Nebraska Division Orders: A Comprehensive Overview Nebraska Division Orders are legal documents that facilitate the distribution of royalty payments to oil and gas interest owners in Nebraska. These orders specify the proportional allocation of production revenue from oil and gas wells among multiple owners or parties involved, ensuring fair and accurate compensation. Typically, division orders are drafted and issued by oil and gas companies or operators operating in Nebraska. Nebraska Division Orders serve several crucial purposes in the oil and gas industry. They establish the percentages or fractional interests of royalty owners, provide vital details about the producing well, and ensure that payments are made accurately and according to the terms agreed upon. These orders legally bind both parties, the royalty interest owner and the oil and gas company, to fulfill their obligations within the defined terms and conditions. There are two primary types of Nebraska Division Orders: 1. Standard Nebraska Division Orders: These are the most common types of division orders used in Nebraska. They provide a detailed breakdown of the royalty interest owner's share of production revenue, usually expressed as a decimal, and include information such as the interest owner's name, address, legal description of the property, well names, and the operator's contact details. Standard division orders also define payment terms, including the frequency of payments, deductions, and applicable taxes. 2. Modified Nebraska Division Orders: In certain circumstances, modified division orders may be used to accommodate specific contractual arrangements or unique arrangements between the operator and a particular royalty owner. These orders deviate from the standard division order format to reflect customized provisions or adjustments tailored to individual agreements. Modified division orders ensure that the specific requirements or preferences of the parties involved are met, while still maintaining legal compliance. When a well is drilled, and its production reaches a stage where revenue distribution becomes necessary, the operator prepares and sends the division orders to the eligible royalty interest owners. The owners are then required to review and sign the orders, acknowledging their acceptance of the terms and the accuracy of the assigned decimal interest. Once all division orders are received and processed, the operator can calculate and initiate royalty payments based on the agreed-upon terms. It's important to note that division orders can vary from state to state, and even within different counties within Nebraska. Therefore, it is crucial for both operators and royalty interest owners to consult legal professionals experienced in Nebraska oil and gas law to ensure compliance with all applicable regulations and to draft division orders that reflect the specific conditions of the property and the parties involved. In conclusion, Nebraska Division Orders play a pivotal role in ensuring accurate and fair distribution of oil and gas royalties. By establishing the ownership share and outlining payment terms, these legal documents provide clear guidelines for both the operator and the royalty interest owner, facilitating smooth and transparent transactions within the oil and gas industry in Nebraska.

