Nebraska Assignment of Overriding Royalty Interests (ORI's) is a legal document through which a percentage of an assignor's net revenue interest, after the deductions of certain costs, is transferred to another party, commonly referred to as the assignee. This assignment effectively allows the assignee to receive net profits generated from specific oil, gas, or mineral interests in Nebraska. The primary purpose of this assignment is to provide the assignee with a passive interest in the production and revenue generated from the assigned oil, gas, or mineral assets. The assignee does not bear any financial responsibility for the costs associated with exploration, drilling, production, or marketing activities. Instead, they receive a designated percentage of the net revenue interest, which is calculated after deducting certain expenses. The specific terms and conditions of a Nebraska Assignment of Overriding Royalty Interests can vary, depending on the negotiated agreement between the assignor and assignee. Different types of assignments within this category may include: 1. ORI Assignment with Fixed Percentage: In this type of assignment, the assignee receives a predetermined, unchangeable percentage of the assignor's net revenue interest. This fixed percentage ensures the assignee a consistent share of the profits throughout the project's lifespan. 2. ORI Assignment with Sliding Scale Percentage: This assignment involves a sliding scale percentage arrangement, where the assignee's percentage share varies based on specific profit thresholds. For example, the assignee may receive a lower percentage if the revenue is below a certain amount but receive a higher percentage if the revenue surpasses a predetermined threshold. 3. Term-limited ORI Assignment: This type of assignment has a specific duration during which the assignee is entitled to receive a percentage of the assignor's net revenue interest. Once the term expires, the rights and benefits granted by the assignment revert to the assignor. 4. ORI Assignment with Performance-based Provisions: In certain cases, the assignment agreement may include performance-based provisions. These provisions outline conditions or milestones that the assignee must meet for the assignment to remain valid. They can include the assignee's obligation to finance a certain level of production or meet minimum revenue targets within a specified timeframe. 5. Participating ORI Assignment: In a participating assignment, the assignee not only receives a percentage of the assignor's net revenue interest but also has the right to participate in certain decision-making processes related to the assigned assets. This participation may include attending meetings, receiving periodic reports, and being consulted on matters affecting the assigned interests. It is important to note that the terms and types of Nebraska Assignment of Overriding Royalty Interests may vary significantly based on the negotiation between the parties involved, the nature of the assigned assets, and the prevailing industry practices. Legal counsel should always be sought to ensure the assignment accurately represents the interests and expectations of both the assignor and assignee.

Nebraska Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out Nebraska Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

