Nebraska Bookkeeping Agreement - Self-Employed Independent Contractor

Description

How to fill out Nebraska Bookkeeping Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the biggest libraries of legal kinds in America - gives a wide array of legal papers templates you are able to download or print out. Using the web site, you may get a large number of kinds for organization and personal functions, categorized by categories, states, or keywords.You can find the most up-to-date versions of kinds such as the Nebraska Bookkeeping Agreement - Self-Employed Independent Contractor in seconds.

If you have a membership, log in and download Nebraska Bookkeeping Agreement - Self-Employed Independent Contractor from the US Legal Forms catalogue. The Down load switch can look on every single type you look at. You get access to all in the past saved kinds inside the My Forms tab of your own accounts.

If you would like use US Legal Forms initially, here are simple directions to help you started out:

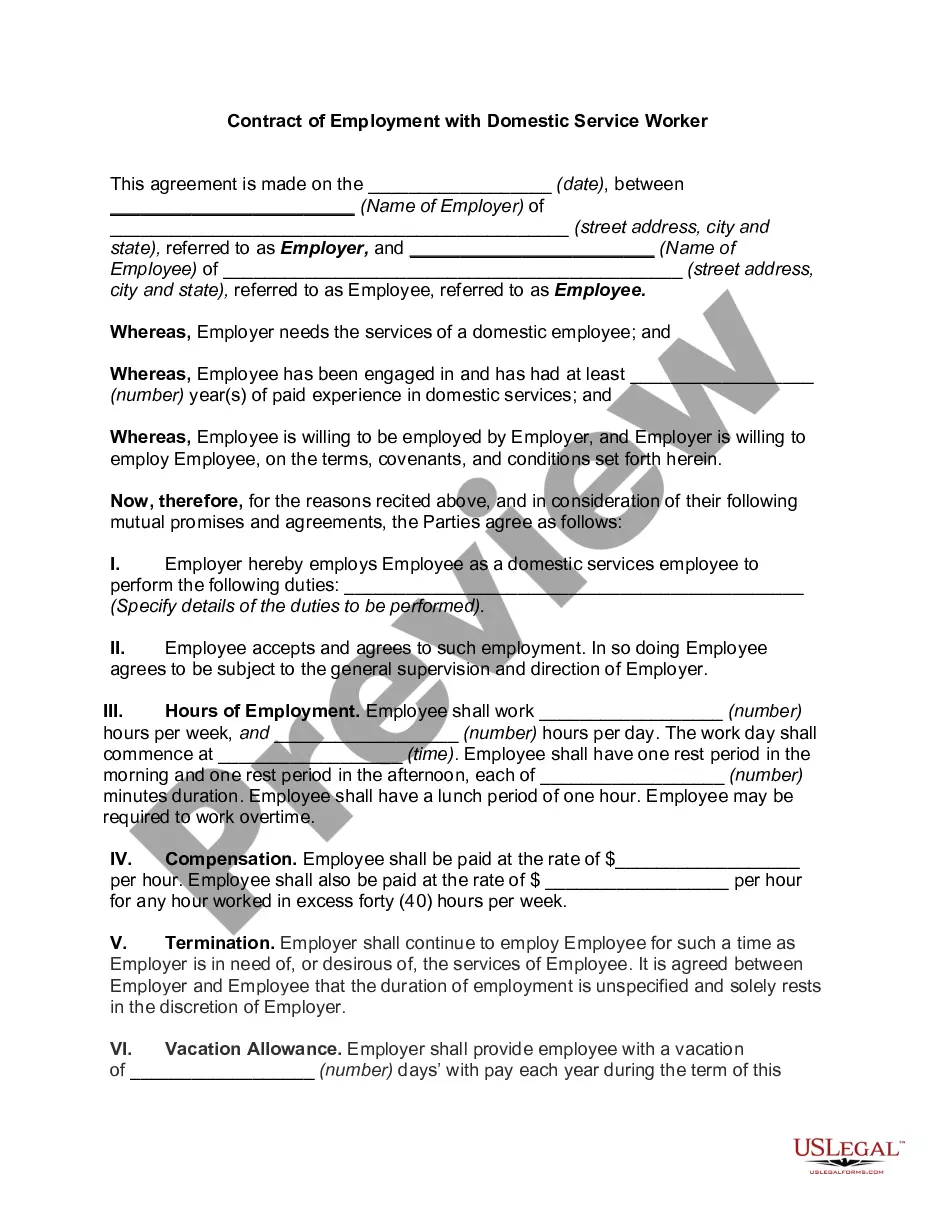

- Ensure you have selected the proper type for your city/region. Click the Review switch to review the form`s articles. Read the type information to actually have selected the correct type.

