"Instructions for Completing Mortgage Deed of Trust Form" is a American Lawyer Media form. The following form is for instructions for completing mortgage deed of trust.

Nebraska Instructions for Completing Mortgage Deed of Trust Form

Description

How to fill out Instructions For Completing Mortgage Deed Of Trust Form?

If you need to total, acquire, or printing lawful document web templates, use US Legal Forms, the biggest collection of lawful kinds, which can be found on the web. Use the site`s basic and hassle-free lookup to obtain the paperwork you need. Various web templates for company and individual uses are categorized by groups and suggests, or search phrases. Use US Legal Forms to obtain the Nebraska Instructions for Completing Mortgage Deed of Trust Form with a handful of mouse clicks.

If you are currently a US Legal Forms customer, log in for your accounts and click on the Down load button to find the Nebraska Instructions for Completing Mortgage Deed of Trust Form. You can also gain access to kinds you earlier downloaded from the My Forms tab of your respective accounts.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for that correct metropolis/land.

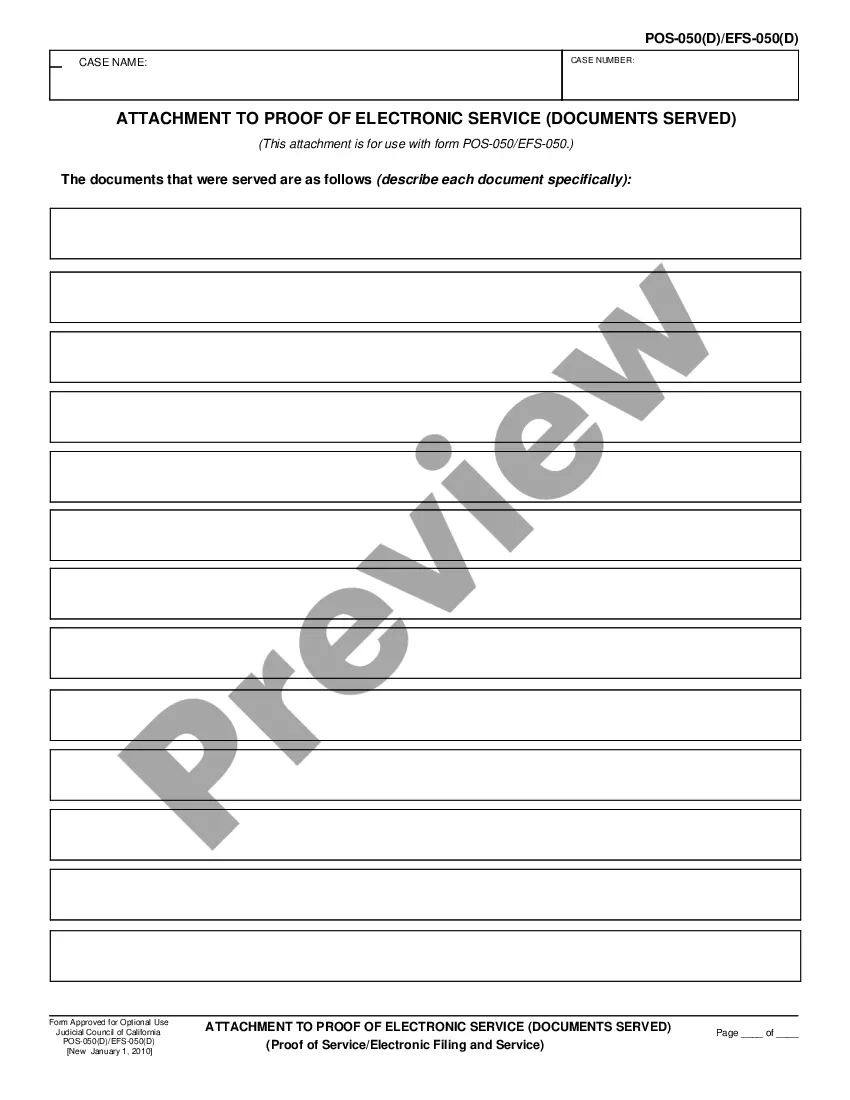

- Step 2. Use the Review solution to look over the form`s content material. Do not forget about to read through the explanation.

- Step 3. If you are unhappy with all the kind, take advantage of the Lookup industry towards the top of the display screen to locate other versions from the lawful kind template.

- Step 4. Once you have discovered the form you need, select the Buy now button. Pick the rates program you like and add your references to register on an accounts.

- Step 5. Process the deal. You may use your credit card or PayPal accounts to complete the deal.

- Step 6. Find the formatting from the lawful kind and acquire it on your own product.

- Step 7. Total, revise and printing or signal the Nebraska Instructions for Completing Mortgage Deed of Trust Form.

Every single lawful document template you acquire is the one you have eternally. You may have acces to every single kind you downloaded inside your acccount. Click on the My Forms area and select a kind to printing or acquire yet again.

Be competitive and acquire, and printing the Nebraska Instructions for Completing Mortgage Deed of Trust Form with US Legal Forms. There are many expert and condition-specific kinds you can use for your personal company or individual demands.

Form popularity

FAQ

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. Deed Of Trust: A Definition | Rocket Mortgage rocketmortgage.com ? learn ? deed-of-trust rocketmortgage.com ? learn ? deed-of-trust

Foreclosure process: Mortgages typically go through a judicial foreclosure process, through your county court system. Deeds of trust use a non-judicial foreclosure process. Length of time to foreclose: Mortgage foreclosures usually take significantly longer than non-judicial foreclosures with a deed of trust.

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement. Register of Deeds Forms | Lancaster County, NE ne.gov ? Deed-Forms ne.gov ? Deed-Forms

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

A Nebraska deed of trust (?trust deed?) is a legal form that transfers a property title from an owner (the borrower) to a neutral party (the trustee) as collateral for a real estate loan from a moneylender (the beneficiary). The title returns to the owner once they've paid back the loan in full to the beneficiary. Free Nebraska Deed of Trust Form | PDF | Word - eSign esign.com ? deeds ? deed-of-trust esign.com ? deeds ? deed-of-trust

Any assignment of a mortgage and any assignment of the beneficial interest under a deed of trust may be recorded, and from the time the same is filed for record operates as constructive notice of the contents thereof to all persons; and any instrument by which any mortgage or deed of trust of, lien upon or interest in ... Cal. Civ. Code § 2934 - Casetext casetext.com ? article-1-mortgages-in-general ? se... casetext.com ? article-1-mortgages-in-general ? se...