Nebraska Agreement for Sales of Data Processing Equipment

Description

How to fill out Nebraska Agreement For Sales Of Data Processing Equipment?

Are you presently in the situation in which you require files for both company or personal purposes just about every day time? There are a variety of legal file templates accessible on the Internet, but locating ones you can rely on isn`t easy. US Legal Forms delivers a large number of develop templates, like the Nebraska Agreement for Sales of Data Processing Equipment, that are composed in order to meet federal and state requirements.

In case you are presently knowledgeable about US Legal Forms internet site and get an account, just log in. Next, you may acquire the Nebraska Agreement for Sales of Data Processing Equipment web template.

Should you not offer an account and wish to start using US Legal Forms, abide by these steps:

- Get the develop you will need and make sure it is for the right city/area.

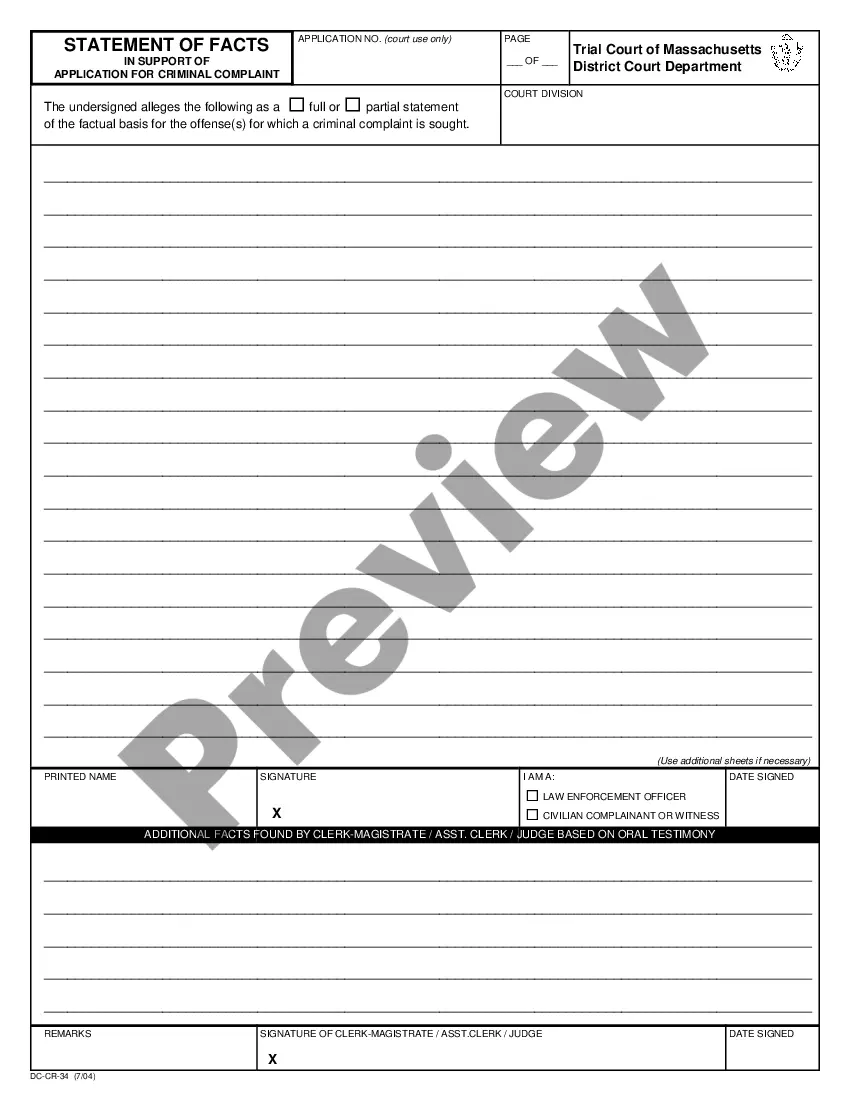

- Take advantage of the Preview key to analyze the form.

- See the information to ensure that you have chosen the right develop.

- When the develop isn`t what you are seeking, utilize the Lookup field to find the develop that meets your needs and requirements.

- When you get the right develop, click Acquire now.

- Opt for the rates plan you would like, complete the necessary details to create your account, and pay money for an order with your PayPal or charge card.

- Pick a handy paper format and acquire your backup.

Get all the file templates you might have purchased in the My Forms food list. You can aquire a extra backup of Nebraska Agreement for Sales of Data Processing Equipment whenever, if needed. Just select the necessary develop to acquire or print the file web template.

Use US Legal Forms, the most comprehensive selection of legal forms, in order to save time as well as prevent errors. The service delivers skillfully produced legal file templates which you can use for an array of purposes. Make an account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

Nebraska sales tax details The Nebraska (NE) state sales tax rate is currently 5.5%. Depending on local municipalities, the total tax rate can be as high as 7.5%, but food and prescription drugs are exempt.

Traditional Goods or ServicesMedicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax. For a detailed list of taxable services view Sales Tax Frequently Asked Questions through the Nebraska Department of Revenue.

Accordingly, most states offer product-specific exemptions for items such as food, clothing, prescription medicines, and medical (prosthetic) devices. Those states that don't provide a complete exemption for these items often impose a lower tax rate on them.

Some items are exempt from sales and use tax, including:Sales of certain food products for human consumption (many groceries)Sales to the U.S. Government.Sales of prescription medicine and certain medical devices.Sales of items paid for with food stamps.

Traditional Goods or Services Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.

Service fees for the installation of software are subject to sales tax. Moreover, charges for software maintenance services including delivery of updates for prewritten software are generally taxable. However, maintenance contracts that only provide support services for canned software are not taxable.

An individual or business that has been issued a common or contract carrier certificate of exemption may only use it to purchase those items described above prior to the expiration date on the certificate. The certificate of exemption expires every 5 years. (See Nebraska Common or Contract Carrier Information Guide).

Computer Software Maintenance AgreementsCharges for maintenance agreements to maintain computer software that include free or reduced-price upgrades, enhancements, changes, modifications, or updates are taxable.

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states. Every state is different when it comes to sales tax!)

Personal property is all property other than real property and franchises. Recovery Period. The recovery period is the federal Modified Accelerated Cost Recovery System (MACRS) recovery period over which the Nebraska adjusted basis of property will be depreciated for property tax purposes.