Nebraska Division Orders

Description

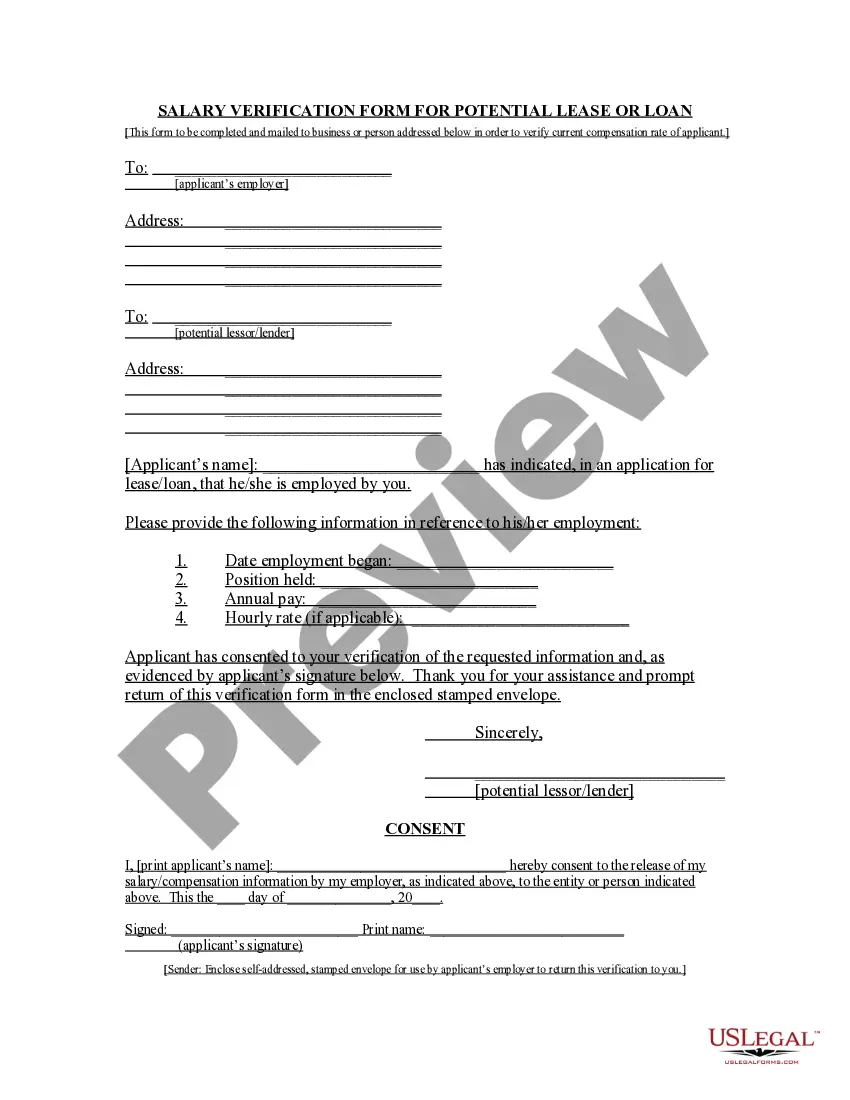

How to fill out Nebraska Division Orders?

If you want to full, download, or print authorized record templates, use US Legal Forms, the most important assortment of authorized forms, which can be found on the Internet. Use the site`s simple and easy handy look for to obtain the files you want. A variety of templates for business and person reasons are sorted by types and suggests, or key phrases. Use US Legal Forms to obtain the Nebraska Division Orders in a few click throughs.

If you are currently a US Legal Forms consumer, log in in your accounts and click the Obtain key to have the Nebraska Division Orders. You can even entry forms you in the past downloaded within the My Forms tab of your respective accounts.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for that right metropolis/country.

- Step 2. Take advantage of the Preview method to look through the form`s content material. Never forget to see the description.

- Step 3. If you are unsatisfied with the type, take advantage of the Lookup discipline on top of the display screen to locate other variations from the authorized type web template.

- Step 4. Once you have identified the form you want, click on the Acquire now key. Opt for the pricing prepare you prefer and add your references to register for the accounts.

- Step 5. Procedure the deal. You can utilize your Мisa or Ьastercard or PayPal accounts to accomplish the deal.

- Step 6. Select the structure from the authorized type and download it on the product.

- Step 7. Complete, edit and print or indication the Nebraska Division Orders.

Each and every authorized record web template you purchase is yours permanently. You possess acces to each and every type you downloaded in your acccount. Click the My Forms area and pick a type to print or download again.

Remain competitive and download, and print the Nebraska Division Orders with US Legal Forms. There are millions of specialist and express-particular forms you may use for your business or person requirements.

Form popularity

FAQ

Violation of a Protection Order: Any person convicted of violating the terms of a protection order after being served shall be guilty of a Class I misdemeanor. Any person convicted of violating a protection order who has a prior conviction for violating a protection order shall be guilty of a Class IV felony. Neb. Rev.

An ?ex parte? protection order lasts until you go to court, if you ask for a hearing to contest the order. At court, the judge decides if the protection order will be canceled or continued for one year. If you do not ask for a hearing, then the protection order remains in effect for a year.

A restraining order typically applies to individuals engaged in legal disputes, while a civil protection order is specifically intended for cases involving domestic violence or harassment.

Generally, when we talk about a no-contact order, we mean an order issued after a person is charged with a crime and ordered to stay away from the victim (and the victim's family, friends, home, and/or place of work).

Home > Areas Served > Criminal Defense > Domestic Violence > No-Contact Orders in Omaha. In certain cases, judges might choose to issue a no-contact condition in a defendant's bond. This is a provision of bail that states the defendant cannot have any contact with the plaintiff at all throughout the case.

Violation of a Protection Order: Any person convicted of violating the terms of a protection order after being served shall be guilty of a Class I misdemeanor. Any person convicted of violating a protection order who has a prior conviction for violating a protection order shall be guilty of a Class IV felony. Neb. Rev.