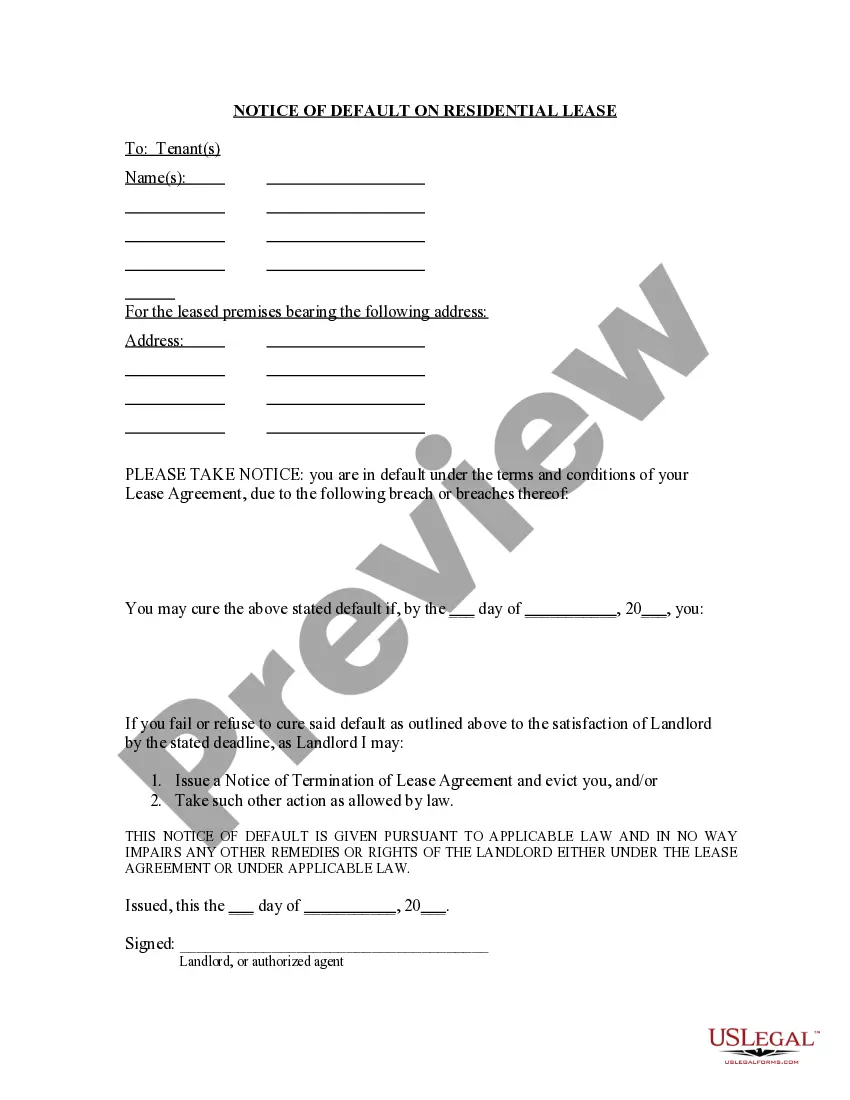

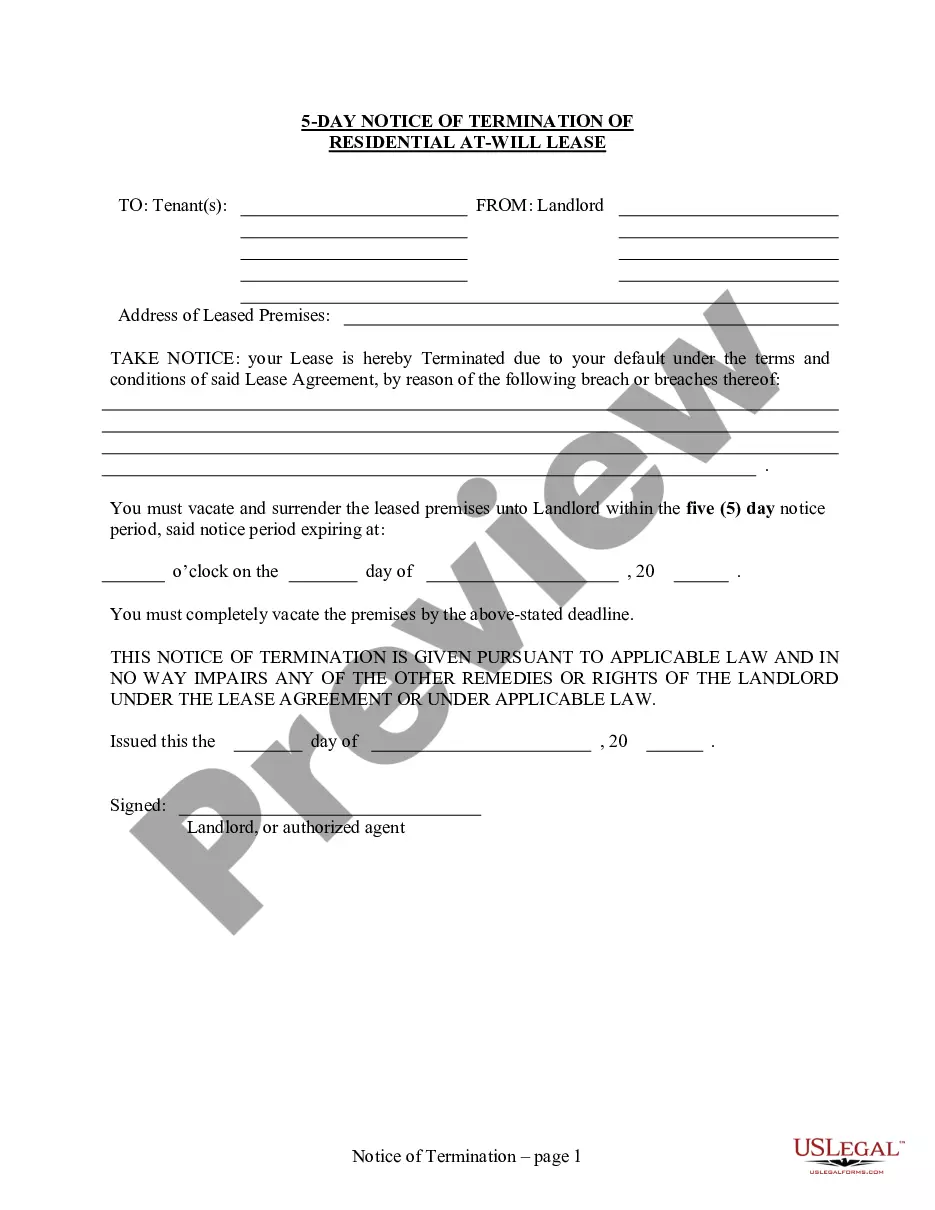

Nebraska Form — Enhanced CD Agreement is a legal document that encompasses the terms and conditions surrounding the purchase and use of an Enhanced Certificate of Deposit (CD) within the state of Nebraska. This agreement outlines the rights and obligations of both the financial institution offering the CD and the individual or entity purchasing it. Enhanced CDs are specialized financial instruments that typically offer higher interest rates compared to traditional CDs. They provide investors with the opportunity to earn a higher return on their investment over a fixed period of time, usually ranging from a few months to several years. The Nebraska Form — Enhanced CD Agreement acts as a binding contract between the parties involved, ensuring the lawful and secure transaction of funds. The agreement typically contains the following key elements: 1. Parties involved: This section identifies the financial institution issuing the Enhanced CD and the individual or entity purchasing it. It includes their legal names, contact details, and any necessary identification information. 2. CD terms and conditions: This section clarifies the specific terms and conditions of the Enhanced CD, including the interest rate, maturity date, minimum deposit requirements, and any penalties for early withdrawal or cancellation. 3. Funding and account maintenance: This section outlines the methods for funding the Enhanced CD, such as wire transfers, checks, or electronic funds transfer. It also provides instructions for maintaining the account, including statements, notifications, and account updates. 4. Withdrawal procedures: This section details the process for withdrawing funds from the Enhanced CD upon maturity or before the agreed-upon term. It may include information on penalties, partial withdrawals, and beneficiary designations. 5. Termination and renewal: If applicable, this section outlines the steps for terminating the agreement before maturity or renewing the CD after its term expires. It may include provisions for automatic renewal, rollovers, or options to switch to different CD products. It is important to note that while this description provides a general overview of a Nebraska Form — Enhanced CD Agreement, specific variations and different types of forms may exist depending on the financial institution. Some variations may include specific clauses or conditions tailored to the institution's policies or the investor's unique requirements. Therefore, it is crucial to carefully review and understand the terms and conditions of the agreement before entering into any financial commitment.

