A Nebraska gift deed is a legal document used to transfer ownership of real property without any exchange of money or valuable consideration. It is commonly used when someone wants to gift their property to another individual or entity, such as a family member, friend, or charitable organization. Unlike a traditional sale deed, a gift deed does not involve a purchase price, as the transferor essentially gives the property as a gift. This can be an effective way to pass down real estate to heirs, transfer property between family members, or contribute to charitable causes without any monetary transaction involved. Keywords: Nebraska gift deed, transfer ownership, real property, valuable consideration, gift, purchase price, transferor, heirs, family members, charitable organization, real estate, monetary transaction. Different types of Nebraska gift deeds: 1. General Gift Deed: This is the most commonly used type of Nebraska gift deed. It transfers the property title from the granter (the person gifting the property) to the grantee (the person receiving the gift) without any specific conditions or restrictions. 2. Gift Deed with Reservation: This type of gift deed allows the granter to reserve certain rights or interests in the property, even after gifting it. For example, the granter may retain the right to live in the property for a specified period or receive income generated from the property. 3. Conditional Gift Deed: In a conditional gift deed, the transfer of ownership is subject to certain conditions or requirements specified by the granter. These conditions must be met by the grantee for the transfer to become valid. For instance, the granter may require the grantee to complete certain tasks or obligations before assuming ownership. 4. Gift Deed to a Trust: This type of gift deed involves gifting the property to a trust, rather than an individual or organization. The trust then manages the property on behalf of the beneficiaries, providing specific instructions on how the property should be used or distributed. Keywords: general gift deed, gift deed with reservation, conditional gift deed, gift deed to a trust, granter, grantee, transfer of ownership, rights, interests, conditions, requirements, tasks, obligations, trust, beneficiaries.