- In case the type does not match your requirements, make use of the Search industry towards the top of the monitor to get the the one that does.

- When you are happy with the shape, verify your choice by clicking on the Acquire now switch. Then, choose the costs prepare you want and provide your accreditations to sign up for the accounts.

- Method the purchase. Make use of Visa or Mastercard or PayPal accounts to perform the purchase.

- Select the format and download the shape on the product.

- Make alterations. Fill up, edit and print out and indicator the saved Nebraska Bookkeeping Agreement - Self-Employed Independent Contractor.

Every single web template you added to your bank account lacks an expiry date which is your own property permanently. So, in order to download or print out another copy, just proceed to the My Forms section and click on in the type you need.

Gain access to the Nebraska Bookkeeping Agreement - Self-Employed Independent Contractor with US Legal Forms, probably the most comprehensive catalogue of legal papers templates. Use a large number of specialist and condition-specific templates that satisfy your company or personal needs and requirements.

Form popularity

FAQ

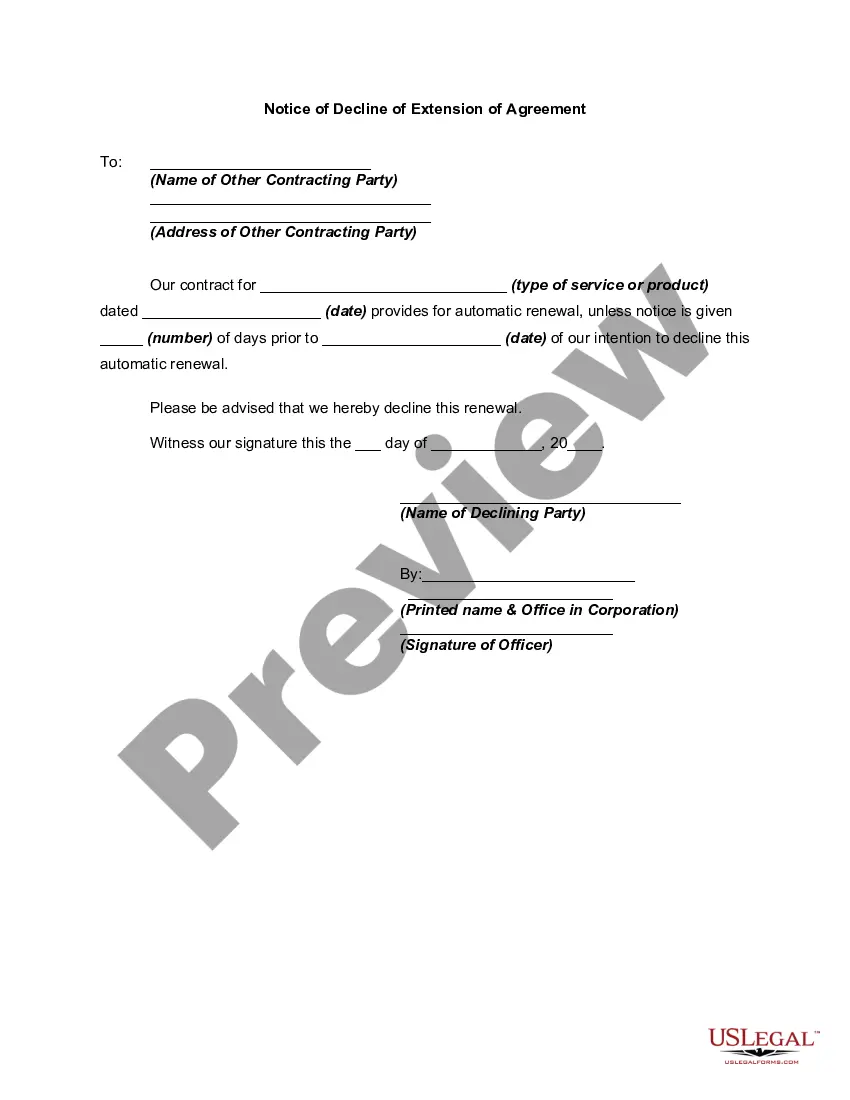

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Payroll software automates a large majority of your payroll program, and can calculate wages and taxes, and some even will turn in taxes for you. Doing payroll by hand is the most time-consuming and requires someone learning how to do payroll, and that person is called a bookkeeper.

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

How to Become an Independent BookkeeperGet Your Degree. No one's going to trust you with their money if you haven't studied accounting and bookkeeping.Gain Practical Experience.Add Some Credentials.Handle Your Legal Issues.Start Marketing Yourself.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.