Nebraska Form - Enhanced CD Agreement

Description

How to fill out Nebraska Form - Enhanced CD Agreement?

If you wish to total, down load, or printing legitimate document themes, use US Legal Forms, the greatest collection of legitimate types, that can be found on-line. Utilize the site`s simple and practical search to discover the documents you need. Different themes for enterprise and individual purposes are categorized by categories and states, or search phrases. Use US Legal Forms to discover the Nebraska Form - Enhanced CD Agreement in just a handful of clicks.

When you are already a US Legal Forms consumer, log in to your accounts and click on the Obtain option to find the Nebraska Form - Enhanced CD Agreement. You may also entry types you formerly saved inside the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for your right metropolis/country.

- Step 2. Take advantage of the Review solution to check out the form`s content material. Don`t neglect to learn the explanation.

- Step 3. When you are unsatisfied using the develop, utilize the Lookup field towards the top of the display screen to find other versions of the legitimate develop template.

- Step 4. Upon having discovered the form you need, select the Buy now option. Choose the pricing prepare you favor and put your references to register on an accounts.

- Step 5. Approach the financial transaction. You can utilize your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Find the format of the legitimate develop and down load it on your product.

- Step 7. Total, revise and printing or sign the Nebraska Form - Enhanced CD Agreement.

Every single legitimate document template you purchase is the one you have permanently. You possess acces to every develop you saved in your acccount. Select the My Forms segment and select a develop to printing or down load again.

Be competitive and down load, and printing the Nebraska Form - Enhanced CD Agreement with US Legal Forms. There are thousands of specialist and express-distinct types you can utilize for the enterprise or individual needs.

Form popularity

FAQ

Selling a vehicle for $1 instead of gifting it could result in your recipient paying sales tax based on the car's fair market value ? it's better to stick with the official gifting process.

A gift is a voluntary transfer without any consideration. The donor paid the tax on the previous transfer. If the person accepting the motor vehicle or trailer as a gift or inheritance assumes a lien, mortgage, or encumbrance, the amount owing shall be subject to sales and use tax.

Nebraska imposes an inheritance tax on a beneficiary's right to receive property from a deceased individual (a ?decedent?). With certain exceptions discussed below, Nebraska's inheritance tax applies to all the assets owned by a decedent who is a Nebraska resident at the time of his or her death.

*Note: Individuals transacting a motor vehicle transfer of ownership must complete a Bill of Sale at the time of sale.

How To Transfer A Car Title To A Family Member In Nebraska. The process is essentially the same as a sale. The person giving the car is listed as the seller and the person receiving the car is listed as the buyer. You may put any amount you wish for the amount paid.

To obtain a resale certificate in Nebraska, you will need to complete the Nebraska Resale or Exempt Sale Certificate for Sales Tax Exemption (Form 13). Keep in mind that you first need a valid sales tax permit, as your sales tax identification number is required to complete the form.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the ...

A gift is a voluntary transfer without any consideration. The donor paid the tax on the previous transfer. If the person accepting the motor vehicle or trailer as a gift or inheritance assumes a lien, mortgage, or encumbrance, the amount owing shall be subject to sales and use tax.