Nebraska Due Diligence Review Form is a comprehensive document used for conducting thorough investigations and analysis of various business entities, properties, or assets in the state of Nebraska. This form plays a critical role in evaluating the potential risks, legal compliance, financial stability, and overall viability of a particular entity or asset. Key elements covered by the Nebraska Due Diligence Review Form include: 1. Business Entity Information: This section captures crucial details about the entity under review. It includes the legal name, registered address, corporate structure, and identification numbers. 2. Corporate Governance: This section examines the governance structure of the entity, including its board of directors, management team, key personnel, and any affiliations with other companies or organizations. 3. Legal Compliance: The form explores whether the entity adheres to Nebraska state laws, regulations, and licensing requirements. It investigates any previous legal issues, ongoing litigation, or potential risks associated with non-compliance. 4. Financial Analysis: This section delves into the financial health of the entity by assessing its financial statements, reports, tax filings, cash flow projections, and debt obligations. It provides a comprehensive overview of the entity's financial performance, liquidity, and profitability. 5. Asset Evaluation: If the due diligence pertains to a specific property or asset, this section provides a detailed assessment of its physical condition, market value, ownership history, liens, and encumbrances. It may involve property inspections, environmental assessments, and appraisals. 6. Contracts and Agreements: The form examines contracts, leases, and other agreements entered into by the entity. It evaluates their terms, obligations, rights, and potential risks, ensuring they align with the entity's goals and do not pose any legal or financial challenges. 7. Intellectual Property: If applicable, this section addresses any intellectual property owned by the entity, including patents, trademarks, copyrights, or trade secrets. It may involve assessing the protection, validity, and potential infringement risks associated with these assets. Different types of Nebraska Due Diligence Review Forms may include variations tailored for specific industries or transactional purposes, such as: 1. Real Estate Due Diligence Review Form: Focused on evaluating the risks and feasibility of real estate transactions, property development projects, or mortgage lending. 2. Mergers and Acquisitions (M&A) Due Diligence Review Form: Specifically designed for assessing entities involved in mergers, acquisitions, or joint ventures, considering the financial, legal, and operational aspects of the transaction. 3. Due Diligence Review Form for Financial Institutions: Addressing the unique risks and regulatory considerations associated with banks, credit unions, or other financial service providers. 4. Due Diligence Review Form for Licensing and Permitting: Concentrating on ensuring businesses comply with Nebraska's licensing and permitting requirements, particularly for regulated industries such as healthcare, finance, or alcohol sales. It is essential to note that the specific content and structure of the Nebraska Due Diligence Review Form may vary depending on the purpose, transaction, or industry. Customized forms should be designed to address specific risk areas and comply with relevant legal and industry standards.