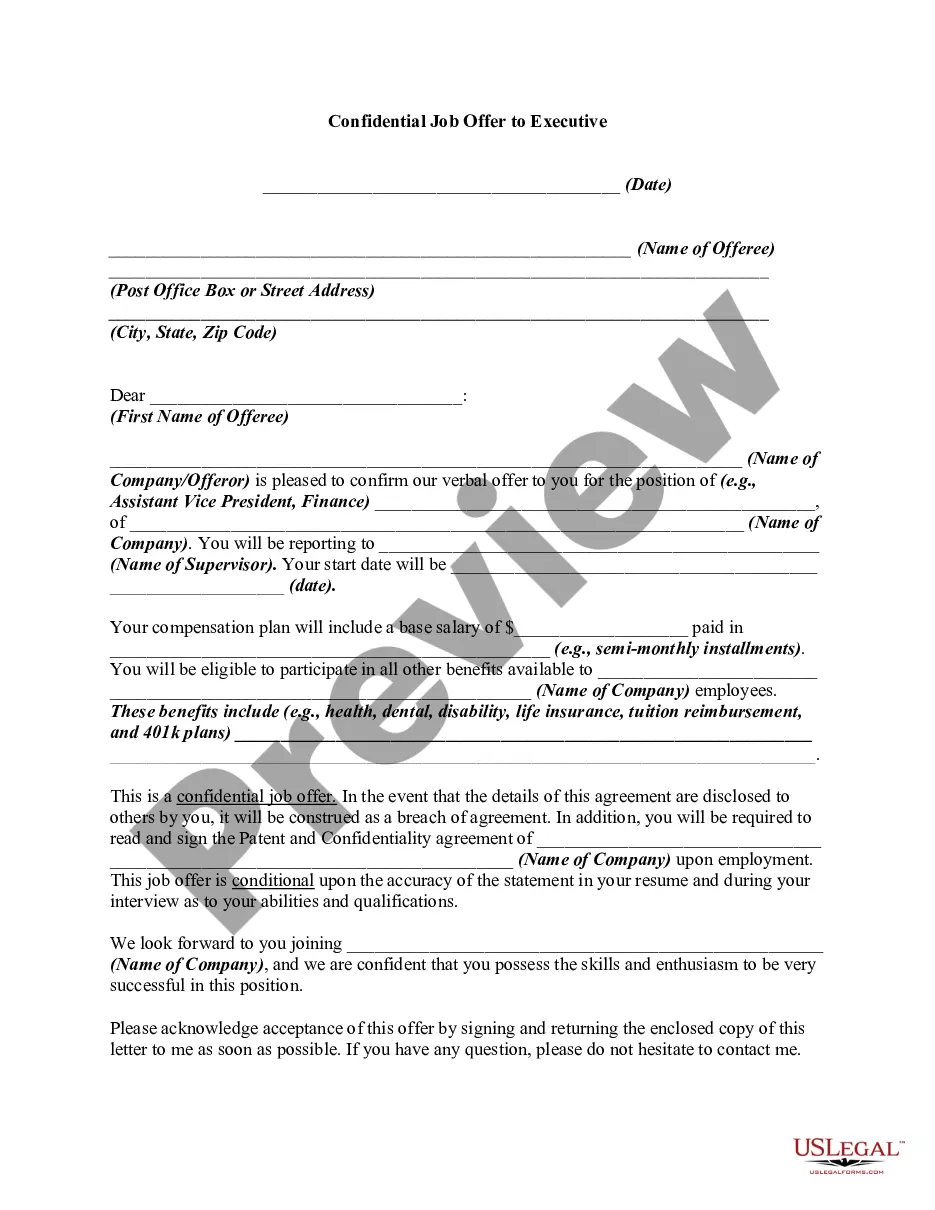

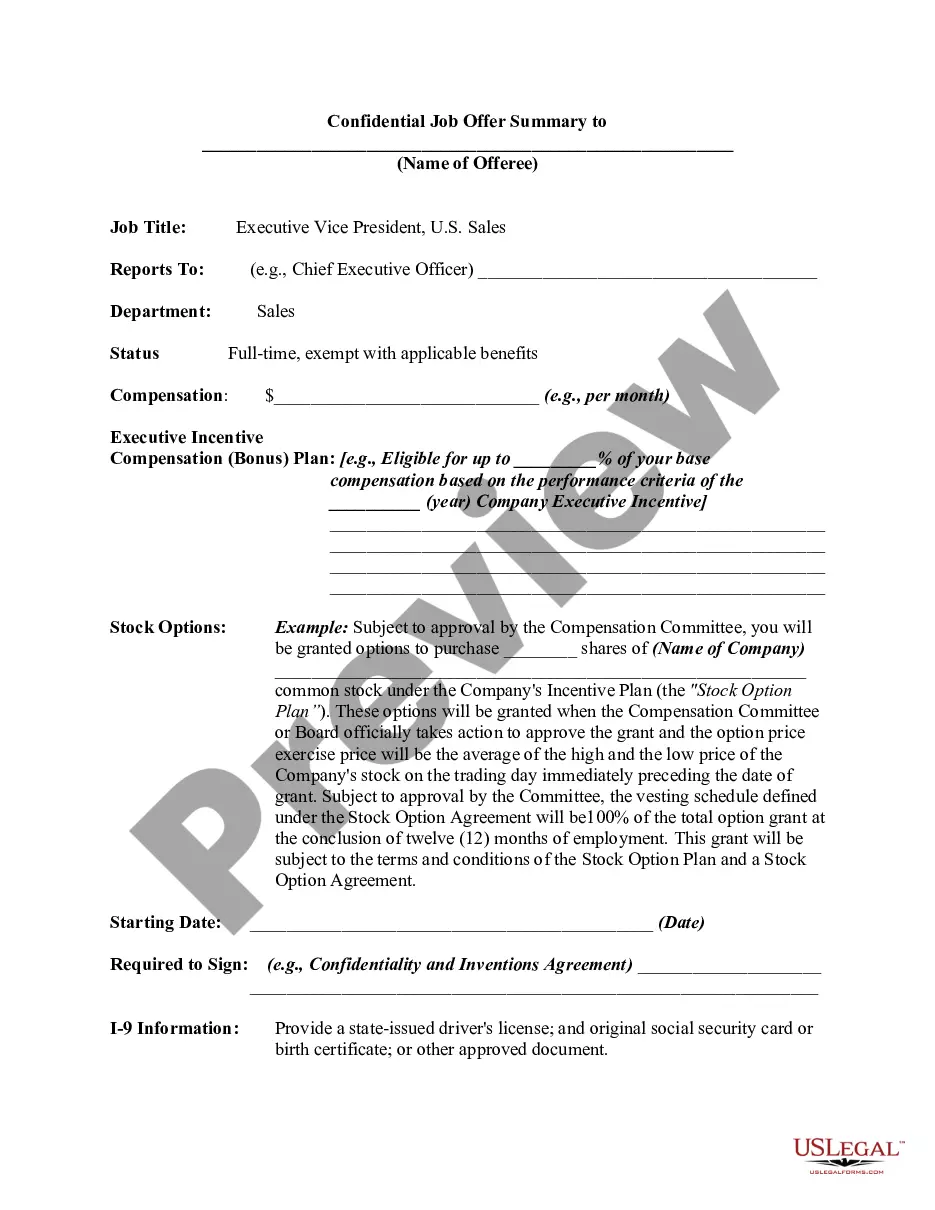

Are you presently within a place that you require paperwork for possibly business or individual functions nearly every working day? There are tons of lawful document web templates available on the Internet, but discovering versions you can depend on isn`t simple. US Legal Forms provides thousands of kind web templates, such as the Nebraska Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits, that happen to be composed to satisfy federal and state specifications.

In case you are presently acquainted with US Legal Forms internet site and have a merchant account, merely log in. Afterward, it is possible to obtain the Nebraska Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits template.

Should you not have an bank account and would like to begin using US Legal Forms, follow these steps:

- Get the kind you need and ensure it is for the appropriate area/state.

- Make use of the Preview key to analyze the shape.

- Browse the information to ensure that you have selected the right kind.

- In the event the kind isn`t what you are trying to find, take advantage of the Research discipline to discover the kind that meets your requirements and specifications.

- Once you obtain the appropriate kind, click on Get now.

- Choose the pricing program you need, fill in the desired details to generate your bank account, and pay for the transaction utilizing your PayPal or credit card.

- Choose a convenient document structure and obtain your version.

Get each of the document web templates you may have purchased in the My Forms menus. You can get a more version of Nebraska Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits at any time, if required. Just click on the needed kind to obtain or printing the document template.

Use US Legal Forms, by far the most substantial assortment of lawful kinds, to save lots of time as well as stay away from blunders. The assistance provides skillfully produced lawful document web templates that you can use for an array of functions. Generate a merchant account on US Legal Forms and initiate producing your life a little easier.