Nebraska Counselor Agreement - Self-Employed Independent Contractor

Description

How to fill out Nebraska Counselor Agreement - Self-Employed Independent Contractor?

If you need to full, download, or produce legitimate document themes, use US Legal Forms, the largest selection of legitimate forms, which can be found on-line. Utilize the site`s easy and hassle-free research to get the papers you want. Different themes for company and person reasons are categorized by categories and says, or keywords. Use US Legal Forms to get the Nebraska Counselor Agreement - Self-Employed Independent Contractor in just a number of clicks.

In case you are currently a US Legal Forms buyer, log in for your bank account and click on the Obtain option to find the Nebraska Counselor Agreement - Self-Employed Independent Contractor. You can also gain access to forms you formerly saved inside the My Forms tab of your respective bank account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape for the appropriate area/country.

- Step 2. Make use of the Preview method to check out the form`s content material. Don`t overlook to read the outline.

- Step 3. In case you are unsatisfied with all the type, utilize the Search discipline towards the top of the display screen to locate other types from the legitimate type design.

- Step 4. Upon having found the shape you want, click the Purchase now option. Select the rates program you like and add your accreditations to sign up on an bank account.

- Step 5. Method the deal. You should use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Find the formatting from the legitimate type and download it on your own gadget.

- Step 7. Comprehensive, modify and produce or indicator the Nebraska Counselor Agreement - Self-Employed Independent Contractor.

Each legitimate document design you purchase is yours for a long time. You might have acces to each type you saved in your acccount. Select the My Forms segment and pick a type to produce or download once more.

Remain competitive and download, and produce the Nebraska Counselor Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of skilled and status-particular forms you can utilize for your personal company or person needs.

Form popularity

FAQ

A person is required to come into an agreement (known as Independent Contractor Agreement and/or ICA) if he is appointed as an independent contractor with the company, being the other party. This ICA recognises the rights, duties, obligations, services of the contractor, etc.

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.

