Nebraska Letter Confirming Nonconfidentiality of Information

Description

How to fill out Nebraska Letter Confirming Nonconfidentiality Of Information?

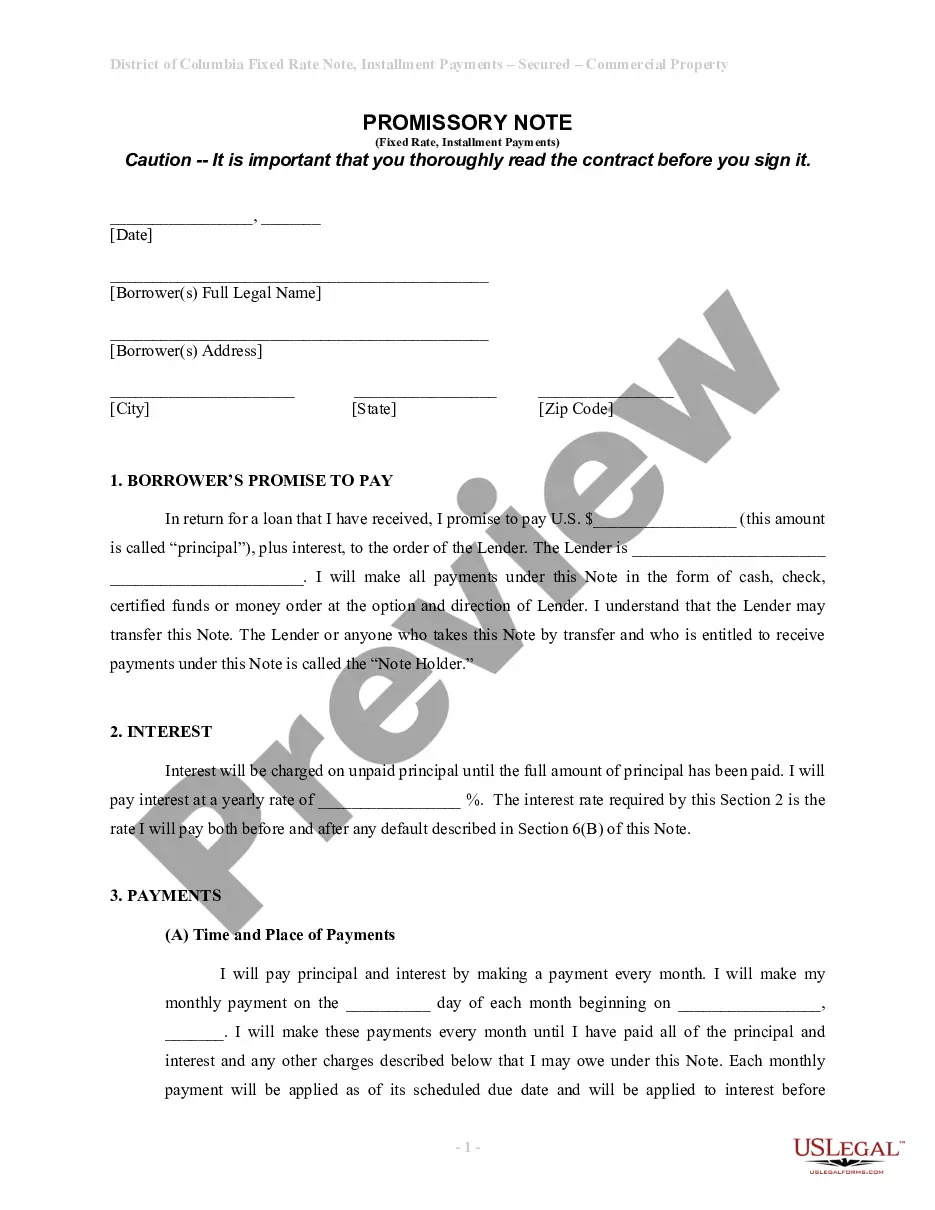

Are you within a position that you require documents for sometimes organization or person purposes almost every working day? There are a variety of legitimate file web templates available on the net, but finding kinds you can trust is not easy. US Legal Forms provides 1000s of kind web templates, like the Nebraska Letter Confirming Nonconfidentiality of Information, which are published to fulfill state and federal demands.

Should you be currently familiar with US Legal Forms internet site and possess an account, basically log in. Following that, you may obtain the Nebraska Letter Confirming Nonconfidentiality of Information template.

Should you not come with an profile and need to begin to use US Legal Forms, follow these steps:

- Find the kind you want and ensure it is for that right area/state.

- Make use of the Review switch to review the shape.

- Browse the explanation to ensure that you have chosen the proper kind.

- In case the kind is not what you`re searching for, utilize the Search discipline to obtain the kind that suits you and demands.

- Once you obtain the right kind, simply click Buy now.

- Pick the pricing program you want, complete the necessary information and facts to produce your money, and pay for an order utilizing your PayPal or charge card.

- Select a handy paper format and obtain your backup.

Locate each of the file web templates you possess purchased in the My Forms menu. You can obtain a additional backup of Nebraska Letter Confirming Nonconfidentiality of Information whenever, if required. Just select the required kind to obtain or print out the file template.

Use US Legal Forms, one of the most comprehensive collection of legitimate varieties, to save time and stay away from faults. The support provides skillfully created legitimate file web templates which can be used for a variety of purposes. Produce an account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

The so-called ?convenience of the employer? rule means that if a worker previously commuted into Nebraska for work, and then stopped commuting into Nebraska and stayed in Iowa, that worker still owes taxes to Nebraska.

Form Number, Description:1040N - Nebraska Individual Income Tax Return. Year:2022. Status:eFileIT. Form Number, Description:1040N Schedule I,II,III - Nebraska Adjustments to Income, Credit for Tax Paid to Another State, Computation of Nebraska Tax. Year:2022.

Form 941N is filed whether or not there were payments made during the quarter that were subject to Nebraska income tax withholding. The Form 941N is due on or before the last day of the month following the end of the quarter. The Form 941N may be e-filed using DOR's free Form 941N filing program.

If your small business has employees working in Nebraska, you'll need to withhold and pay Nebraska income tax on their salaries. This is in addition to having to withhold federal income tax for those same employees.

Yes. The wages paid to employees for work done in Nebraska is subject to Nebraska income tax withholding.

Form W-4NA is used by payors of nonresident individuals to compute Nebraska income tax withheld from payments for personal services performed substantially in Nebraska.

Payees that chose not to have federal income tax withheld on the federal Form W-4P may elect to be exempt from withholding income tax for Nebraska on the Nebraska Form W-4N. Payees completing the Nebraska Form W-4N may skip lines 1 and 2 and write ?exempt? on line 3 of the Nebraska Form W-4N.