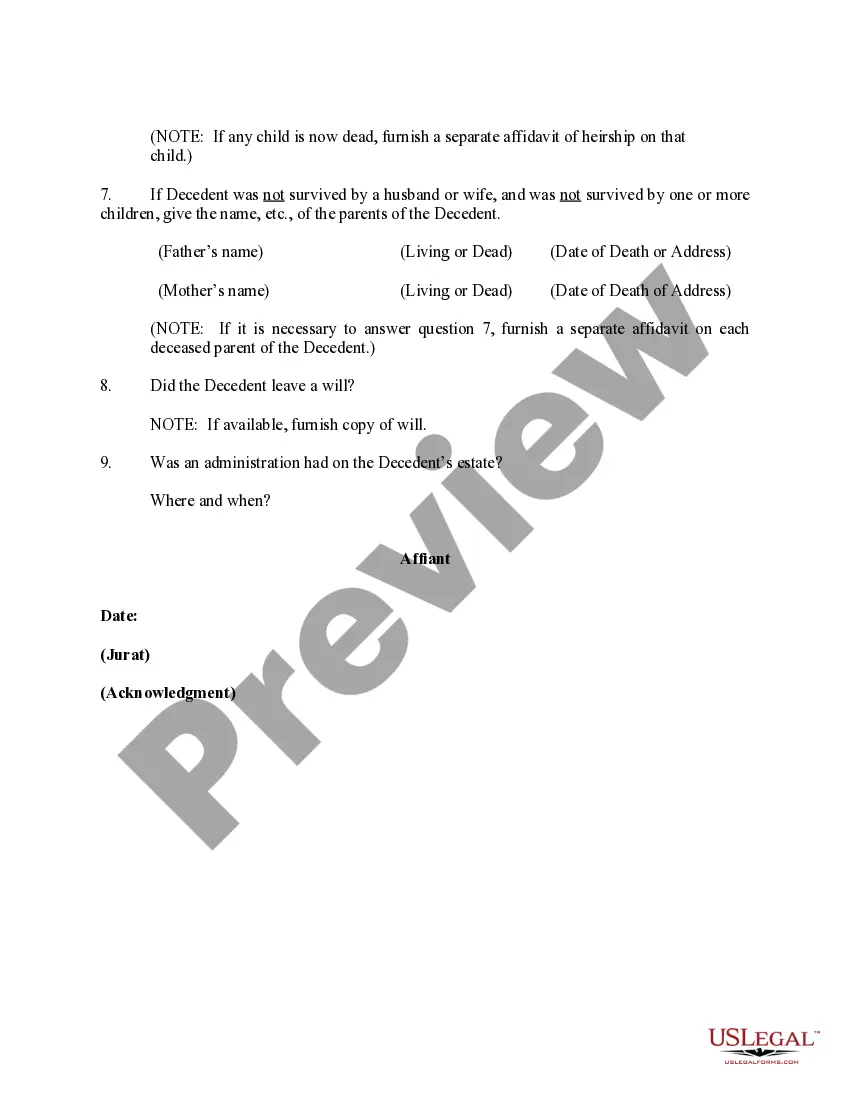

Nebraska Affidavit of Heirship for Small Estates

Description

How to fill out Affidavit Of Heirship For Small Estates?

