Nebraska General Home Repair Services Contract - Long Form - Self-Employed

Description

How to fill out Nebraska General Home Repair Services Contract - Long Form - Self-Employed?

US Legal Forms - one of the biggest libraries of legitimate varieties in America - delivers an array of legitimate papers templates it is possible to acquire or produce. Utilizing the internet site, you will get 1000s of varieties for organization and personal purposes, sorted by classes, claims, or key phrases.You will discover the most recent models of varieties such as the Nebraska General Home Repair Services Contract - Long Form - Self-Employed within minutes.

If you currently have a monthly subscription, log in and acquire Nebraska General Home Repair Services Contract - Long Form - Self-Employed through the US Legal Forms catalogue. The Down load switch will show up on every type you view. You have access to all in the past downloaded varieties within the My Forms tab of your accounts.

If you wish to use US Legal Forms for the first time, allow me to share basic instructions to obtain began:

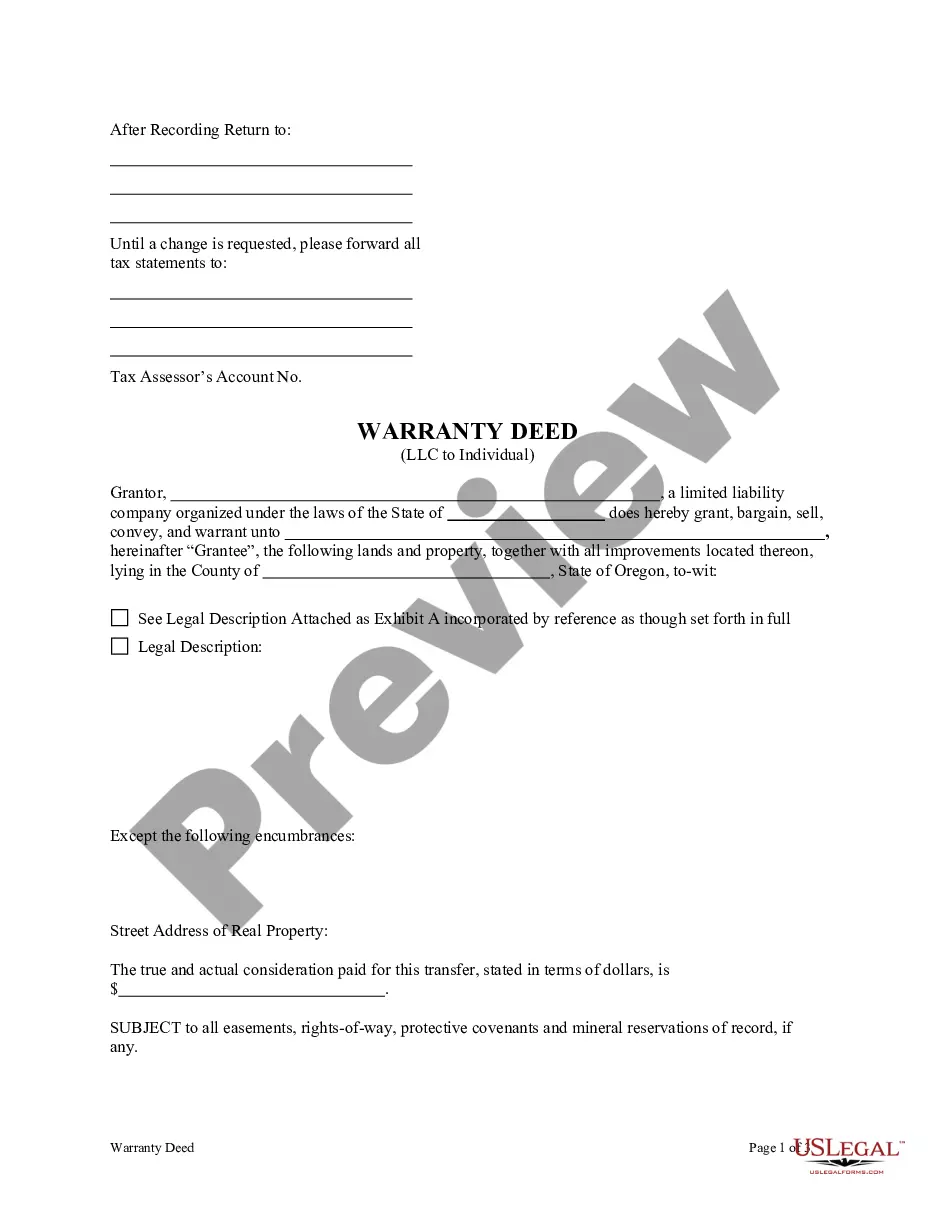

- Be sure to have chosen the best type for your personal town/region. Click on the Review switch to analyze the form`s content. Read the type information to actually have chosen the correct type.

- If the type doesn`t satisfy your demands, take advantage of the Search area near the top of the display screen to discover the one that does.

- When you are happy with the form, confirm your selection by simply clicking the Acquire now switch. Then, choose the prices prepare you prefer and provide your accreditations to sign up for the accounts.

- Process the financial transaction. Use your charge card or PayPal accounts to complete the financial transaction.

- Select the file format and acquire the form on your system.

- Make adjustments. Fill up, edit and produce and sign the downloaded Nebraska General Home Repair Services Contract - Long Form - Self-Employed.

Every web template you included in your bank account lacks an expiry date and it is the one you have for a long time. So, if you wish to acquire or produce another backup, just proceed to the My Forms area and then click in the type you want.

Get access to the Nebraska General Home Repair Services Contract - Long Form - Self-Employed with US Legal Forms, by far the most considerable catalogue of legitimate papers templates. Use 1000s of specialist and express-certain templates that meet your business or personal demands and demands.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.