Nebraska Indemnities refer to legal agreements that are designed to protect an individual or entity from financial loss or damage caused by specified events or circumstances. These indemnities work by providing compensation, reimbursement, or protection against potential liabilities, losses, or obligations. The state of Nebraska offers various types of indemnities that cater to different sectors and circumstances. Some different types of Nebraska Indemnities include: 1. Professional Liability Indemnity: This type of indemnity is specifically tailored for professionals such as doctors, lawyers, engineers, and architects. It safeguards them against claims arising from professional errors, omissions, malpractice, or negligence. This coverage ensures that professionals are protected financially if they face legal action due to their professional services. 2. Product Liability Indemnity: Nebraska provides indemnity coverage to manufacturers, distributors, wholesalers, and retailers to protect them from liability arising from products they produce or sell. This coverage shields them from claims related to product defects, failure to warn, or any injuries caused by the products they offer. 3. General Liability Indemnity: This type of indemnity is broad in nature and offers protection against a wide range of potential risks and liabilities. It covers claims related to bodily injury, property damage, defamation, slander, libel, and other similar legal actions. General liability indemnities are essential for businesses, property owners, and individuals engaging in various activities that may pose potential risks to others. 4. Employment Practices Liability Indemnity: This indemnity covers employers against claims arising from wrongful termination, discrimination, sexual harassment, or other employment-related issues. It ensures that businesses are protected from potential financial losses resulting from legal battles with their employees or former employees. 5. Cyber Liability Indemnity: With the increasing risk of cyber threats, Nebraska offers indemnity coverage for businesses and individuals that face potential liability due to data breaches, cyber-attacks, or other cyber-related incidents. This type of indemnity helps in covering costs related to data recovery, notification to affected parties, legal expenses, and any damages resulting from such incidents. In conclusion, Nebraska Indemnities encompass various types of insurance coverage that protect individuals, professionals, businesses, and organizations from potential financial losses and liabilities. These indemnities are designed to offer peace of mind while operating in a wide range of industries or circumstances by ensuring they are adequately protected against unforeseen events.

Nebraska Indemnities

Description

How to fill out Nebraska Indemnities?

Have you been in a placement that you will need paperwork for both enterprise or person purposes almost every day? There are a variety of legitimate document templates available online, but getting kinds you can rely is not easy. US Legal Forms gives a huge number of form templates, such as the Nebraska Indemnities, which can be written to fulfill state and federal requirements.

Should you be previously knowledgeable about US Legal Forms web site and possess a merchant account, merely log in. Afterward, you are able to obtain the Nebraska Indemnities web template.

If you do not provide an profile and wish to begin to use US Legal Forms, abide by these steps:

- Find the form you need and ensure it is for that right metropolis/county.

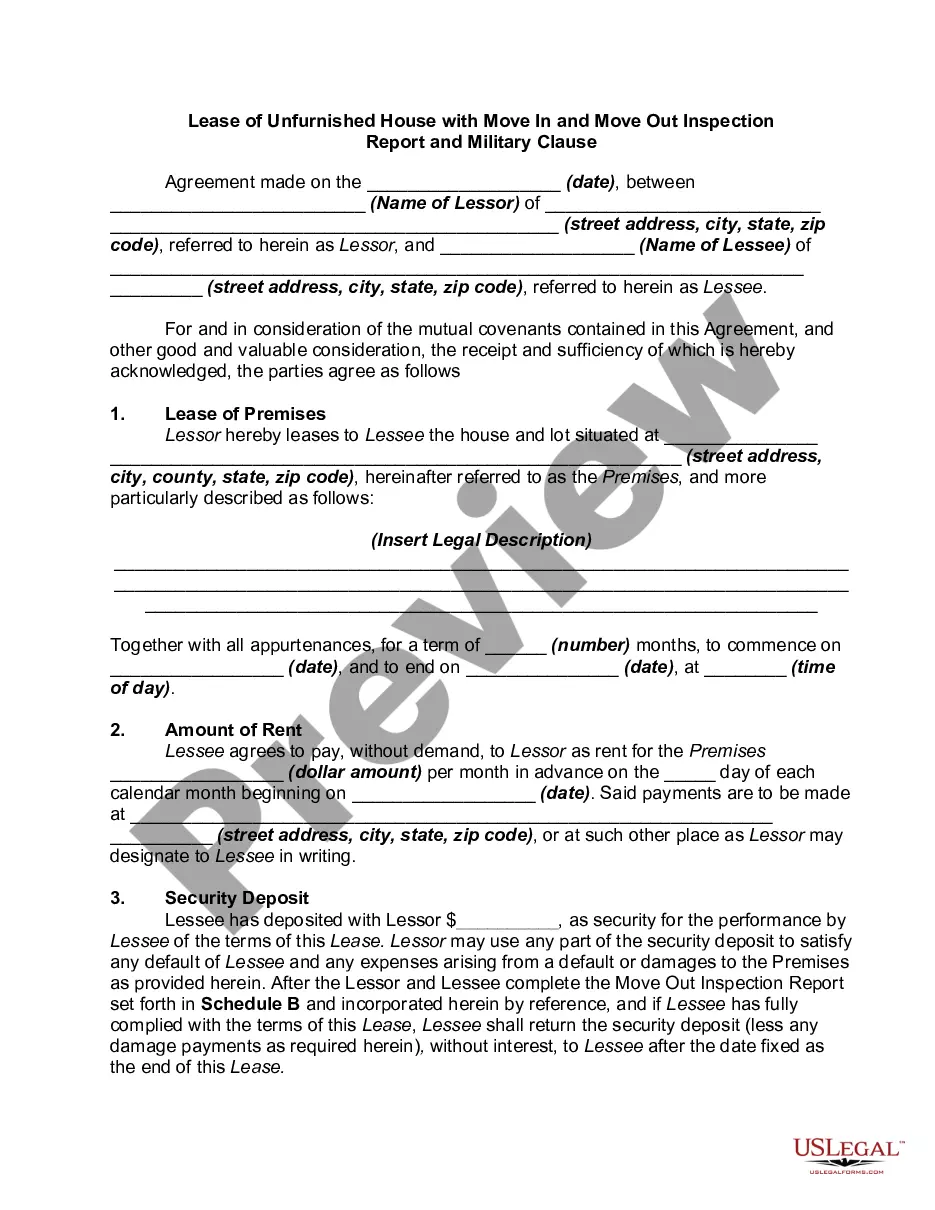

- Make use of the Review button to review the shape.

- Look at the description to actually have chosen the proper form.

- In the event the form is not what you are looking for, utilize the Look for industry to find the form that fits your needs and requirements.

- When you obtain the right form, click Buy now.

- Opt for the costs strategy you would like, complete the necessary information to produce your bank account, and pay for the transaction making use of your PayPal or credit card.

- Pick a convenient data file format and obtain your version.

Find every one of the document templates you might have purchased in the My Forms food selection. You can aquire a more version of Nebraska Indemnities at any time, if needed. Just click on the required form to obtain or print the document web template.

Use US Legal Forms, probably the most comprehensive selection of legitimate forms, to save lots of some time and prevent faults. The assistance gives appropriately manufactured legitimate document templates which can be used for a range of purposes. Generate a merchant account on US Legal Forms and begin making your lifestyle easier.