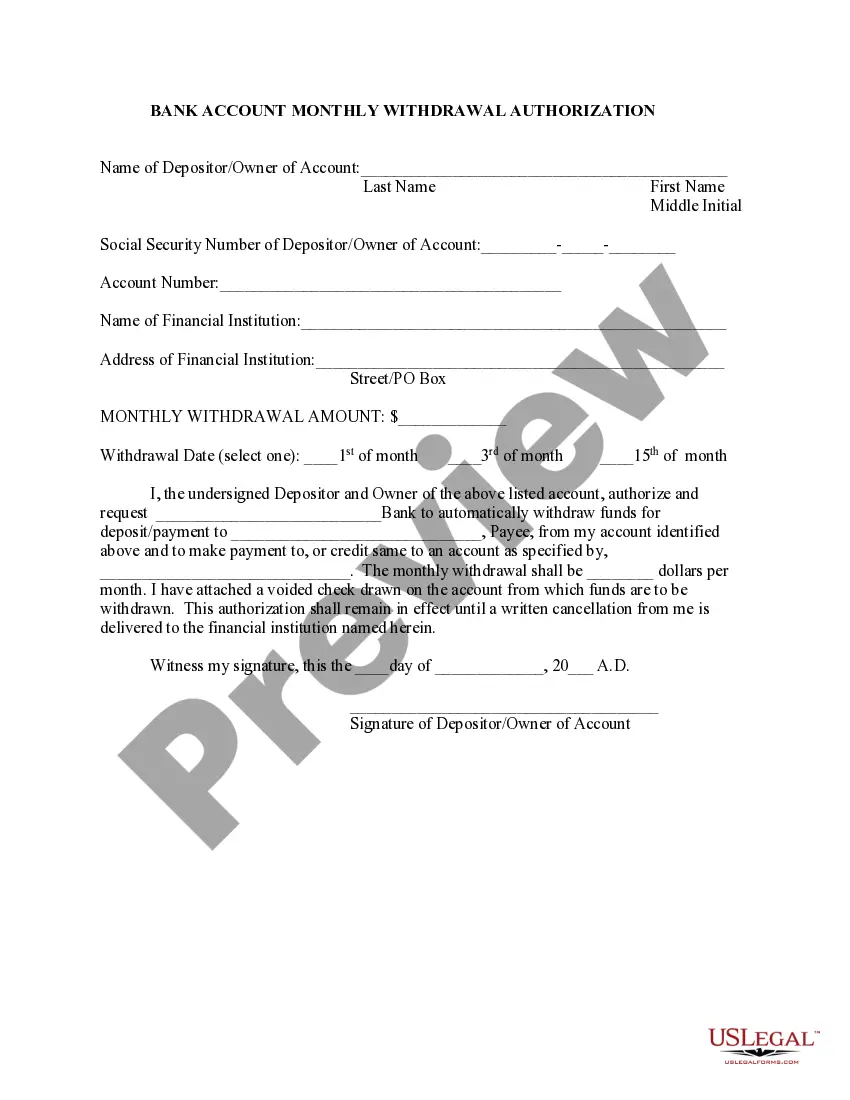

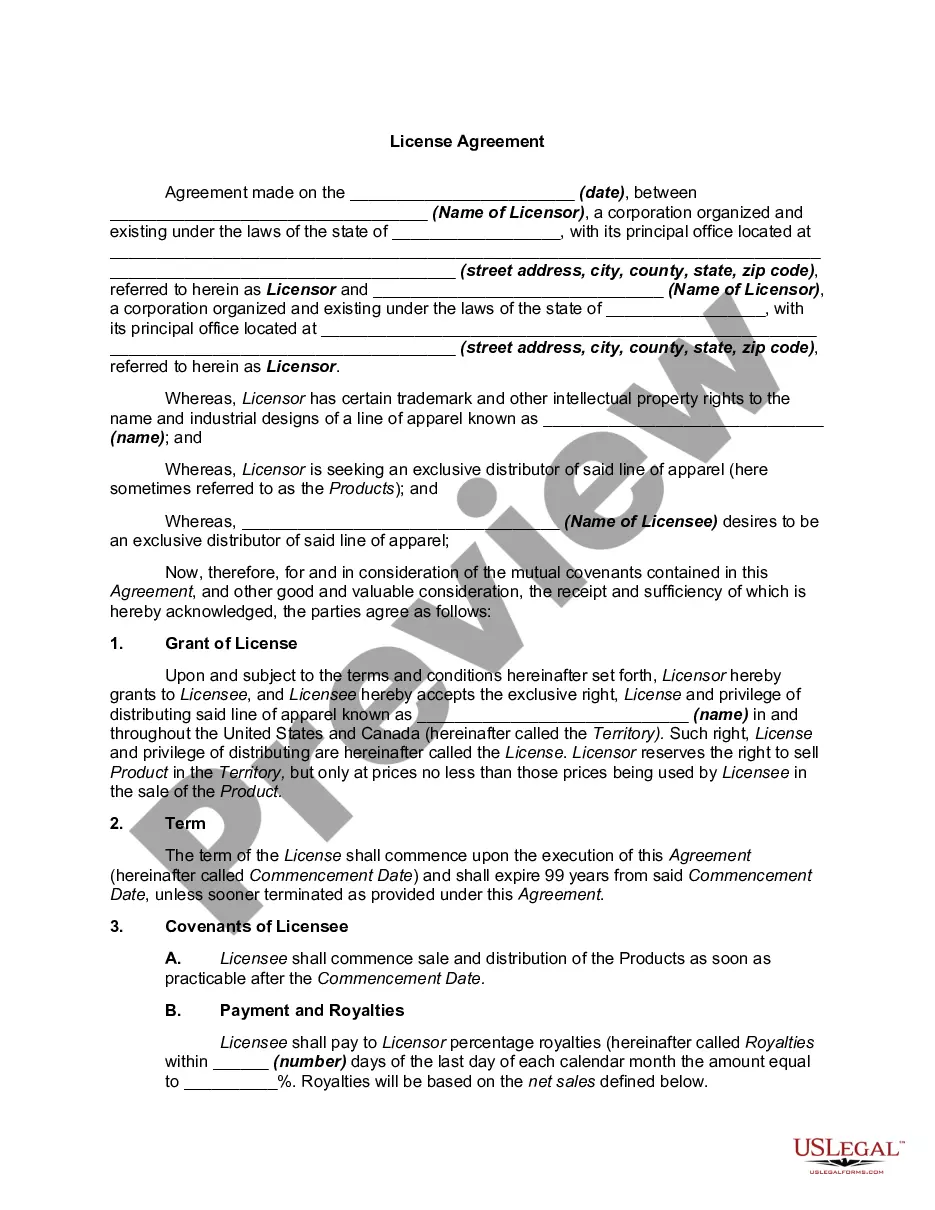

- Take advantage of the Review button to check the form.

- Read the description to ensure that you have selected the right form.

- When the form isn`t what you are searching for, use the Search industry to discover the form that suits you and needs.

- If you get the right form, just click Acquire now.

- Opt for the costs prepare you need, fill out the required info to produce your money, and pay money for the transaction making use of your PayPal or bank card.

- Pick a hassle-free file file format and download your copy.

Locate each of the file web templates you may have bought in the My Forms food selection. You can aquire a extra copy of Nebraska Retail Web Site Service Agreement whenever, if necessary. Just click the required form to download or print out the file design.

Use US Legal Forms, one of the most extensive collection of lawful forms, to save lots of time and avoid errors. The services provides professionally made lawful file web templates that can be used for a range of purposes. Create an account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

Contractors making over-the-counter sales must collect and remit Nebraska and applicable local sales tax on the total sales price, including all amounts charged to build or assemble the item sold. Most nonprofit organizations are not exempt from sales tax in Nebraska. Nebraska Taxation of Contractors General Information nebraska.gov ? files ? doc ? info nebraska.gov ? files ? doc ? info

This Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in Nebraska. Also, when owners of an existing business change, a Form 20 needs to be filed.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the ...

Nebraska generally does not tax SaaS, but has issued informal guidance that Security SaaS products may be taxable. The state does impose sales tax on certain digital goods and services. Is SaaS taxable in Nebraska? | The SaaS sales tax index - Anrok anrok.com ? saas-sales-tax-by-state ? nebraska anrok.com ? saas-sales-tax-by-state ? nebraska

Nebraska considers a seller to have physical nexus if you have any of the following in the state: An office or place of business. Employees, agents, sales people, contractors, etc. present in the state.

Services are generally not taxable in Nebraska, with the following exceptions: Admissions to a location for purposes of amusement, entertainment or recreation. Pest control services. Building cleaning and maintenance. Installation or application of tangible personal property. Does Nebraska Charge Sales Tax on Services? - TaxJar taxjar.com ? blog ? 2023-06-does-nebraska-... taxjar.com ? blog ? 2023-06-does-nebraska-...

Generally speaking, professional services are not subject to sales tax in the state of Nebraska. Are professional services taxable in Nebraska? - Wrike Wrike ? faq ? are-professional-servic... Wrike ? faq ? are-professional-servic...

Sales of warranties, guarantees, service agreements, and maintenance agreements are taxable when the items or property covered or services to be provided are taxable. Sales tax is due whether the agreement is sold with the item or sold separately.