Nebraska Subordination of Lien: Understanding the Process and Different Types In the state of Nebraska, a subordination of lien is a legal process that allows for the rearrangement of the priority of existing liens on a property. This may be necessary when an individual or entity wishes to obtain a new loan or mortgage, but existing liens take precedence over the new financial obligation. By obtaining subordination, the priority of the liens can be adjusted, enabling the individual or entity to secure the new loan. The subordination of lien process in Nebraska involves various key steps. It requires a written agreement between the lien holder, borrower, and the new lender with specific terms and conditions. This agreement outlines the adjustments in priority and the rights of each party involved. The documentation must be properly recorded with the appropriate Nebraska county office to be legally binding and enforceable. There are different types of Nebraska Subordination of Lien, each serving specific purposes and accommodating different scenarios: 1. Mortgage Subordination: Mortgage subordination occurs when there is an existing mortgage on a property, and the property owner wishes to obtain an additional loan or mortgage for various purposes, such as home renovations or debt consolidation. By obtaining mortgage subordination, the new lender's lien can be prioritized over the existing mortgage, allowing the borrower to access the necessary funds. 2. Mechanic's Lien Subordination: In the construction industry, a subcontractor or supplier may file a mechanic's lien against a property when they are not paid for their services or materials. If the property owner intends to refinance or obtain additional financing, they may require a mechanic's lien subordination. This subordination allows the lender's lien to take priority over the unpaid mechanic's lien, which reassures the new lender that their lien will be protected. 3. Judgment Lien Subordination: A judgment lien can be filed against a property when a court awards a judgment to a creditor in a lawsuit. Similar to the other types of subordination, judgment lien subordination is requested when the property owner needs to obtain new financing while existing judgment liens are in place. This subordination helps the new lender by ensuring their lien priority. 4. IRS Lien Subordination: In cases where the Internal Revenue Service (IRS) has placed a tax lien on a property due to unpaid taxes, an individual or entity may seek an IRS lien subordination. This type of subordination allows a new lender's lien to take priority over the IRS lien, which may facilitate obtaining new financing for the property owner. It is important to note that the specific terms and requirements for subordinating a lien in Nebraska may vary depending on the circumstances and the county involved. Seeking legal advice and guidance from a qualified attorney or real estate professional is recommended when navigating the subordination process. In conclusion, Nebraska Subordination of Lien is a legal process that adjusts the priority of liens on a property to allow for new financing. Mortgage subordination, mechanic's lien subordination, judgment lien subordination, and IRS lien subordination are several types of lien subordination that serve specific purposes. Understanding the nuances of each type is crucial for property owners, lenders, and other parties involved in the subordination process.