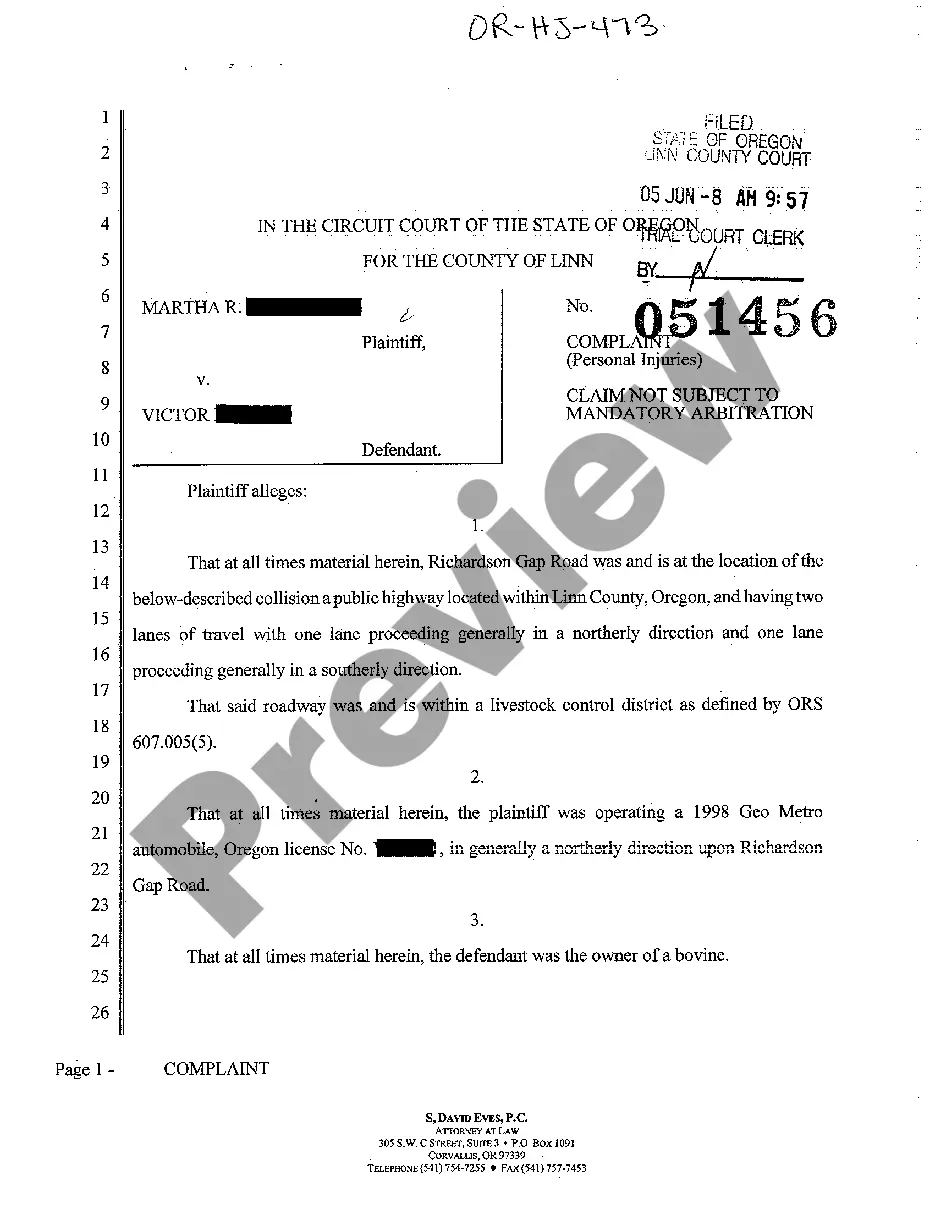

Nebraska Due Diligence Review Form

Description

How to fill out Nebraska Due Diligence Review Form?

Choosing the right lawful file template might be a have difficulties. Naturally, there are plenty of themes available on the net, but how can you get the lawful type you require? Take advantage of the US Legal Forms internet site. The support gives a huge number of themes, like the Nebraska Due Diligence Review Form, which you can use for company and personal demands. Every one of the kinds are inspected by experts and satisfy state and federal requirements.

If you are already signed up, log in to your profile and click on the Obtain button to obtain the Nebraska Due Diligence Review Form. Utilize your profile to appear throughout the lawful kinds you have acquired earlier. Visit the My Forms tab of your profile and obtain an additional version of your file you require.

If you are a whole new customer of US Legal Forms, here are easy directions that you should comply with:

- First, be sure you have chosen the proper type to your area/area. You are able to check out the form using the Review button and read the form information to ensure it will be the right one for you.

- In case the type is not going to satisfy your expectations, make use of the Seach area to obtain the appropriate type.

- When you are sure that the form is acceptable, click on the Acquire now button to obtain the type.

- Select the prices strategy you want and enter the essential information. Make your profile and pay for the order with your PayPal profile or charge card.

- Pick the file format and download the lawful file template to your system.

- Complete, modify and printing and indication the attained Nebraska Due Diligence Review Form.

US Legal Forms will be the biggest catalogue of lawful kinds that you can find numerous file themes. Take advantage of the company to download appropriately-created paperwork that comply with express requirements.