Nebraska Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Nebraska Drafting Agreement - Self-Employed Independent Contractor?

If you have to comprehensive, down load, or print out legal papers web templates, use US Legal Forms, the most important collection of legal forms, which can be found on-line. Take advantage of the site`s basic and convenient lookup to obtain the files you require. Different web templates for company and specific functions are categorized by classes and claims, or key phrases. Use US Legal Forms to obtain the Nebraska Drafting Agreement - Self-Employed Independent Contractor in a handful of mouse clicks.

In case you are presently a US Legal Forms buyer, log in to your accounts and then click the Obtain switch to get the Nebraska Drafting Agreement - Self-Employed Independent Contractor. You may also access forms you formerly acquired in the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for the appropriate town/nation.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Do not forget about to read the explanation.

- Step 3. In case you are unsatisfied using the form, utilize the Lookup field towards the top of the display screen to find other types of your legal form template.

- Step 4. Once you have located the shape you require, go through the Acquire now switch. Pick the pricing strategy you like and put your qualifications to sign up on an accounts.

- Step 5. Procedure the financial transaction. You can use your bank card or PayPal accounts to complete the financial transaction.

- Step 6. Pick the file format of your legal form and down load it on your own system.

- Step 7. Total, edit and print out or indication the Nebraska Drafting Agreement - Self-Employed Independent Contractor.

Each legal papers template you get is the one you have eternally. You may have acces to each form you acquired in your acccount. Click the My Forms area and choose a form to print out or down load again.

Contend and down load, and print out the Nebraska Drafting Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of expert and express-particular forms you can utilize for your personal company or specific requires.

Form popularity

FAQ

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

5 Things 1099 Employees Need to Know About TaxesYou're Responsible for Paying Quarterly Income Taxes.You're Responsible for Self-Employment Tax.Estimate How Much You'll Need to Pay.Develop a Bulletproof Savings Plan.Consider Software & Tax Pros.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

Here are eight questions you should be ready to answer about contract work:How long is the contract?What are the company and position like?What are the typical hours?Is this a temp-to-hire position?How much is the contract pay rate?Are there benefits available?How will this position help me professionally?More items...?

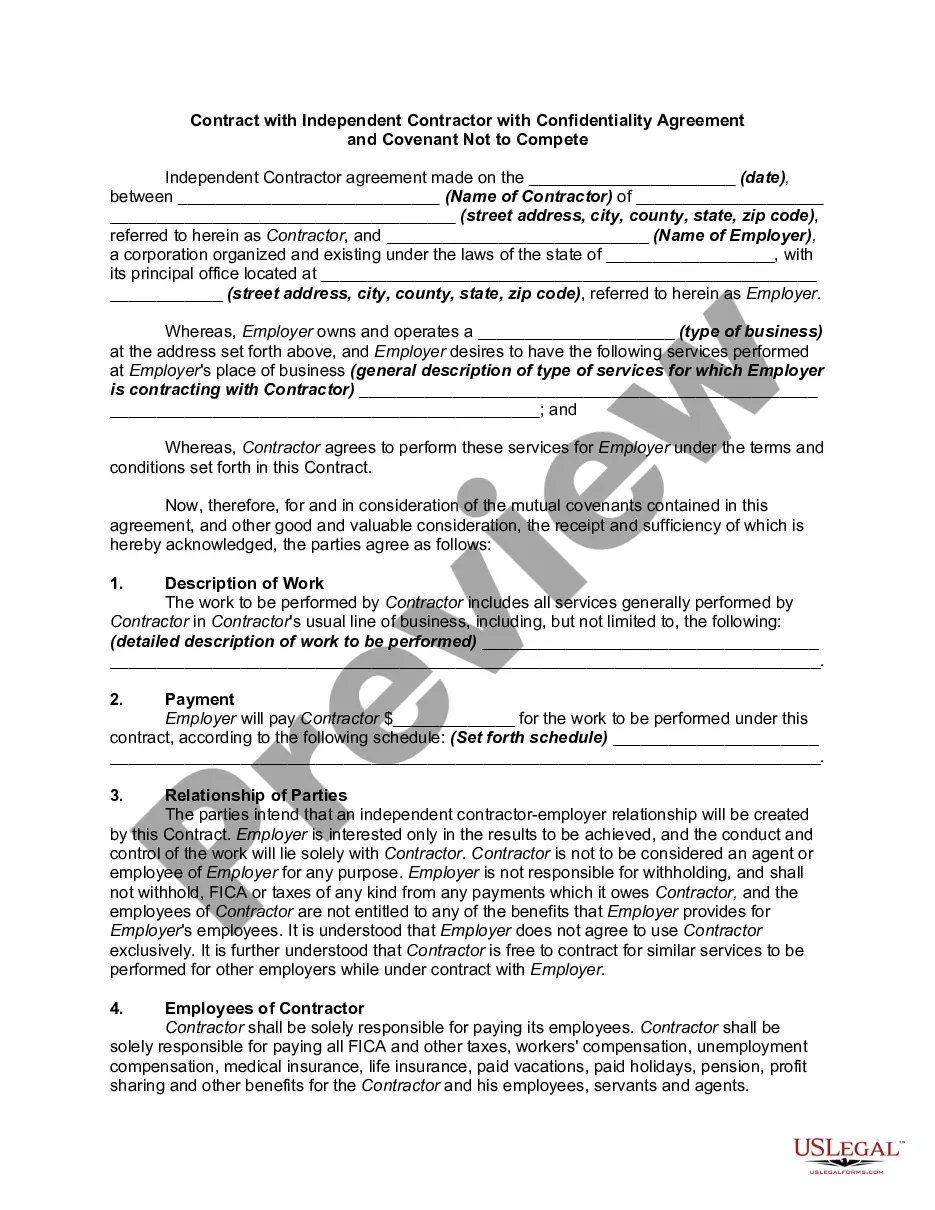

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.