Nebraska Clauses Relating to Venture Interests

Description

How to fill out Clauses Relating To Venture Interests?

Choosing the right legitimate document design could be a have difficulties. Of course, there are tons of web templates available online, but how will you find the legitimate develop you require? Utilize the US Legal Forms web site. The assistance provides thousands of web templates, including the Nebraska Clauses Relating to Venture Interests, that you can use for business and private needs. Each of the varieties are checked by professionals and satisfy state and federal needs.

Should you be currently listed, log in for your profile and click the Down load option to get the Nebraska Clauses Relating to Venture Interests. Make use of your profile to appear throughout the legitimate varieties you have acquired formerly. Go to the My Forms tab of the profile and get another copy of the document you require.

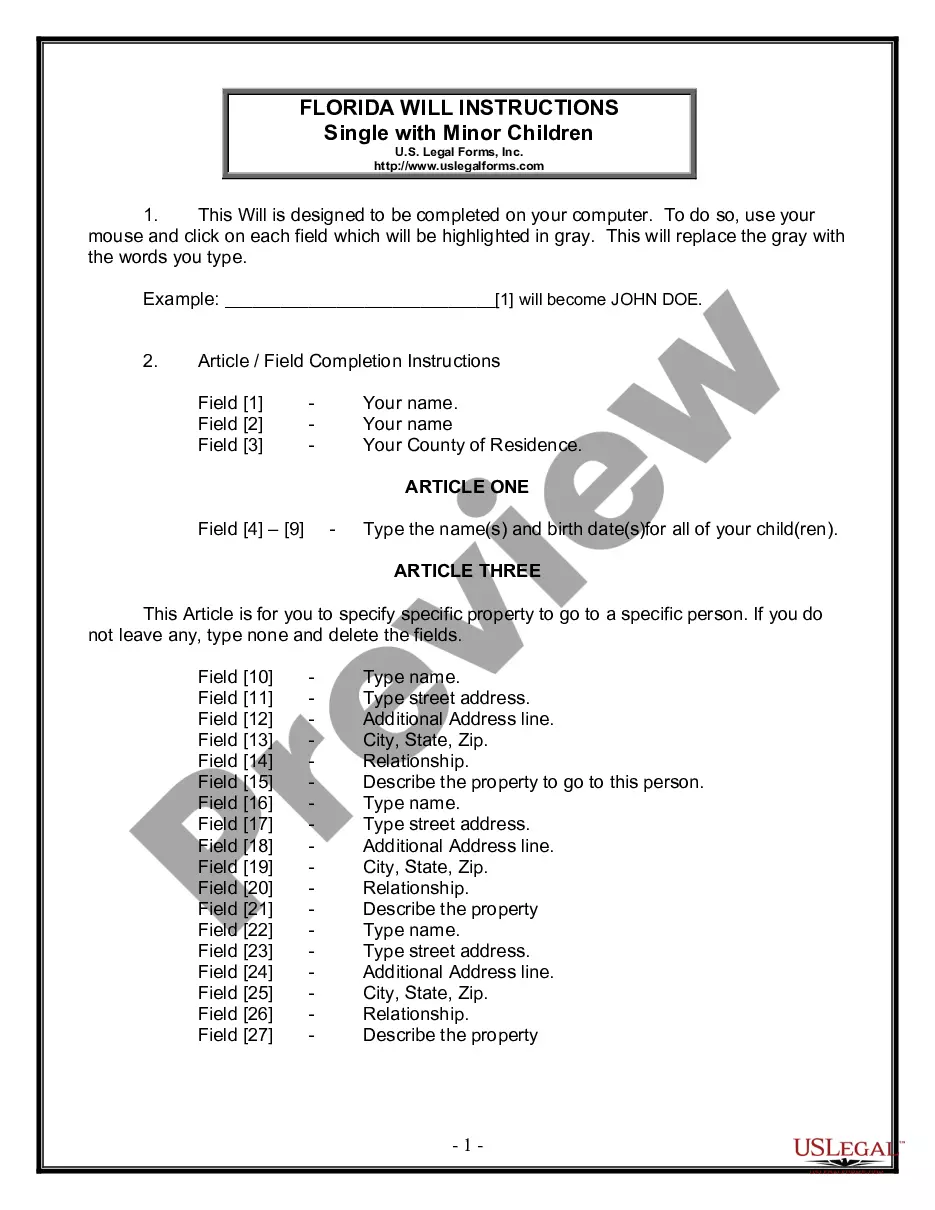

Should you be a fresh end user of US Legal Forms, listed below are simple directions so that you can adhere to:

- First, make sure you have chosen the correct develop for your city/region. You can look through the form utilizing the Review option and read the form description to make certain this is the best for you.

- In case the develop does not satisfy your requirements, utilize the Seach industry to find the right develop.

- When you are certain that the form is suitable, select the Get now option to get the develop.

- Choose the pricing program you want and enter the necessary information and facts. Make your profile and pay for an order utilizing your PayPal profile or Visa or Mastercard.

- Choose the submit file format and acquire the legitimate document design for your device.

- Full, modify and printing and signal the received Nebraska Clauses Relating to Venture Interests.

US Legal Forms will be the largest collection of legitimate varieties that you can see different document web templates. Utilize the company to acquire professionally-created papers that adhere to status needs.

Form popularity

FAQ

Prejudgment interest is authorized when there is not a dispute as to the amount due on a claim or to the plaintiff's right to recover. Echo Group v. Tradesmen Internat., 312 Neb.

Non-compete provisions and agreements may be enforceable. The legal standard in Nebraska is that non-competes are enforceable if they are reasonable.

In the sale-of- business context, courts may blue pencil. Nebraska Reformation is not permitted, even with the presence of a clause allowing a court to reform an overbroad covenant.

§ 45-014. Post-judgment interest: Effective January 20, 2022, the statutory judgment interest rate in Nebraska is 2.223% per annum. As the name implies, post-judgment interest begins to accrue from the date judgment is entered and continues until the judgment amount, plus accrued interest, is paid in full.

Unless otherwise agreed or provided by law, each charge with respect to unsettled accounts between parties shall bear interest from the date of billing unless paid within thirty days from the date of billing. Source:Laws 1879, § 4, p. 114; R.S. 1913, § 3349; C.S.

Calculating interest owed You input the judgment amount, date, and payment history, and the program does all the calculations for you. The calculator has the interest rate set at 10%.

Nebraska Civil Statutes of Limitations at a Glance There is also a four-year limit for fraud, trespassing, oral contracts, and some other causes of action. For judgments and written contracts, there is a five-year statute of limitations.

Prejudgment interest is the amount of interest the law provides to a plaintiff to compensate for the loss of the ability to use the funds. If prejudgment interest is awarded, it is computed from the date on which each loss was incurred until the date on which you sign your verdict.