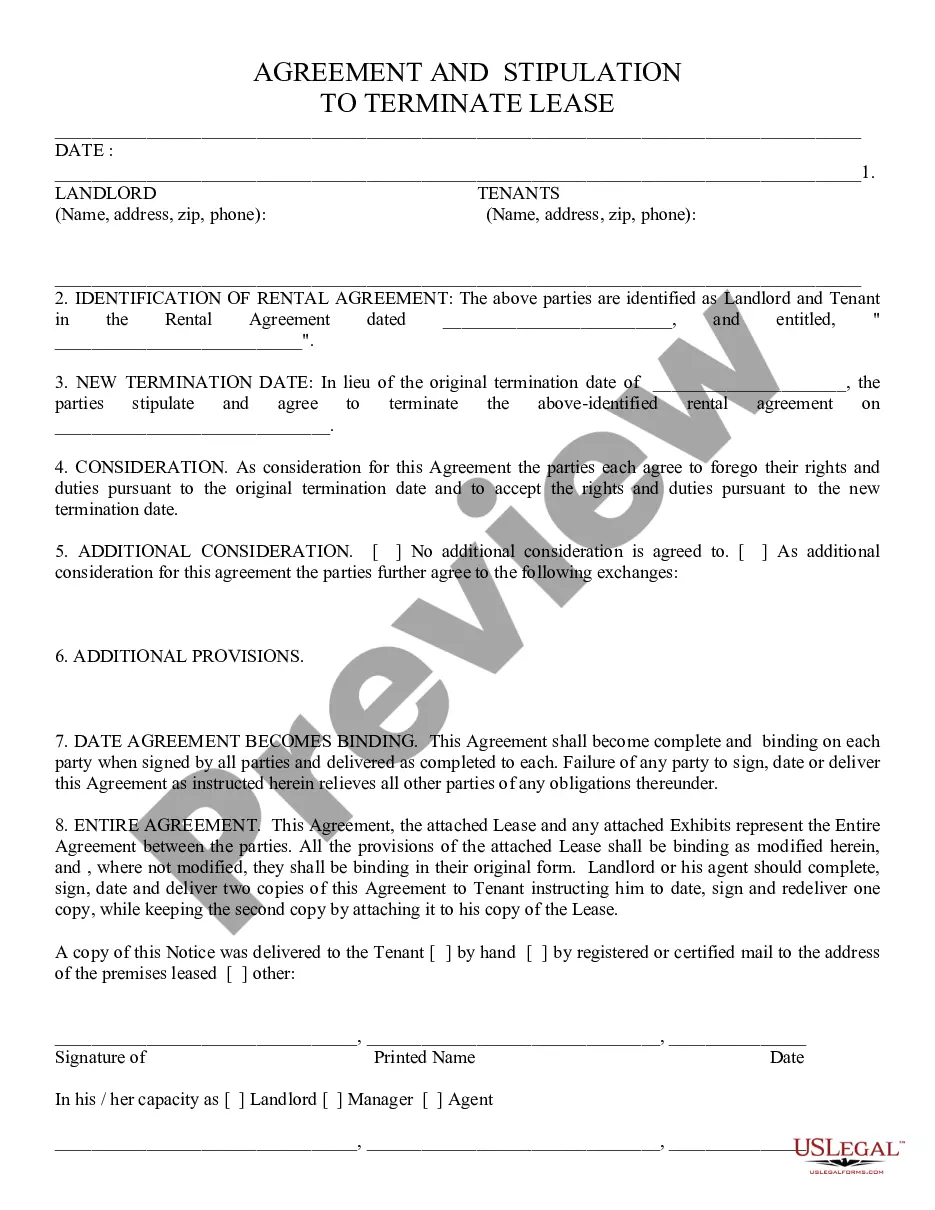

Are you within a placement where you need paperwork for possibly organization or specific functions virtually every time? There are a lot of lawful file templates available on the net, but locating kinds you can rely isn`t simple. US Legal Forms gives 1000s of kind templates, like the Nebraska Affidavit of Heirship for Small Estates, which can be written to meet federal and state specifications.

In case you are currently acquainted with US Legal Forms website and possess your account, simply log in. Following that, you may down load the Nebraska Affidavit of Heirship for Small Estates web template.

If you do not provide an bank account and wish to begin using US Legal Forms, abide by these steps:

- Find the kind you need and ensure it is for the appropriate town/area.

- Make use of the Preview button to examine the form.

- Read the information to ensure that you have selected the appropriate kind.

- If the kind isn`t what you are seeking, utilize the Look for area to get the kind that suits you and specifications.

- When you find the appropriate kind, simply click Get now.

- Choose the rates strategy you want, submit the required details to make your bank account, and buy the order making use of your PayPal or bank card.

- Decide on a convenient data file formatting and down load your version.

Locate all the file templates you have purchased in the My Forms menus. You may get a additional version of Nebraska Affidavit of Heirship for Small Estates anytime, if required. Just select the needed kind to down load or printing the file web template.

Use US Legal Forms, by far the most substantial assortment of lawful kinds, to save lots of efforts and prevent mistakes. The assistance gives appropriately manufactured lawful file templates that you can use for an array of functions. Create your account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

The fair market value of the entire estate of the deceased, less liens and encumbrances (everything the deceased owned minus everything the deceased owes) is $100,000.00 or less.

How to fill out a small estate affidavit in Illinois Fill in your name and information in #1. Complete the information about the decedent in #2-4. Mark either #7a or #7b depending on what is true. ... Complete #9a to indicate the names of the spouse and children if any.

You must file the affidavit with the register of deeds office of the county in which the real property of the deceased is located and also file, in any other county in Nebraska in which the real property of the deceased that is subject to the affidavit is located, the recorded affidavit and a certified or authenticated ...

Though the affiant is not legally required to have a lawyer, it is wise for the affiant to hire one. It may seem wasteful to hire a lawyer when an estate is small, but many of the same rules that govern the full blown Illinois probate process apply to the affidavit.

The task of settling a deceased person's estate, also known as probate, falls upon the executor. In Nebraska, this involves several key steps: validating the deceased's will, inventorying their assets, paying off any debts and taxes, and finally, distributing the remaining assets to the designated beneficiaries.

Deliberately altering or destroying a will, or failing to file it within 30 days after the death of the testator, is considered a Class 3 felony under Illinois law. All original wills which are admitted to probate shall remain in the custody of the clerk, unless otherwise ordered by the court.

To use a small estate affidavit, all of the following must be true: The total amount of property in the estate is worth $100,000 or less; The person who died did not own any real estate, or they owned real estate that went to someone else when they died.

You must adhere to restrictions before the courts accept your request. In addition, when you use a small estate affidavit you run the risk of being personally liable to return any property or funds to the estate should there be any creditors or other heirs to the estate.