Nebraska Direction For Payment of Royalty to Trustee by Royalty Owners

Description

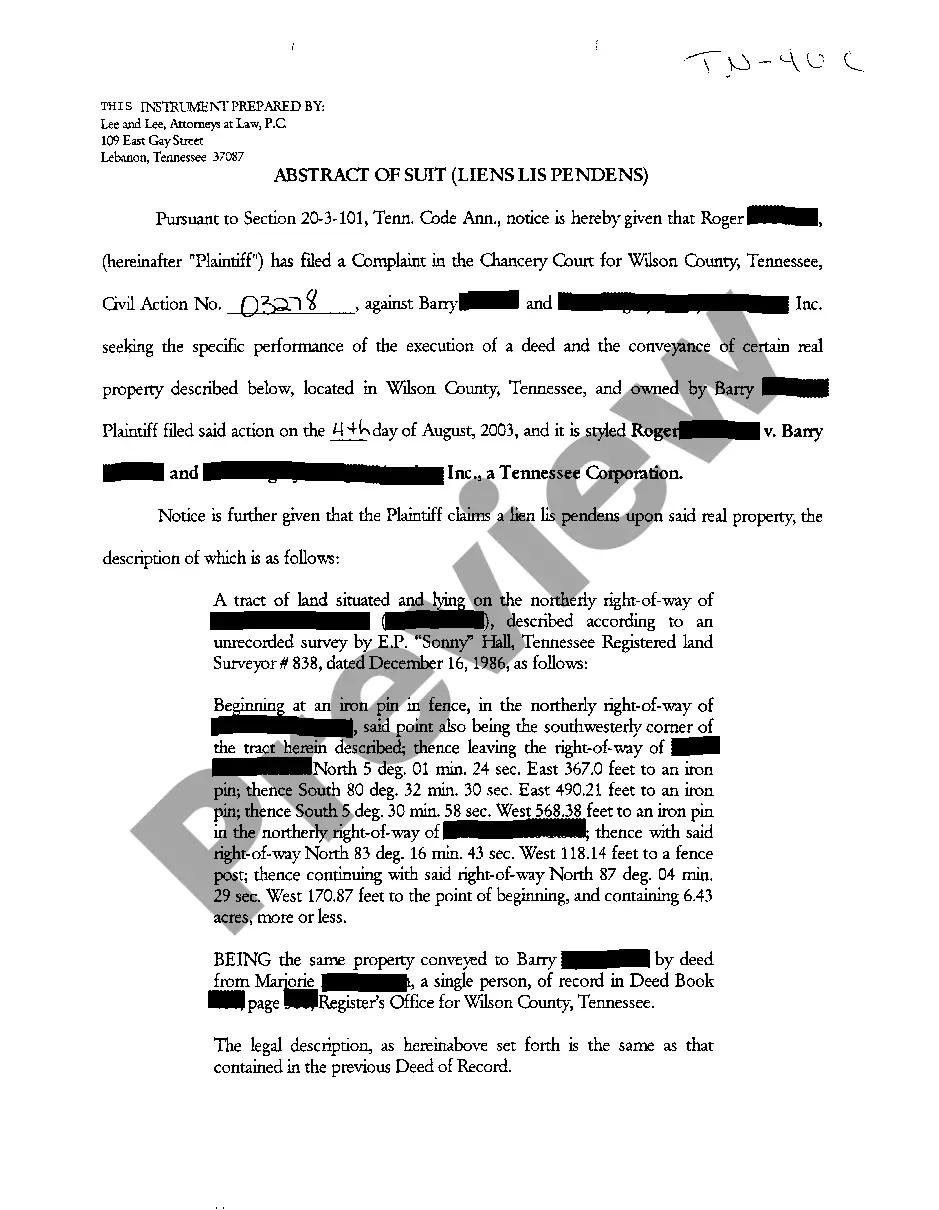

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

Are you in the placement where you require paperwork for possibly organization or individual purposes nearly every time? There are tons of authorized file layouts accessible on the Internet, but locating ones you can rely isn`t simple. US Legal Forms provides thousands of type layouts, just like the Nebraska Direction For Payment of Royalty to Trustee by Royalty Owners, which can be published to meet state and federal needs.

When you are currently knowledgeable about US Legal Forms internet site and possess a merchant account, merely log in. After that, you may obtain the Nebraska Direction For Payment of Royalty to Trustee by Royalty Owners web template.

Unless you have an profile and wish to begin using US Legal Forms, abide by these steps:

- Get the type you need and ensure it is for your right town/county.

- Make use of the Preview switch to check the form.

- Read the outline to ensure that you have selected the appropriate type.

- In case the type isn`t what you are trying to find, use the Lookup field to get the type that meets your requirements and needs.

- When you obtain the right type, click Buy now.

- Pick the costs strategy you would like, fill out the necessary information and facts to make your money, and pay for an order using your PayPal or Visa or Mastercard.

- Choose a practical data file structure and obtain your version.

Find every one of the file layouts you might have purchased in the My Forms food list. You can obtain a further version of Nebraska Direction For Payment of Royalty to Trustee by Royalty Owners whenever, if necessary. Just click the essential type to obtain or print out the file web template.

Use US Legal Forms, by far the most considerable assortment of authorized varieties, in order to save time as well as avoid errors. The assistance provides expertly made authorized file layouts that you can use for a variety of purposes. Create a merchant account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss. However, if you hold an operating oil, gas, or mineral interest or are in business as a self-employed writer, inventor, artist, etc., report your income and expenses on Schedule C.

Royalties are both taxable as income and deductible as a business expense. These payments must be reported to the IRS and are usually recorded on Schedule E: Supplemental Income and Loss. However, this depends on whether you own a business, the type of property in question, and who retains ownership of the property.

What are the sales and use tax rates in Nebraska? The Nebraska state sales and use tax rate is 5.5%.

Payments for rents, royalties or similar amounts are subject to withholding tax under the Act.

As provided in Nebraska Sales and Use Tax Regulation 1-101, taxable security services include services to protect property from theft, vandalism, or destruction or to protect individuals from harm.

In most cases, you report royalties on Schedule E (Form 1040).

You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss. However, if you hold an operating oil, gas, or mineral interest or are in business as a self-employed writer, inventor, artist, etc., report your income and expenses on Schedule C.

You report these on Schedule C of IRS form 1040. If you earn more than $400 through self-employment, including royalties, you must report that income on your tax return. Royalties from one-time earnings (a gig that isn't your primary job), or mineral interests, are reported on Schedule E of IRS Form 1040.