Nebraska Gift Deed

Description

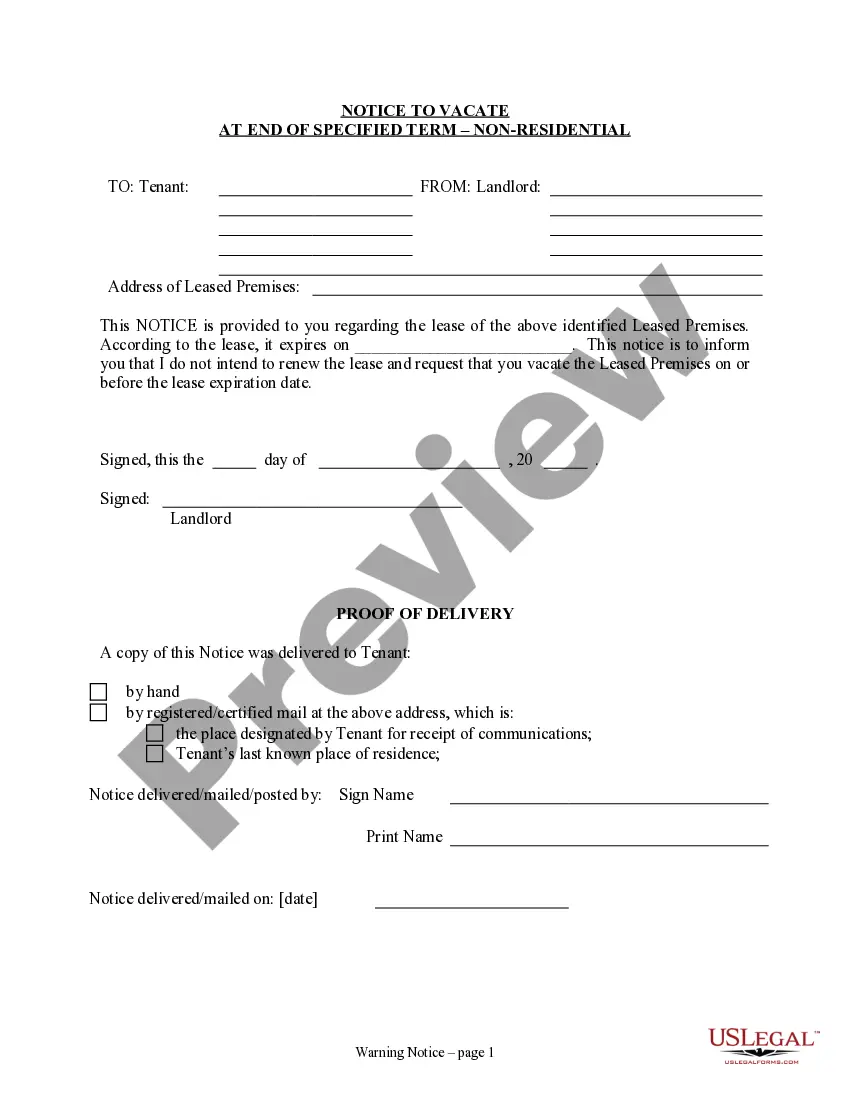

How to fill out Nebraska Gift Deed?

US Legal Forms - one of many most significant libraries of authorized types in America - provides a variety of authorized document themes you can obtain or produce. Making use of the website, you can get thousands of types for company and person reasons, sorted by categories, states, or key phrases.You can get the newest versions of types such as the Nebraska Gift Deed within minutes.

If you already have a subscription, log in and obtain Nebraska Gift Deed from your US Legal Forms collection. The Acquire switch will appear on each and every type you see. You have accessibility to all earlier downloaded types in the My Forms tab of your accounts.

If you want to use US Legal Forms initially, listed here are basic instructions to help you get began:

- Ensure you have selected the correct type for the metropolis/state. Select the Review switch to analyze the form`s content material. Browse the type information to actually have selected the proper type.

- When the type doesn`t match your specifications, use the Search area near the top of the screen to discover the one who does.

- When you are satisfied with the form, affirm your choice by visiting the Purchase now switch. Then, select the costs plan you favor and give your qualifications to register for an accounts.

- Method the purchase. Make use of charge card or PayPal accounts to accomplish the purchase.

- Find the formatting and obtain the form on your own device.

- Make adjustments. Fill out, modify and produce and indication the downloaded Nebraska Gift Deed.

Every single design you included in your bank account lacks an expiry day and is the one you have for a long time. So, if you would like obtain or produce yet another backup, just visit the My Forms portion and click in the type you will need.

Obtain access to the Nebraska Gift Deed with US Legal Forms, one of the most considerable collection of authorized document themes. Use thousands of expert and status-specific themes that fulfill your company or person demands and specifications.

Form popularity

FAQ

How to Write a Nebraska Quitclaim Deed Preparers name and address. Name and mailing address of the party to whom the recorded deed should be sent. County where the real property is located. The consideration paid to the grantor (dollar amount should be written in words and numbers) Grantors name and address.

Hear this out loud PauseA Nebraska transfer-on-death deed?or TOD deed?transfers real estate from the current owner to one or more named beneficiaries effective at the owner's death. A Nebraska property owner signs and records a TOD deed during life, but the deed does not affect rights in the property until the owner dies.

Hear this out loud PauseYou must file the affidavit with the register of deeds office of the county in which the real property of the deceased is located and also file, in any other county in Nebraska in which the real property of the deceased that is subject to the affidavit is located, the recorded affidavit and a certified or authenticated ...

Hear this out loud PauseThe three most common Nebraska deed forms for transferring real estate ownership from its current owner (the grantor) to a new owner (the grantee) are warranty deeds, special warranty deeds, and quitclaim deeds.

In Nebraska, the TOD deed will transfer the described property to the named beneficiary, subject to any liens or mortgages (or other encumbrances) on the property at your death without going through probate.

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement.

Hear this out loud PauseA defining feature of a Nebraska quitclaim deed is that it transfers real estate with no warranty of title. It transfers whatever interest the current owner holds in the real estate on the date of the deed. At the same time, the current owner does not promise that these rights are valid or free of defects.