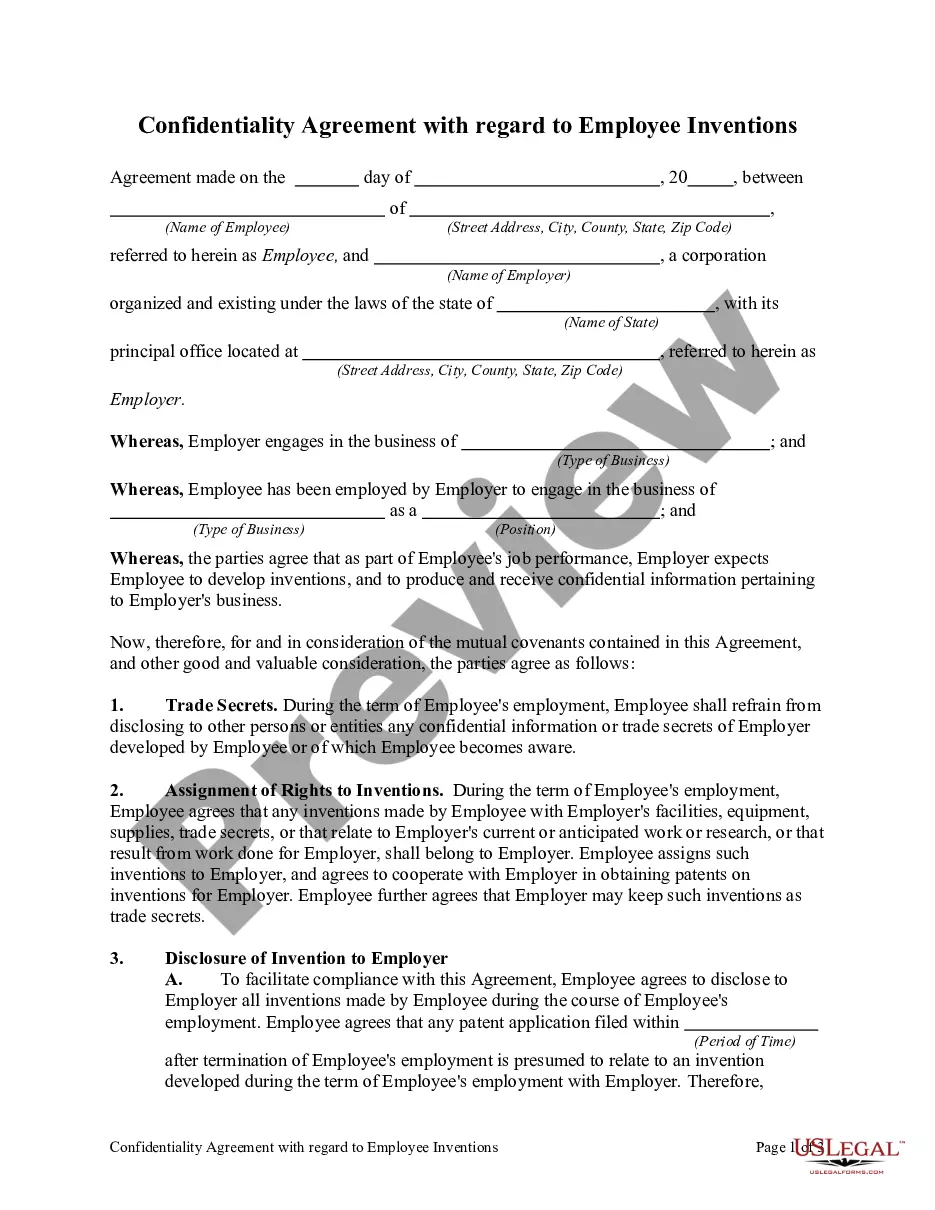

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

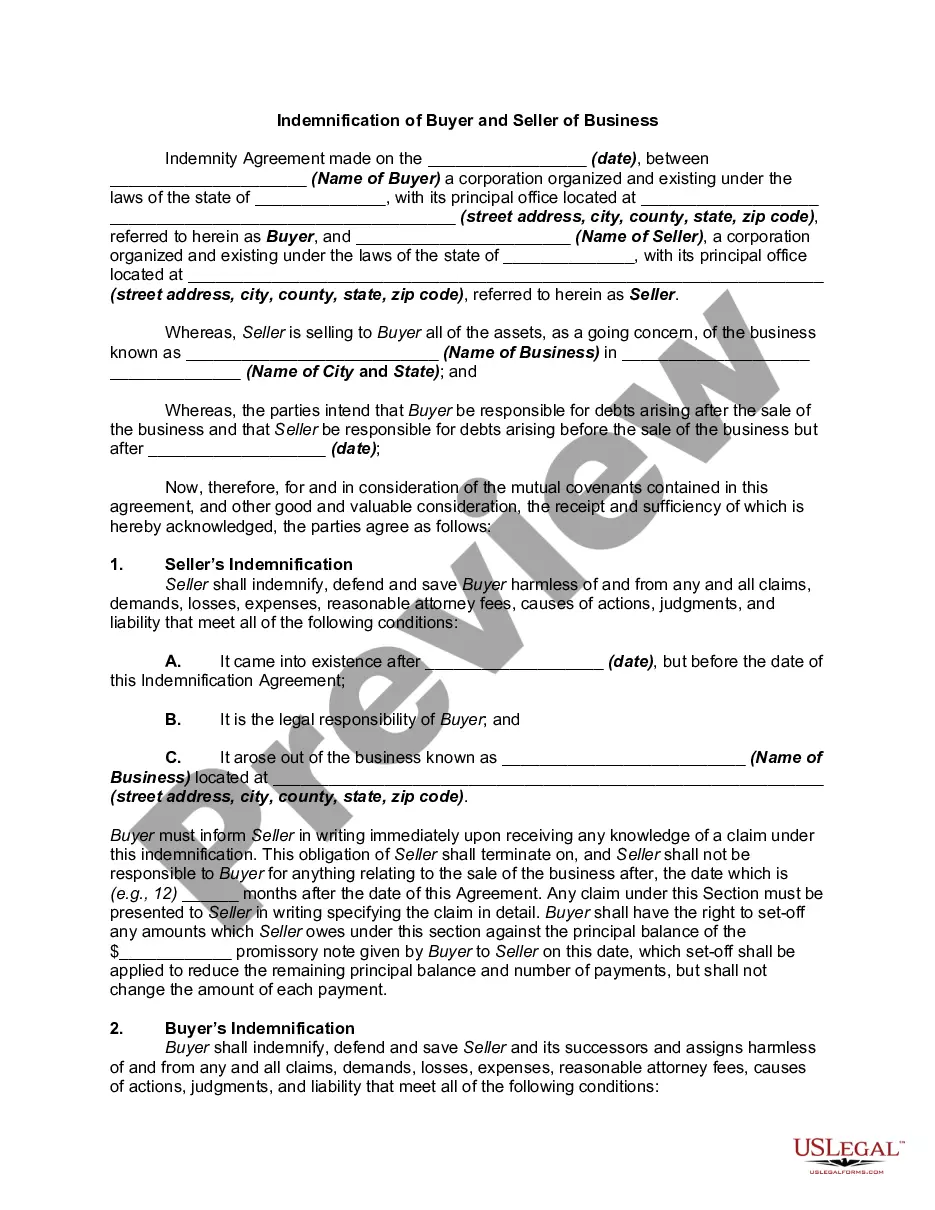

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.