Nebraska Subordination of Lien

Description

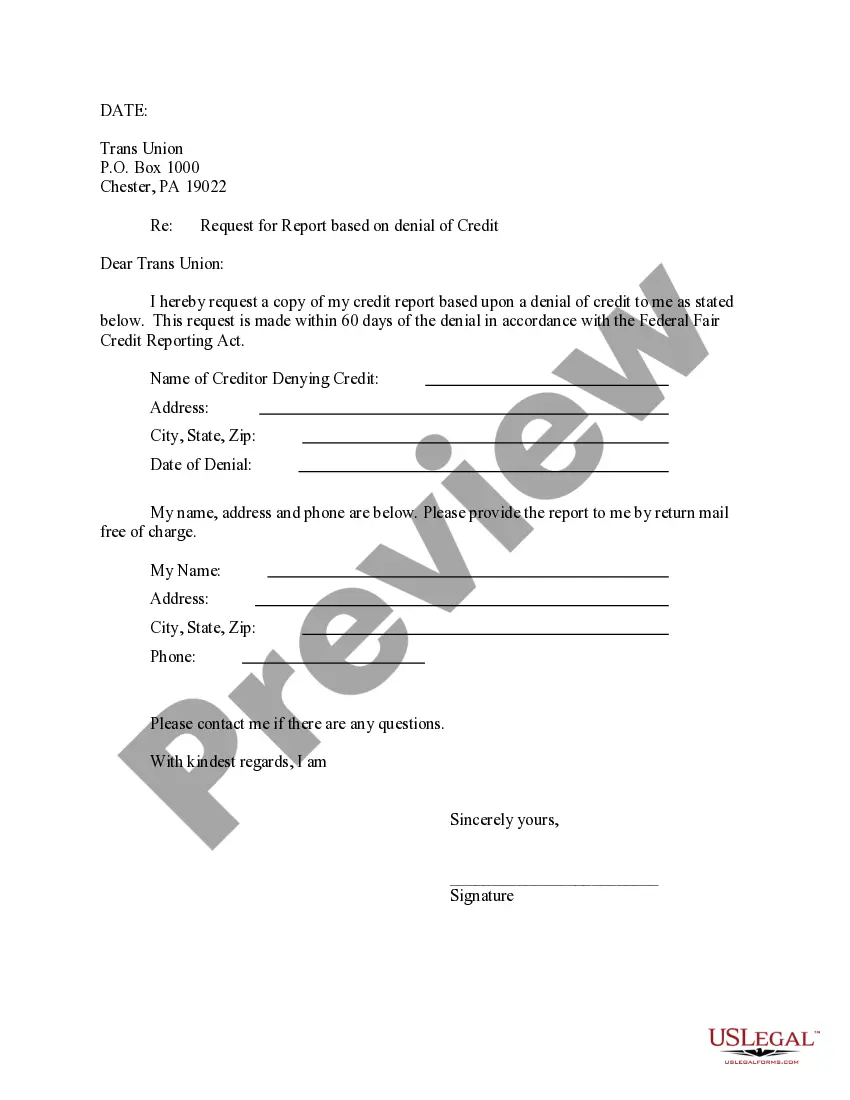

How to fill out Nebraska Subordination Of Lien?

Have you been in the situation the place you require paperwork for possibly business or personal functions nearly every working day? There are plenty of authorized document templates accessible on the Internet, but finding versions you can trust isn`t easy. US Legal Forms offers a huge number of type templates, just like the Nebraska Subordination of Lien, which are composed in order to meet federal and state specifications.

When you are already familiar with US Legal Forms website and have a merchant account, simply log in. Next, you can download the Nebraska Subordination of Lien format.

Unless you come with an account and would like to begin using US Legal Forms, adopt these measures:

- Get the type you want and ensure it is for that appropriate area/state.

- Use the Preview switch to analyze the form.

- See the explanation to actually have chosen the right type.

- In case the type isn`t what you are looking for, take advantage of the Search discipline to get the type that fits your needs and specifications.

- Whenever you discover the appropriate type, simply click Purchase now.

- Pick the prices strategy you would like, complete the required info to create your money, and purchase the order using your PayPal or charge card.

- Select a practical data file file format and download your backup.

Find each of the document templates you might have purchased in the My Forms menu. You can aquire a further backup of Nebraska Subordination of Lien anytime, if necessary. Just click the necessary type to download or produce the document format.

Use US Legal Forms, by far the most extensive variety of authorized forms, to save lots of some time and steer clear of faults. The services offers skillfully created authorized document templates that you can use for a selection of functions. Generate a merchant account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

The kind of liens that can directly affect your personal property include mortgage, judgment, attachment, estate tax, Federal tax, bail bond, municipal utility and vendor's liens but can also include corporate franchise tax (if you own a business), mechanic's or vendee's (if you work in the building industry).

Existing Paper Certificate of Title: A copy of the lien instrument and the $7.00 lien notation fee must be submitted to any county Motor Vehicle Office. They will notify the first lienholder to deliver the title to the Motor Vehicle Office within fifteen (15) days for notation of the subsequent lien.

The mortgage lender, therefore, has the right to place a lien on your property, giving them legal rights over the property. An involuntary lien (or non-consensual lien) is levied against your wishes and is the result of not fulfilling your financial obligations.

Civil Contempt of Court A person may be incarcerated for civil contempt for willfully failing and refusing to comply with a court order, such as a purge plan, for child support.

If a contract on a property is not paid, the lender has a legal right to seize and sell the property. Various types of liens can be established including by a creditor, legal judgment, or tax authority.

A general lien covers all of the debtor's property, while a specific lien covers only a certain piece of real property. General liens affect all the property, both real and personal, of a debtor.

A judgment lien is created automatically on debtor property located in the Nebraska county where the judgment is entered. For any debtor property located outside the Nebraska county where the judgment is entered, the creditor files the judgment with the district court county clerk .

Property liens are typically associated with a specific piece of real estate. The lien is put in place by the creditor or the lender that extended financing. The lien is the creditor's legal claim that provides them with legal protections and rights in the event a property owner does not pay their obligations on time.